Posted by:

Admin

Date:

February 17, 2026

Category:

What Are the Best Budgeting Strategies for Young Professionals?

As a young professional, navigating your finances has never been easy. However, it has never been harder in the UK. Young professionals now find themselves juggling short-term expenses with long-term financial goals. This is due to inflation outpacing wage growth and rising rental costs. Especially in the larger cities, the cost of living keeps increasing, forcing many to dip into their savings or use their credit. According to studies, 79% of young UK professionals have never created a budget or used a budget strategy. 77% of them admit to not having emergency funds. In such an environment, it is absolutely essential to adopt budgeting strategies. This disciplined money management can lead them to be more resilient and financially agile. This blog covers all you need to know about a budget strategy.

Why Budgeting Strategies Matter

Creating a solid budget strategy in your earlier career can be a financial lifeline later on. Rising rents and energy bills are making the job hard, but UK-based trends are shaping a new money mindset.

Low Confidence, High Financial Stress

Nearly 45% of UK adults lack confidence when managing day-to-day money. Younger adults, aged 18 to 34, have been feeling this issue even more deeply. Every 1 in 2 young adult feels that they are anxious about their finances. As a result of this uncertainty, young people may overspend, avoid their financial responsibility or miss payments altogether. Therefore, there is a dire need for flexible and accessible financial strategies that don’t overwhelm these young people. They should not exactly require a financial know-how. The goal is to make young people feel in control.

A Shift Toward Openness and Goal-Based Saving

Young professionals in the UK are becoming more proactive and transparent about money despite financial difficulty. Recent studies suggest that around 86% of people under the age of 34 are comfortable talking about their money. They share their savings goal, spending limit and long-term plans. This reflects the growing awareness around budgeting. Young professionals are now aware that budgeting strategies are not just about saving money. It is about designing a lifestyle matching your values and ambitions.

Modern Budgeting: One Income, Many Goals

For today’s young professionals, saving into one general pot isn’t the way. They are diversifying their goals. As reported by multiple sources, most UK adults use multiple savings pots. These pots frequently serve a variety of purposes:

- Short-term travel plans

- Starting a business

- Investing in crypto

- Paying off credit card debt

- Saving for a first home

These varied priorities suggest the need for budgeting strategies for young adults that support them in such goals.

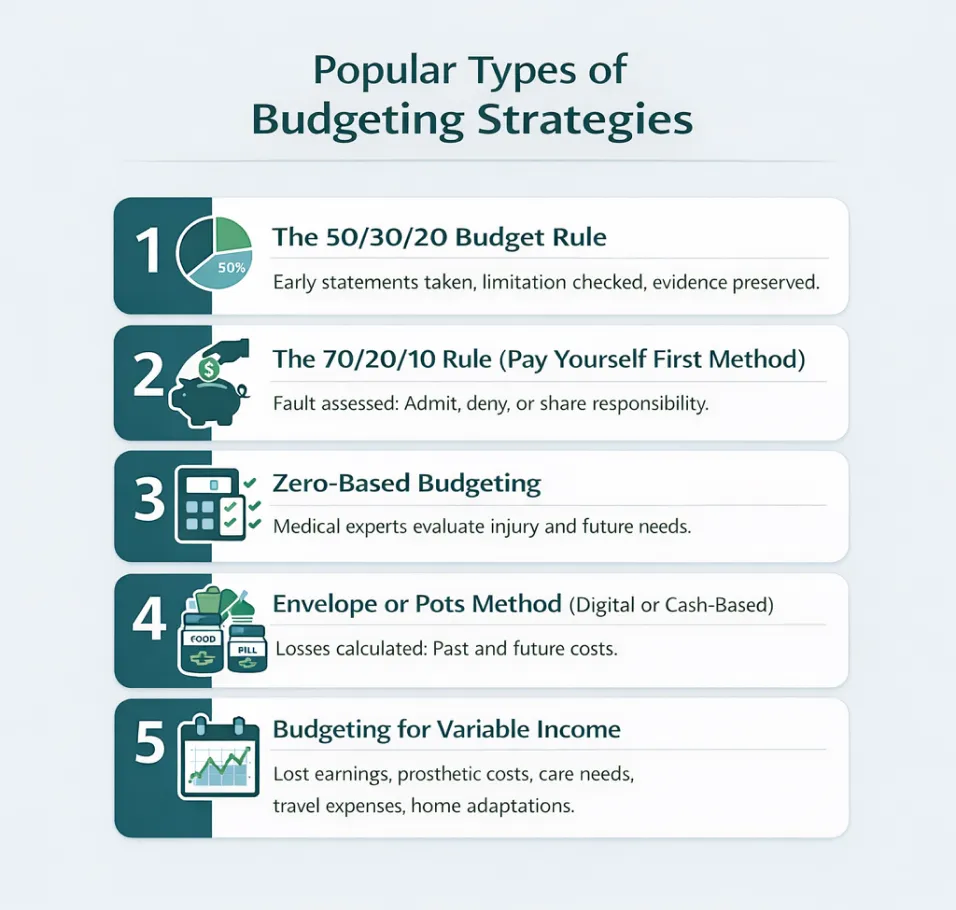

Popular Types of Budgeting Strategies

Here are some popular budgeting strategies that you can use as a young professional:

1. The 50/30/20 Budget Rule

The 50/30/20 rule is one of the most common ways through which young people in the UK are learning to manage their money. It’s a very simple method. After you are done paying tax, your income is divided into the following three parts:

- 50% for needs: This money is for the basics that you cannot avoid. For instance, you can’t just go without paying rent, food, energy bills, council tax, etc.. Similarly, shopping, travel costs, etc., have to be paid at all times, so all of this is a necessity.

- 30% for wants: You have to set aside this money for fun and non-essentials. This may vary for everyone. Some common wants are meals out, Netflix, clothes or hobbies.

- 20% for savings and paying off debt: This money is for building your emergency fund. It can also be used as savings for a long-term goal. Another use would be for clearing out student loans or credit cards.

Why the 50/30/20 Budget Strategy Works Well for Young People in the UK

This is one of the budgeting strategies that work really well because it isn’t too strict. You don’t feel like you have to give up everything when you start controlling your spending. Also, a lot of budgeting apps are there to help you follow this rule more easily. There are apps such as Emma, Moneyhub, and Snoop that let you label and track your spending. This allows you to not lose sight of your needs. If you are spending too much on wants, these apps can give you a warning. Financial advisers thus often suggest this budgeting strategy when you are just starting out your career. This is because it is easy to follow, and it can grow with you as you earn more.

How the 50/30/20 Budget Strategy Helps If Your Income Changes Month to Month

This budgeting strategy can work for you even if your income is variable. Like if you are a freelancer or work shifts or rely on commissions, you won’t get the same pay every month. Your plan is just based on your lowest expected income. Suppose you earn £2000 sometimes and sometimes £1600, and you wonder what strategies can help you budget on a variable income. So, what you can do is base your budget on £1600 and treat the rest as a bonus. This extra money is your bonus. Put it in savings, pay extra debt or treat yourself with it. This budgeting strategy, thus, works the best for this kind of income.

An Example for the 50/30/20 Budget Strategy

Let’s say Carrie gets paid £2000 a month.

- £1,000 (50%) goes to her essentials. She pays £750 for rent, £150 for groceries, £70 for bills, and £30 for council tax.

- £600 (30%) is for her “wants”: She goes out with her friends, has a gym membership and goes clothes shopping.

- £400 (20%) goes to her savings and paying off debts: She puts this in her emergency fund and pays her credit card debt.

What the 50/30/20 Budget Rule has in common with business budgeting

This budgeting strategy is very similar to how marketing departments allocate their budgets. Their money is divided into three parts. The first one is used to run everyday operations. The second is used for campaigns or experiments. The third one is used for long-term investments. This means that the budgeting strategy is a proven way to plan money. It may work this well in your personal life, too.

2. The 70/20/10 Rule (Also Called the Pay-Yourself-First Method)

This budgeting method shifts the perspective on how you think about money. Before spending, it saves first, which is the opposite of the usual methods. Here is how it works:

- You save 20% of your total income, i.e., put it in your savings or investments as soon as you get paid.

- You set aside 10% of your money for paying off debts like student loans and credit cards. You can also set it aside for charity if that is something you really care about.

- The final 70% is what you spend on your daily expenses. Your needs and wants are both covered in this. This means you use the 70% to pay rent, bills, groceries, meals, holidays, subscriptions, etc..

This method is called the pay-yourself-first method because you make your future a priority. Your savings are as important as your bills. It is not something you would do if you are left with something.

Why the 70/20/10 Budget Strategy Works Well for Young People in the UK

This method is great for building good money habits early on. Your future goals, such as a house, retirement, holiday, or a rainy day, thus always have something contributed to them. This is made easier by using apps such as Monzo, Starling, and Revolut. These apps help you in the following ways:

- You can set up automatic transfers to your savings accounts on the day you are paid.

- You can round up your purchases and spare change into savings.

- You can use them to split income into different pots. Like you may use one for taxes, one for travel and the last one for long-term saving.

How the 70/20/10 Budget Strategy Helps if Your Income Goes Up and Down

This budgeting strategy also works really well for people with variable incomes. The only change you make in case of variable income is that instead of saving a fixed amount each month, you save a fixed percentage. This means no matter whether you earn £1000 or £3000, you’ll save 20% every month. Your savings are thus realistic and flexible. You can also tweak the percentages slightly to suit your unique situation.

An Example for the 70/20/10 Budget Strategy

Let’s have an example of John, who earns £2500 in a good month:

- John immediately moves 20% i.e., £500, into his savings. These savings can be an emergency fund, holiday account or investment app.

- Then he sets aside 10% (£250) to pay off his credit card debt.

- He lives on the remaining £1750, which is 70% of his total income. He uses this money to cover food, travel and fun things.

Now imagine John’s income drops to £1800 the next month. He’ll still save 20%, which is £360, and put £180 toward debt (10%). That would leave him with £1,260 (70%) to live on.

3. Zero‑Based Budgeting

In this budgeting strategy, your entire income is planned such that at the end of each month, every single one of your pounds is assigned a goal. It can be paying for a bill, or funding a goal or saving the future. The key idea is as follows:

Income – Expenses = £0

This strategy does not imply that all your money should be spent. It means that every one of your quids is assigned a purpose. You count your savings and emergency fund as expenses too, using this plan.

How Zero‑Based Budgeting Works in the UK Context

This budgeting strategy is useful for you if you want complete control over your finances. It is one of the most effective ways to keep track of spending. This is because you view every single one of your expenses up front and make sure it fits in with your income. If you are naturally careful with money or at least want to build the habit, this method works great for you.

Example of Zero-Budgeting

Suppose Linda gets £2,200 a month. Using this budgeting strategy, she’ll map out her expenses as follows:

- £850 for rent

- £150 for groceries

- £70 for council tax

- £100 for utilities

- £150 for transport

- £250 for debt repayment

- £300 for savings

- £200 for wants, like if she wants to eat out or pay for her subscriptions

- £130 for upcoming expenses like a friend’s wedding or Christmas fund

By the end of the month, Linda knows where all her money is going. She does not have to guess, she has no leftover amounts, and she has no guilt of impulse purchases. Even her fun money is accounted for.

Why Zero-Budgeting is powerful but requires more effort

When you use this budgeting strategy, you get complete visibility into where your money is going. This is excellent for cutting back on overspending. But it is more time-intensive than other methods. You’ll have to sit down at the start of each month and adjust your plan every time based on your expenses and income. It is ideal for you in the following cases:

- You are on a tight budget

- Your income is irregular

- You are working towards a big financial goal (such as buying a house)

For this budgeting strategy, you can use apps like YNAB (You Need A Budget) and Money Dashboard Classic. They’ll help you assign money to each category and also help you re-adjust if something comes up mid-month.

4. Envelope or Pots Method (Digital or Cash-Based)

This budgeting strategy is quite an old approach. It is still incredibly effective for people who are visual learners and the ones who are trying to cut down on overspending. Here is the basic idea. You split your monthly income into envelopes or pots. Each of them is labelled for specific purposes. For instance, you can divide your income into groceries, rent, shopping, transport, or entertainment. You can only spend what you allocated for each section in the envelope. Once the money is gone, it’s gone. Traditionally, paper envelopes were used for this purpose. Now this method is made safer and easier using digital banking. You can create digital pots using apps like HyperJar, Goodbudget, and Plum. You can track your spending in real time using these.

Why the Envelope or Pots Method Works Well for Young People in the UK

Cashless payments have been on the rise in the entire world, and the UK is no exception. Because of this, it is easy to lose track of how much you are spending. At this point, it is people’s second nature to tap a card or use Apple Pay. As a result, you are spending more than you realise, and it doesn’t even feel like money is getting out of your hand. Using pots or envelopes helps you create natural envelopes. You can use apps like Starling and Monzo, through which you can divide your balance into named Spaces or Pots. To resist temptation, you can lock pots or establish guidelines like “add £20 every Friday.”

How this Budget Strategy Supports Goals and Prevents Overspending

This budgeting strategy is especially good for people who:

- Often spend too much money without recognising it

- Want a simple way to manage money, which is preferably low-tech or app-based

- Prefer visual organisation, i.e., they want to know how much money is left at a glance

This method suits most young adults who have already put their money into some sort of pots. The logic behind this can also be used for everyday budgeting, too.

Example for Envelope or Pots Budget Strategy

Mia gets paid £2000 a month. She sets her monthly envelopes or digital posts as follows:

- £800 rent

- £150 groceries

- £100 utilities

- £60 council tax

- £200 savings

- £250 debt repayment

- £100 travel

- £150 entertainment

- £190 for flexible spending (like gifts, treats, or unexpected costs)

Having this budgeting strategy helps Mia stay in control. She knows when she is nearing the limit in any category and take action accordingly.

5. Budgeting for Variable Income

You can use the 70/20/10 rule or the 50/30/20 rule when you have variable income. You also have the option to access a budgeting strategy optimised especially for your case. Here are three of them.

Build your budget on the ‘worst-case month’

When your income fluctuates, the easiest way to manage it is by using either of the two options. You can choose the lowest income of your last year and base your budget on that. Or you may take an average of your last 6 months’ income and make a budget on that. You have a solid foundation that you know you’ll be able to cover even in the quieter months.

Set up a holding account and ‘pay yourself’ monthly

Another option for variable income would be setting up a holding account. This way, you will not have to spend from your main account. Your income will land in the holding account. Then you can transfer a fixed account to your main account as if you were paying yourself a salary. This method smoothens your spending over time. It also helps you plan with confidence for the longer term. For lean months, you’ll have a buffer since you’ll be using extra income from higher months.

Use two budgets: one for lean, one for flush

A great strategy would be to build two versions of your budget. The first version would be used in a slower month. This will be the bare minimum costs you need for covering rent, bills, food, etc.. Another full version can be made for better months. Here you can add savings, social spending and non-essential.

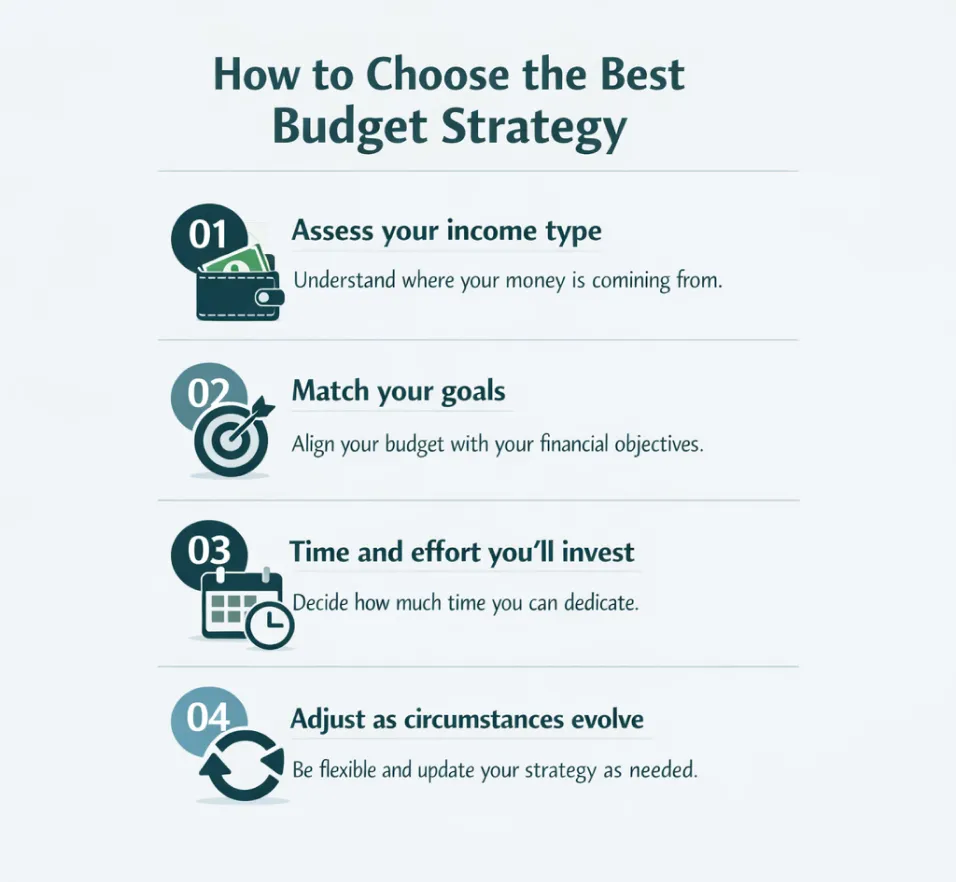

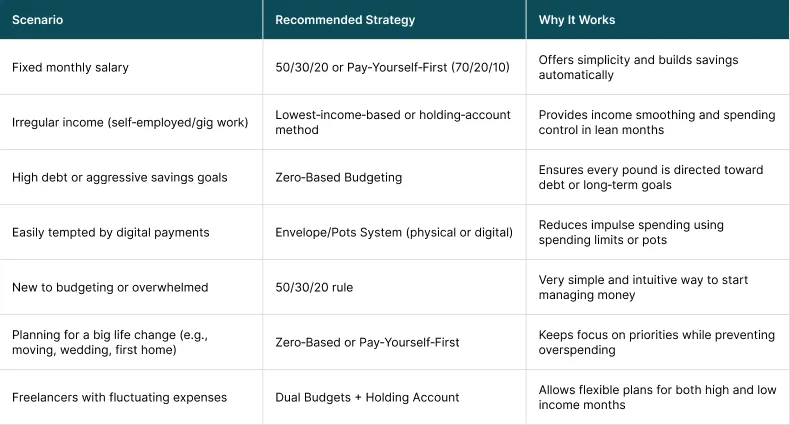

How to Choose the Best Budget Strategy

Choosing the best budgeting strategy depends on a number of different factors, which may vary for everyone. Here is how to narrow it down:

Assess your income type

The first thing that you have to assess is how predictable your money is. If you have a steady salary, choose percentage-based methods like the 50/30/20 or 70/20/10. They offer you simplicity and consistency. If your income is variable, use methods that involve a buffer or holding account. You can use zero-based budgeting with dual budgets. You can adjust without stress.

Match your goals

Choosing the right budgeting strategy is based a lot on what your end goal is. If you are saving for a short-term goal like travel, a business idea, or a crypto investment, you should use a flexible method. For instance, you can use digital envelopes or the Pay-Yourself-First rule. But if your goal is long-term, like buying a house, you need a strong savings habit and automation to keep you on track.

Time and effort you’ll invest

Think about how much time and energy you want to spend on budgeting. If you want to have a full hands-on approach that keeps you in control, use zero-based budgeting. If you want to keep things simple, use percentage rules like the 50/30/20 budget strategy or app-based systems. They will keep things light and breezy for you.

Adjust as circumstances evolve

Your budget has to grow with you. An increase in your income should increase how much you save every month. If you have a high-interest debt, you can shift more to repayments. You must realign your budgeting strategy every few months to whatever your situation evolves to.

Conclusion

As important as a budgeting strategy is, there is no one-size-fits-all solution. What works for a variable income freelancer may not work for you if you have a steady job. That is why we at Sterling Cooper Consultants take a personalised, UK-focused approach to your budget strategy. Our financial experts help you manage the right style with your income, goals, and lifestyle. We support you, starting simple. And then when your confidence grows, we layer in more structure. Our tools and guidance help you build long-term habits. We also offer budget review plans cause the income isn’t always the same. So, to get help, contact us now.Ready to take control of your money with a budget that actually works?

FAQs

Recent Posts

What Is a Payroll Report and Why Is It Essential for Every Business?

What Is Workforce Analytics and Why Is It Essential for Modern HR?