Posted by:

Admin

Date:

July 2, 2025

Category:

2025–26 Tax Year Updates: Understanding the Latest Changes

Each April brings new numbers and fresh questions for anyone dealing with taxes in the UK. You are not alone if you are trying to work out how 2025 vs 2026 tax brackets will affect your wallet. Here we break down the key differences between tax brackets 2025 vs 2026 and show how your net earnings could change. We also cover the main updates from HMRC MTD income tax changes 2026 to rising council tax bills so you can plan with confidence.

Why the 2025–26 Tax Year Matters

Understanding the 2025 vs 2026 tax brackets matters because it determines your payroll deductions and your tax free savings limit. With thresholds frozen, personal and dividend allowances adjusted and the introduction of quarterly digital reporting under HMRC’s Making Tax Digital (MTD) everyone from full time employees to subcontractors will feel the effect. Payroll teams need to load the new rates into their payroll software now. On your end, it’s a good idea to revisit your household budget and consider boosting your pension contributions so you’re fully set for April.

Key Dates And Deadlines for 2025 vs 2026 Tax Brackets and Filings

- 6 April 2025: Tax year begins.

- 5 October 2025: Deadline to register for Self-Assessment if new to the system.

- 31 January 2026: Online return and balancing payment due.

- 31 July 2026: Second Payment on Account (if applicable).

If you miss a deadline, you’ll face an immediate £100 fine, then daily charges on top, so be sure to note each date in your calendar.

Income Tax Bands And Rates 2025–26

HMRC confirms that the basic UK tax bands for 2025 and 2026 match those from 2024–25. However, inflationary pressures mean that rate freezes results into a steeper tax burden for many. Below the table shows the 2025–26 income tax bands, thresholds, and corresponding rates.

Source: Gov. UK

Even though top-end bands remain fixed, a rise in nominal wages can push earners into higher brackets which is called a phenomenon dubbed “fiscal drag.” As the UK Parliament puts it:

“When thresholds and allowances are ‘frozen’, there is an overall increase in tax paid to the Treasury without an actual increase in tax rates”

UK Parliament

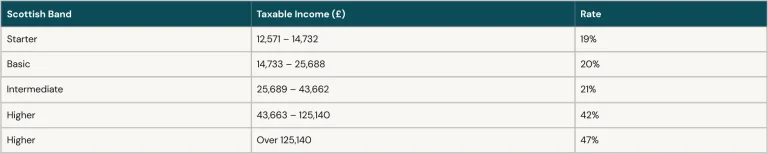

Scotland’s Separate Tax Regime

When it comes to 2025 vs 2026 tax brackets, Scottish taxpayers face a distinct set of rates and thresholds:

Source: Gov. UK

By offering a fifth rate band at 19%, Scotland aims to ease the burden on lower-income earners, even as its higher bands become among the steepest in the UK.

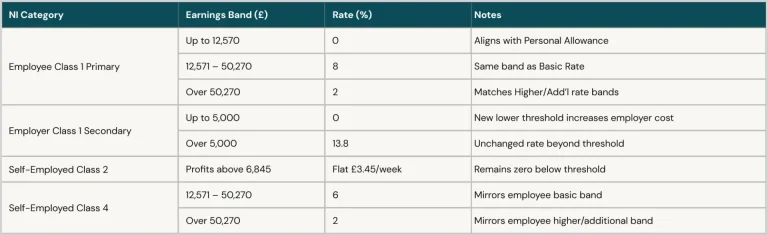

How National Insurance Changes 2025 vs 2026 tax brackets

National Insurance sits alongside income tax but follows its own thresholds and rates. Its bands mirror the frozen figures for 2025–26, yet a lower employer cutoff means some wages now attract NI earlier, even though employee and self-employed rules stay much the same under the 2025 vs 2026 tax brackets. The table below shows how employee, employer, and self-employed NIC thresholds and rates compare with the new tax bands.

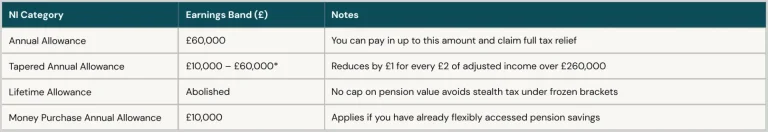

Pension Allowance Updates in 2025 vs 2026 tax brackets

Pension allowances are another vital element that interacts with the 2025 vs 2026 tax brackets. While tax bands remain frozen, your pension contributions still attract relief, making them a powerful tool for cutting taxable income. The tables below outline how the main pension caps apply in the coming year.

Core Allowances & Reliefs in 2025 vs 2026 tax brackets

Here’s an overview of the main allowances and reliefs under the 2025 vs 2026 tax brackets to help reduce your taxable income and keep more of your money:

1. Personal Allowance & Tapering

This structure determines how much of your earnings you can keep tax-free each year.

Personal Allowance

You don’t pay income tax on your first £12,570 of earnings each year. Most people under state pension age get this automatically. It means HMRC ignores that slice when they calculate your bill.

Tapering

Once you earn over £100,000, your tax-free slice starts to shrink. Every extra £2 you make trims £1 off your allowance. By the time you hit £125,140, there’s nothing left to spare.

2. Marriage & Blind Person’s Allowance

These allowances offer extra relief for couples and individuals with specific needs.

Marriage Allowance

If one partner isn’t using their full allowance, they can pass £1,260 of it to the other. That can cut the recipient’s tax by up to £252 a year. It is useful when one partner earns less and does not use all of their allowance.

Blind Person’s Allowance

If you are registered blind, you get an extra £3,070 tax-free. You can use this allowance in addition to your standard Personal Allowance. It offers a small but valuable boost for those with sight loss.

3. Savings and Dividends

A single allowance lets you keep some of your bank interest and dividend payments without paying tax. If you pay the basic rate of income tax, the first £1,000 of savings interest is yours to keep; higher-rate taxpayers keep £500. You also receive £500 of dividend income tax-free each year.

HMRC MTD income tax changes 2026

Starting in April 2026, anyone earning over £10,000 a year from self-employment, property, or other non-PAYE sources will need to file tax updates every quarter under MTD for Income Tax Self-Assessment. As part of the wider 2025 vs 2026 tax brackets changes, submitting quarterly MTD updates shifts all tax reporting online. This approach spots errors faster and makes managing cash flow much more straightforward.

Quarterly Updates via Approved Software

You’ll record your income and outgoings every three months in approved MTD software. Think of it as a regular financial health check. It spots mistakes early and keeps you from panicking over a big annual return.

Digital End-of-Year Declaration

The familiar SA100 paper form is outdated and replaced by a final digital declaration. You’ll confirm your totals once a year online, which dovetails with the quarterly submissions and ensures all your figures add up correctly.

Penalties for Non-Compliance

If you file late, you’ll get fined and pay interest on what you owe. Keep track of your due dates and you won’t get hit by extra fees or headaches.

Check Your Software Now

Anyone running a small business or self-employed should confirm their accounting package supports Making Tax Digital. Give it a trial run well before April 2026 to iron out any issues and familiarise yourself with the new filing steps.

Explore our Corporation Tax Return service for expert guidance.

How Much Will Council Tax Go Up in 2025–2026

Local councils set your council tax, but the government has capped the average increase at 5 percent for 2025–26. Councils in England can add up to 3% extra to pay for adult social care. The Office for National Statistics reports that a typical Band D bill rose from £1,964 to £2,062 in 2024–25, a jump that will stretch household budgets and underlines the importance of knowing your full tax picture.

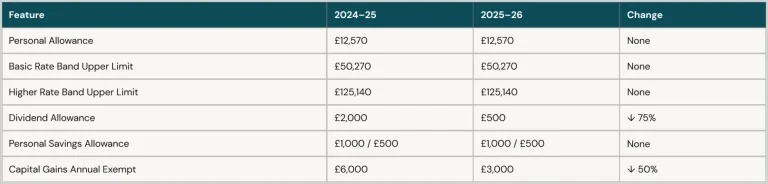

Tax Rates 2025 vs 2026: What’s Shifting?

Although headline bands remain, several nuanced changes affect your effective rate:

- Frozen thresholds: Income bands stay static, so any pay rise nudges you closer to higher rates.

- Dividend & Savings allowances have been trimmed, lowering the “tax rates 2025 vs 2026” for passive income.

- Capital Gains Tax allowances fell to £3,000, half the level of 2023–24.

Together, these moves can push up your marginal rate. A basic-rate earner tapping dividends now faces more tax on that extra £1,000 than in prior years.

UK Tax Bands 2025 2026 Summary

Planning Strategies for 2025 vs 2026 tax brackets

1. Pension Top-Ups

Adding more to your pension pot is one of the simplest ways to cut your tax bill when 2025 vs 2026 tax brackets tighten. Every pound you contribute reduces your taxable income by that amount. Higher-rate taxpayers can reclaim extra relief through their Self-Assessment return.

2. ISA Allocation

Putting money into Individual Savings Accounts keeps returns out of the tax net. You can choose between Cash ISAs and Stocks & Shares ISAs depending on your goals. These accounts are invaluable now that allowances are frozen and interest or gains grow tax-free.

3. Dividend Timing

Think about when you declare dividends if you run your own company. Delaying payouts until after April 2026 can give you a fresh £500 dividend allowance ahead of the next 2025 vs 2026 tax brackets shift. Spreading income across tax years helps you avoid hitting the dividend threshold too soon.

4. Charitable Giving

Donating through Gift Aid boosts each pound you give by 25 percent at source. Higher-rate taxpayers can claim extra relief on their Self-Assessment forms.

Ready to stay compliant and make the most of your tax allowances this year?

Looking Ahead: 2026 and Beyond

When April 2026 arrives and the bands stay frozen, you might find your tax bill creeping up before you notice. Staying on top of your MTD submissions and claiming every allowance now will help you keep more of your earnings.

If you’d like a hand with these changes, Sterling Cooper is here for you. Contact us, we’ll put together a simple plan that fits your situation and keep your tax affairs running smoothly.

FAQs

Recent Posts

Understanding s455 Tax: When HMRC Taxes Your Company Loans

Understanding the 40% Tax Bracket in the UK