Posted by:

Admin

Date:

December 22, 2025

Category:

blogs

Understanding the 1263L Tax Code: A Simple Guide

If you keep seeing “1263L” on your payslip, it means you are entitled to more tax-free income than most UK employees and may not even realise it. Your tax code might seem like a random bunch of letters and numbers, but it is much more than this. It affects how much money you take home every month. This guide helps you understand the 1263L tax code. We’ll break down what it means and how it affects your pay. We’ll also explain how tax code 1263L differs from the standard 1257L code. This article will help you take charge of your wages and make sure you’re not losing money, regardless of whether you’re new to PAYE or just want to double-check your tax deductions.To learn more about tax codes and how they impact your pay check out our blog on Tax Code BR and how it impacts your pay.

What is the 1263L Tax Code?

HMRC (His Majesty’s Revenue and Customs) uses a combination of numbers and letters to define how much of your income should be tax-free. Tax code 1263L HMRC is one such combination. It plays a crucial role in determining the tax amount deducted from your income through the PAYE system. Here is everything you need to know about this.What is the definition of the 1263L tax code?

As described earlier, the main constituents of a tax code are alphabetic and numerical components. In the present case, 1263L tax code displays the amount of Personal Allowance that you are entitled to. This amount is not taxed. HMRC multiplies this figure by 10. This implies that you don’t have to pay tax on £12,630 of your income in the current tax year. The letter ‘L’ is indicative of the fact that you are eligible for the standard tax-free Personal Allowance. You don’t have to make any complex measurements or adjustments to find your tax-free income. This is crucial for understanding the 1263L Tax Code.What is the purpose of the 1263L tax code?

The main purpose of your HMRC 1263L tax code is to inform your employer’s payroll system of what amount of your salary should not be taxed. This serves to provide a fair and accrue amount that is to be deducted from your pay every month by the PAYE. To ensure that your tax deductions reflect your current financial situation, HMRC uses the 1263L tax code to indicate any adjustments, such as expense claims, allowances, or benefits. Without the correct tax code, you may end up paying too much tax or too little. It may lead to a tax bill or a refund later on.Breakdown of the 1263L Tax Code

So, what does tax code 1263L mean in the UK? Well, firstly, the numeric part, i.e., 1263, indicates that you are subject to a higher tax allowance than the standard 1257. To be precise, you are getting an extra £60 of tax-free income. This might be a result of pre-approved finances, such as professional fees and work-related expenses. Over the years, you may receive a modest but meaningful increase in your take-home pay.The letter ‘L’, as described earlier, denotes a full standard Personal Allowance. This means that you do not have untaxed income or company benefits. It also denotes that you have only one stream of income.Key Features of the 1263L Tax Code

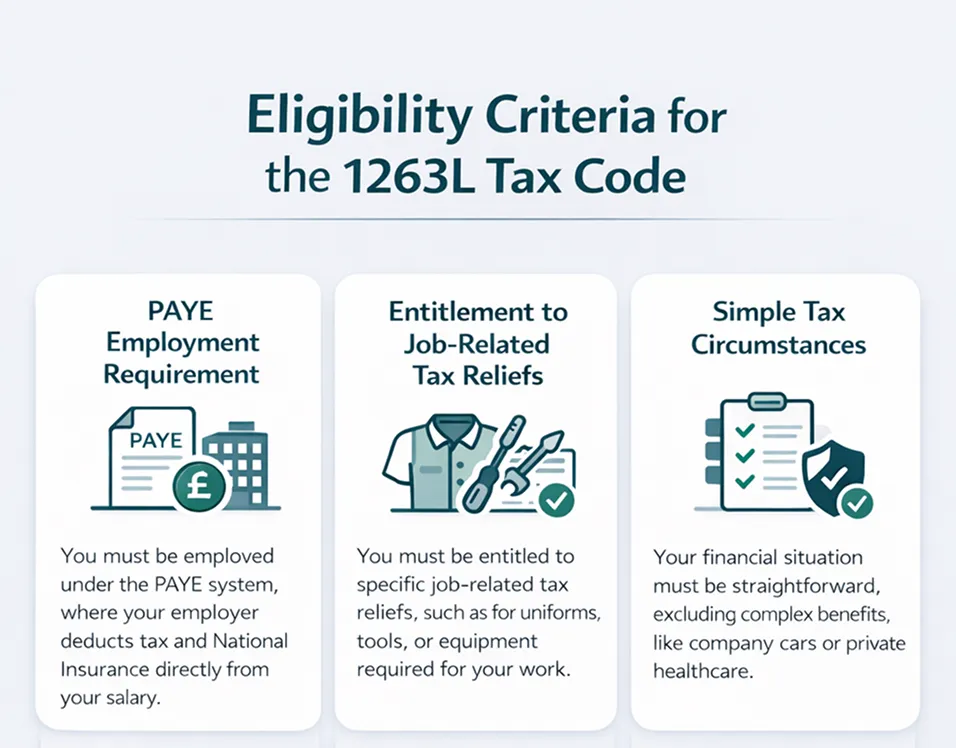

There are certain key features of this tax code that reflect your particular employment circumstances. These features help you understand your differences from the standard 1257L as well as determine your tax-free income. Understanding these features helps you to be efficient and avoid overpaying taxes.Eligibility Criteria for the 1263L Tax Code

The following is the main eligibility criterion for this tax code:PAYE Employment Requirement

Entitlement to Job-Related Tax Reliefs

Simple tax circumstances

Deductions & Credits That May Be Included in 1263L Tax Code

The higher Personal Allowance that comes with the 1263L code is a result of approved deductions and credits. They allow your non-taxable income to increase. Here are a few such examples that can lead to an increase in the portion of your salary exempted from tax:Uniform and Clothing Allowance

Work-Related Tools and Equipment

Travel Between Work Locations

Union Fees and Professional Subscriptions

Adjustments for Previous Overpayments

What are the Implications of the 1263L tax code for Taxpayers?

The implications of the 1263L tax code span numerous aspects of your finances. You get certain benefits, and you have certain responsibilities. Here is a detailed insight into each:Benefits of the 1263L Tax Code

Here are the key advantages of this tax code:1. Slightly Higher Take-Home Pay

One of the key benefits of his tax code is a slight rise in your take-home pay that is still tangible. Compared to the standard tax-free allowance, you get an extra £60. This means an increase of an extra £12 per year. This may seem a minor amount on its own, but it adds up to approximately an extra £140 a year. You can pay a utility bill or cover any small expense using this amount.2. Reflects Approved Tax Reliefs

The presence of this tax code indicates that tax reliefs have been recognised by the HMRC. This means that you don’t have to reclaim these benefits at the end of the tax year. You receive them in real-time. This is beneficial for you if you want to receive your full entitlement without having to go for a lengthy refund claim.Responsibilities You Have as a Taxpayer

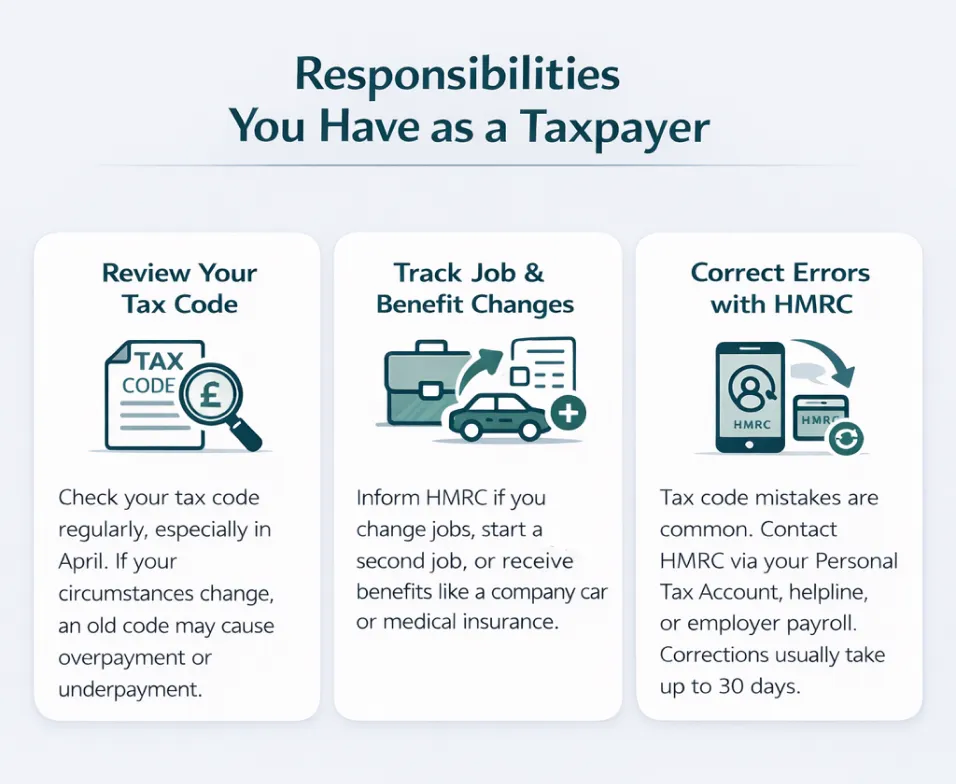

As a taxpayer, you have the following responsibilities to fulfil:Reviewing Your Tax Code Regularly

As a taxpayer, you are responsible for verifying your tax code once HMRC has issued it. A tax code out of normal such as the 1263L, may have been assigned to you for a claim you made in the past. But if your circumstances have changed now, i.e., you no longer need a uniform. Now, the tax code is not correct since it does not represent your present situation. So, you should review your tax code periodically, especially at the beginning of a new tax year in April, to avoid overpaying or underpaying taxes.Tracking Job and Benefit Changes

Your present tax code shows your present employment conditions. If you change your job, start a second job, receive a company car, or get medical insurance from the company, your tax obligations can be affected. It is necessary to inform HMRC about all these changes promptly. Failure to do so would result in the wrong tax code. This can change your tax bill, and you’ll have to pay a refund in the long run.Correcting Errors with HMRC

Mistakes in tax codes are a common occurrence. It is your job to get these mistakes corrected by contacting the HMRC. You can contact them directly in several ways. One way is to use your Personal Tax Account on the HMRC website. You can also call their helpline. In some cases, you can contact them using your employer’s payroll department. Usually, you get a correction in 30 days. A revised code is issued to both you and your employer. When you get discrepancies fixed at once, they have a lesser chance of affecting your future returns.

How the 1263L Tax Code Works in Practice

Your tax code plays a key role within the PAYE system. It ensures employees are taxed based on their individual circumstances. Here is a breakdown of how it works in a real-world setting and how HMRC calculates your code.How the PAYE System Uses Your Tax Code

Taxpayer Information Review

To begin, HMRC uses the information they have about your income and benefits. They further consider your previous claims and your job situation. They then use this information to calculate your tax code. Some other information that they use is as follows:- Employer notifications (via P45 or P46) when you begin or end a job

- Claims for expenses like uniforms or travel reimbursements

- Self-assessment submissions

- Third-party data, like pension providers or investment income platforms

Automation and AI in Tax Code Adjustments

HMRC has implemented automated procedures for issuing and modifying tax codes in recent years. Their real-time information system can be used by employers to inform them about the tax and income of an employee every time they are paid. This allows HMRC to spot inconsistencies more accurately than before. They can also make adjustments faster than ever in this regard. However, if the employers submit the wrong information, there is a higher chance of mistakes than ever before.Employers and Payroll Deductions

Your company uses the 1263L tax code that HMRC has assigned you to determine your monthly tax deductions using payroll software. Every time you receive your payslip, your tax code determines your tax-free income. This provides the threshold over which your income is taxable. Employers must use the most recent HMRC tax code as required by law. The application of wrong code is either due to wrong information or a delay in communication.Yearly and Long-Term Considerations for Your Tax Code

Tax codes never remain static. They not only evolve with your changing circumstances but also with the government policies. Being proactive guarantees that you always pay the right amount of taxes. Here are some aspects that you should pay attention to:Annual Tax Code Changes

Each year in April, HMRC changes tax codes. This is done to align with the start of the UK tax year. These changes can show the following:- Updates on Personal Allowance considering inflation

- Reforms prompted by the budget that impact tax bands and thresholds

- Modifications based on expired tax relief or benefit entitlements

Upcoming Changes: Shift to Payrolling Benefits by 2026

HMRC plans to phase out P11D forms at the end of the 2025/26 tax year. This is one of the most significant reforms that the HMRC is planning. For now, benefits-in-kind are reported by the employers using the P11D. These forms are submitted annually, and the benefits included in them are company cars, fuel, and health insurance. Retrospectively, these benefits are considered in tax codes.By April 2026, HMRC intends to integrate these benefits directly into the payroll. This allows real-time adjustments to tax codes. It also reduces reliance on the end-of-the-year forms. It is anticipated that this change will decrease error margins and increase transparency. However, you’ll have to monitor your tax codes more frequently. They can change mid-year, too.Check out for more updates: 2025–26 Tax Year Updates: Understanding the Latest ChangesConsult Sterling Cooper Consultants for Detailed Guidance

Understanding your payslip and all the information on it is crucial. Not only does wrong information have repercussions, but you also need the right information to plan for the future accordingly. At Sterling Cooper Consultants, we reduce your hassle by providing you with all the information you need in this regard. We find out your taxes and liabilities, file on your behalf and contact HMRC in case you need to. We make sure that you never overpay or underpay your taxes.To get help, contact us now.Need help understanding your payslip?

Sterling Cooper Consultants will handle it all, from explaining your tax code to contacting HMRC on your behalf. We make sure you don’t overpay, underpay, or stay confused. Contact us today and get expert support with zero hassle.

FAQs

You can apply using an HMRC P87 form if you think you qualify for a uniform washing allowance under tax code 1263L.

This question can only be answered by closely examining your tax information because your tax code is unique to your particular situation.

You can request a review from HMRC if you think your tax code is off. A new tax code may also result from changes in your situation, such as getting a larger personal allowance because of your age or disability.

You can check your payslip and pension documents. You can also check any other documents from the HMRC. You can check your Personal Tax Account with the HMRC if you have one.

The cost of conducting your job on a daily basis is probably the reason you have a 1263L tax code. For example, HMRC allows you to claim a portion of your tax back when you pay for the cost of washing your work uniform out of pocket.

Recent Posts

What Is Workforce Analytics and Why Is It Essential for Modern HR?

February 11, 2026

How Capital Gains Tax Is Changing in April 2026?

February 10, 2026