Posted by:

Admin

Date:

November 21, 2025

Category:

How Outsourced Bookkeeping Services Can Save You Time and Money

What is Outsourced Bookkeeping?

Outsourced bookkeeping means hiring someone from outside your business to handle your money records. You don’t have to hire a full-time worker for your company. Instead, you can offer work to a bookkeeping firm, a virtual team, or a freelancer. They keep track of your finances. They also check that your bank accounts match and prepare financial reports for you.

Bookkeeping vs. Accounting vs. Tax Prep

It’s also good to know the difference between these three. Bookkeeping is about recording daily transactions. Accounting, on the other hand, is about studying those records to see the bigger picture. Tax prep is about filing your returns with the government. Each step builds on the other. You can choose the steps you want to be covered in outsourcing services. To learn more about Tax prep and latest changes, check out our blog on 2025-2026 tax year updates.

Technology That Makes It Easy

Most outsourced bookkeepers use modern tools like cloud software. These include QuickBooks and Xero. They also use invoice scanning apps and automated bank feeds. This makes the work faster and more accurate. When you outsource bookkeeping services for your small business, you don’t just save time. You also get up-to-date numbers you can trust.

| Tool / Software | What It Does | Example Platforms |

|---|---|---|

| Cloud Bookkeeping | Store and update your books online | QuickBooks, Xero |

| Invoice Scanning (OCR) | Turns paper receipts into digital data | Dext, Hubdoc |

| Bank Feeds | Connects your bank account so transactions show up automatically | Xero, Sage |

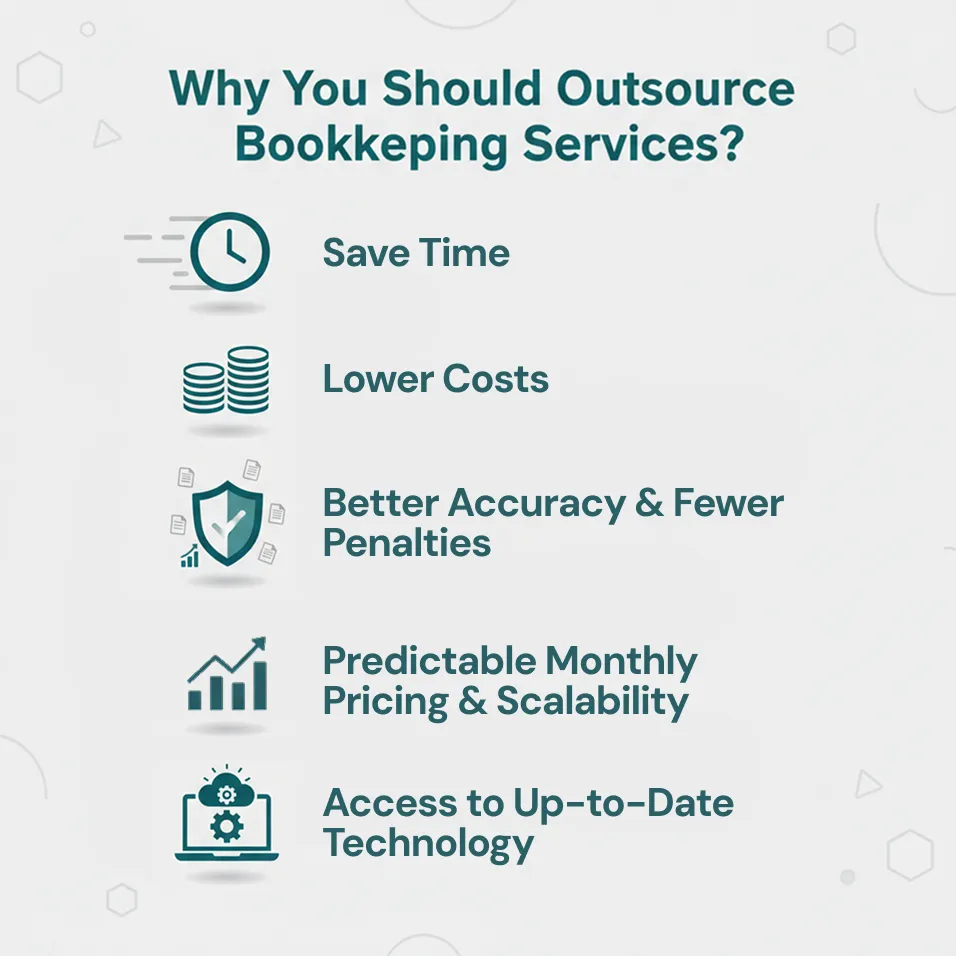

Why you should outsource bookkeeping services? Key reasons to outsource your bookkeeping

There are many reasons to outsource your bookkeeping. As a small business owner, it is especially useful for you if you don’t want to be buried in late-night spreadsheets and loads of receipts. With outsourced bookkeeping services, you get back time, money, and peace of mind. Here are the key reasons that may motivate your choice:

1. Save Time

One of the greatest benefits of bookkeeping is saving time. When you outsource, you no longer spend hours entering transactions or matching bank statements. You can spend this time running or growing your business. By outsourcing bookkeeping services, you get to make money while someone else handles the paperwork.

2. Lower Costs

Hiring a full-time bookkeeper is expensive. Once you count salary, benefits, software, and training, you’ll know the entire cost is too much. Outsourced bookkeeping services are usually cheaper. Businesses can save up to 40% with outsourced bookkeeping as compared to in-house hiring. They offer you flexible plans that fit your budget. This means you only pay for the support you need. You don’t have to pay a full salary year-round.

3. Better Accuracy & Fewer Penalties

Professional bookkeepers handle financial records every day. It is far less likely for them to make mistakes in comparison to business owners doing it on their own. This means cleaner books and fewer errors. It also means no more worrying about late fees or penalties. Accuracy is one of the strongest reasons to outsource your bookkeeping.

4. Predictable Monthly Pricing & Scalability

With outsourcing, you usually pay a flat monthly fee. This means that you always know what you are going to spend on this particular service. Having this knowledge beforehand can help you scale up whenever you want to.

5. Access to Up-to-Date Technology

Outsourced bookkeepers often bring the latest tools. They use automated bank feeds and invoice scanning. They also have dashboards through which you can see the entire financial picture. You don’t need to buy or learn all this software yourself. It’s already part of the service.

Advantages of Outsourcing Bookkeeping Services

The advantages of outsourcing bookkeeping services are many and varied. By outsourcing bookkeeping services you can save time to pursue moneymaking ventures. It gives better reports. You get insights which you can rely on. The information you acquire may not be available in-house.

Here are some advantages of outsourcing bookkeeping services in detail.

1. Tax Readiness & Compliance

One big benefit of outsourcing bookkeeping is staying tax-ready all year. A professional team makes sure your books are neat. They must be up to date and follow the right rules. This means no rushing around at tax season. It also means avoiding paying penalties for mistakes. For example, many services prepare a “year-end package” with profit-and-loss, balance sheet, and reconciled accounts. This package can go straight to your accountant, helping with compliance.

2. Faster, Regular Reporting

Another advantage is faster and more regular reports. You don’t have to wait months to know how your business is doing. You get to have updates every few weeks. Clear numbers help you spot problems early. They also assist you in making smarter decisions. For instance, some services deliver full monthly reports within 3–10 days of the month ending. This way, you always have fresh information on hand.

3. Scaling and Flexibility

You can scale at your will by outsourcing your bookkeeping. This is crucial for small businesses. Also for businesses that have busy seasons and quiet periods. They don’t need to hire extra help. Your provider can adjust support as needed. For example, a hotel might add help for payroll and invoicing during the holiday rush, then cut back when the season slows.

4. Access to Specialist Knowledge

Outsourced teams often bring knowledge about your specific industry. This helps your books follow the right rules and standards. You don’t have to be an expert. A bookkeeper familiar with the hospitality industry would already know how to separate room sales from restaurant income. This helps them with VAT reporting. They also understand the need to manage staff payment properly and maintain records.

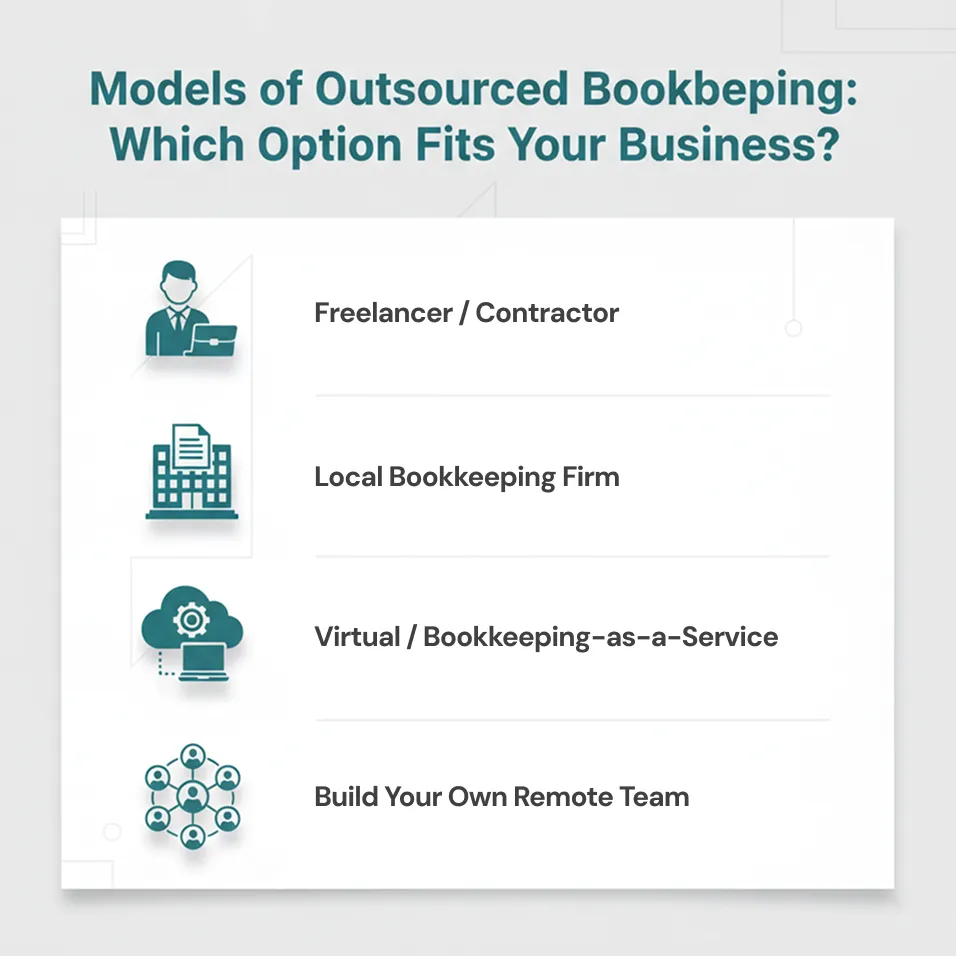

Models of Outsourced Bookkeeping: Which Option Fits Your Business?

When it comes to outsourced bookkeeping, there’s no single model that works for everyone. The choice depends on your business size and budget. Here are some of the more common options:

1. Freelancer / Contractor

A freelancer is one person who handles your bookkeeping. They can be hired on a part-time or contract basis. This option is great for very small businesses because they have simple needs. The cost for this is lower. Also, you can get flexibility in work hours. But the main risk is that if the freelancer is sick or busy, your books may fall behind.

2. Local Bookkeeping Firm

Local bookkeeping firms that have certified bookkeepers can offer you face-to-face help. This set-up provides you with more stability and backup even if one staff member is away. The downside is that it can cost more than a freelancer. But there is an upside that many businesses value. With these firms, you get a personal touch and ease of working with local staff.

3. Virtual / Bookkeeping-as-a-Service

This model is cloud-first, meaning you connect with your bookkeeping team through apps. For a monthly payment, you get access to a whole team. These services often include dashboards and regular reports. You also get a year-end package for your tax accountant. It’s a good fit if you want tech-driven support at a steady cost.

4. Build Your Own Remote Team

Some businesses hire their own remote bookkeepers. They are often from places like Latin America or the Philippines. This gives you more control. Also, you get long-term support at a lower price than hiring locally. However, you need to handle recruiting and training. You also have to undertake the management yourself. This can take extra time and effort.

Comparison Table: Outsourced Bookkeeping Models

How Much Does Outsourced Bookkeeping Cost?

A very important question to ask is, what is the cost of outsourced bookkeeping? The answer varies with the size and complexity of your business.

Typical Price Ranges

- Very Small Business

For very small businesses, it costs around £100–£400 per month (or $200–$700). This usually covers basic monthly bookkeeping. It means you get recorded expenses and reconciled accounts.

- Growing Small Business

For small businesses that are growing, it costs around £400–£1,000 per month. This often includes more transactions, payroll, and VAT returns.

- Larger or Specialist Business

Larger businesses have to pay quite an amount to outsource their bookkeeping. It goes up to £500+ per month and up. There are factors that may lead to higher costs. Complex payrolls and multiple entities, for instance, are two such factors. Similarly, special industry needs (like hospitality) often pay more.

What Affects the Price?

The cost of outsourced bookkeeping services changes based on:

- The number of transactions you have each month

- The need for payroll and its complexity

- Number of bank accounts

- Number of credit cards

- Software integrations

- If you need books ready for audits or investors

- How often do you want reports

- Industry specialisation

Security & Control: What You Must Keep In-House and What to Demand from a Vendor

There are certain safety protocols that you must follow when outsourcing bookkeeping:

Keep Treasury Control

Even if you use bookkeeping services, you should never give away the power to sign checks or approve payments. As a business owner, always keep control of your money yourself. The job of an outsourced bookkeeper should be limited to preparing reports and suggesting payments. The final decision and sign-off should always stay with you.

Minimum Vendor Security Requirements

An outsourced bookkeeper should be chosen with great care. They should meet at least the basic standard of security. At a minimum, the vendor should use encrypted cloud storage and backups. They should only have role-based access. They should sign an NDA and follow clear data-handling rules. They should have SOC2 certification or equivalent.

Separation of Duties & Smooth Workflow

Good bookkeeping services should separate duties. This means no single person controls the entire money flow. A common setup is that the bookkeeper proposes transactions. Then, the owner or manager approves them before payment. This workflow helps prevent mistakes and fraud. This saves time.

How to Choose the Right Outsourced Bookkeeping Provider?

It is very important to have the right partner for outsourced bookkeeping services. It is crucial to choose the right partner for outsourced bookkeeping services. Make a checklist. Your demands and needs must be clear. You can ask questions in an interview or you can copy them into the Request for Proposal.

Some Questions for Your Checklist

Here are some of the questions for you to ask when hiring

- Which accounting software do you use?

The answer should be Xero, QuickBooks, or other mainstream systems. You should also ask if they can integrate with existing systems.

- How often will we get management accounts and cash-flow forecasts?

Ideally it should be at least monthly with a full month-end reporting pack.

- Do you have experience in my industry?

The answer to this question depends on your industry. Each industry has unique requirements. Some may require prior experience while others don’t.

- What is your service scope?

You should be provided with a clear scope document that confirms coverage. This includes bank reconciliations, payroll, VAT returns, and year-end packages.

- What are your compliance practices?

The good answer would include a written security policy, data retention rules, encrypted storage and backups.

- What is your pricing model?

You should get a clear idea of whether they charge a flat monthly fee or hourly rates. Request sample invoices to get a better picture.

Simple Scoring Rubric (1–5 scale)

Implementation & Onboarding Roadmap

Starting with outsourced bookkeeping services is smooth when you have a clear plan. The following roadmap can be used as a checklist with any provider.

1. Sign NDA + Data Access Agreement

The first step is to protect your business information. A Non-Disclosure Agreement (NDA) and data access agreement make sure your records stay private and safe.

2. Select Software

Choose the right accounting software. Decide who gets read-only access and who needs full access. This sets clear boundaries from day one.

3. Historical Data Clean-Up

You can decide on how much data to bring in. You can work with your bookkeeper to bring in older records. Decide on how far back you want to go. This way your books start clean.

4. Map Chart of Accounts

Chart of accounts give income and expenses. Set them up. Also, record regular items like rent, payroll, or supplier invoices so they get posted automatically each month.

5. Set Reporting Cadence

Agree on how often you’ll receive reports and how fast they’ll arrive. Many hospitality providers, for example, deliver month-end accounts within 7–10 days.

6. Training & Approval Workflows

You should review the system together. The owner should approve transactions, while the bookkeeper manages day-to-day entries. This ensures balance and smooth workflow.

7. KPI Setup

After three months, track performance. Track key numbers like cash flow, accounts receivable (A/R days), and accounts payable (A/P days) to spot trends early.

8. Quarterly Tax Check-Ins

Schedule regular calls with your CPA or tax advisor. This keeps your books tax-ready and helps you plan for growth without surprises.

Objections & How to Handle Them

Here are a few objections that may come to your mind regarding outsourced bookkeeping. We’ll be answering them one by one.

“I’ll lose control.”

Many business owners don’t outsource their bookkeeping because they fear it means giving up control. In reality, you can keep full oversight. You can have your bookkeeper make a service workflow such that the transactions come to you for review every time. You also get read-only access to accounts. There is an option for regular management reports as well. Also, Service Level Agreements (SLAs) can include penalties if deadlines are missed. This keeps providers accountable.

“It’s risky to share data.”

Security is a valid concern with outsourced bookkeeping services. The best providers use encrypted cloud storage and sign NDAs. They also use limited access and role-based permissions. Still, it is important that you ask to see their written security policy before signing a contract. Also, check their backups and references. These steps make sharing data much safer.

“I can’t afford it.”

Some believe outsourcing is too expensive, but in most cases, it’s cheaper than hiring a full-time employee. With in-house staff, you have to pay salary, benefits, training, and software costs. Outsourced bookkeeping can be as low as £100–£400 per month for small businesses. In comparison, an in-house hire can cost up to £25,000+ per year. This implies that it is cheaper for the most part.

Case examples for Outsourced Bookkeeping

Example 1: Freelancer

Suppose a small online store. They hired a freelancer for basic bookkeeping, but they have struggled with delays. Now, they have switched to a virtual outsourced bookkeeping service using QuickBooks. The change saved the owner 8 hours each week. It has also cut the month-end close from 12 days to 3 days. Along with this, it has given real-time cash-flow forecasting. This means less stress and faster decisions.

Example 2: Hospitality Business (Hotel)

A mid-sized hotel outsourced bookkeeping to handle payroll and daily cash-ups. This helped them spot missed VAT claims and fix errors that would have caused penalties. By using outsourced bookkeeping services, the hotel avoided costly mistakes. It also recovered lost VAT and gained reliable payroll accuracy. The manager now receives month-end accounts within 10 days. This helps them stay tax-compliant and focused on guests. To make sure you are VAT ready, check out our VAT preparation services.

Conclusion

Outsourced bookkeeping helps small businesses save time and cut costs. It will help them stay tax-ready and get reports they can use to make smart decisions. In sharp comparison to hiring a full-time bookkeeper, you’ll get accurate reports at a lower rate. At Sterling Cooper, we make this even easier for you. We use tools like QuickBooks and Xero to handle your records the right way. Our team gives you clear numbers every month. With us, you always know where your money is going. With our help, you spend less time worrying about books and more time growing your business. To get help, contact us now.

Ready to save time and cut costs with outsourced bookkeeping services?

FAQs

Recent Posts

How much tax do you pay on a second job?

What Is Tax Code BR and How Does It Impact Your Pay?