Posted by:

Admin

Date:

April 14, 2025

Category:

How do I get a VAT Certificate: A Complete Guide

A VAT certificate is a document that every listed business needs to have. It lets you properly charge Value-Added Tax (VAT) on sales. Items and services on which VAT applies need a certificate of VAT to be sold. If your yearly sales go over a certain amount, you have to do it by law.

Importance of VAT certificate

Getting a certificate of VAT is very important for businesses. It is a legal proof that you are registered. It also indicates that you can charge value-added tax on your items or services.

A VAT certificate in the UK holds great value. It indicates that you have passed the criteria of VAT registration. You need to then add VAT to your sales. You also have to report your returns to HM Revenue and Customs (HMRC).

Here are the reasons that make it important:

- You can get penalties without it.

- Without it, you can lose VAT registration.

- It boosts the credibility of your business.

- This certificate can help you attract customers since you are seen as legit.

Which businesses need a VAT registration?

Businesses with turnover above £90,000

A certificate of VAT is mandatory for these businesses. Legally, it is essential. It applies to all companies that are above this value of £90,000.

Businesses with turnover below £90,000

Below a £90,000 turnover, businesses do not need VAT registration. They can register on their own. This may get them benefits e.g., reclaiming VAT on purchases before registering.

Businesses with VAT-exempt goods

They do not have to register for VAT. These businesses include goods and services considered vital for society. Services like schooling, health care, and others are not subject to VAT.

“VAT exemption means that while sellers are not required to charge VAT on their output, neither are they able to reclaim any VAT paid on inputs to their production process”.

Ross Warwick et al.

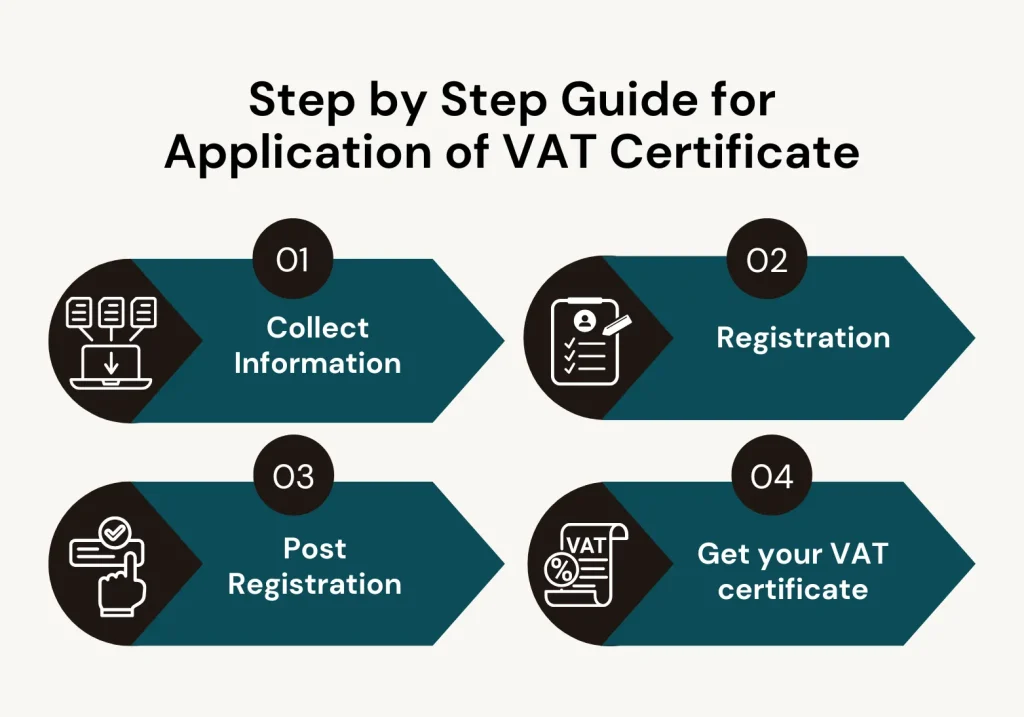

Step by Step guide for application of VAT certificate

“How do I get a VAT certificate” is the question you might be thinking now. Here is a step-by-step guide for applying for a certificate of VAT.

Step 1: Collect information

The information depends on the type of your company.Limited company:

For the limited company you need:- Registration number of company

- Bank account details of company

- Unique Taxpayer Reference

- Annual turnover details

- Self Assessment

- Corporation Tax

- Pay As you Earn (PAYE)

Individual or Partnership:

As an individual or partnership, you’ll need:- National insurance number

- Identity document (passport/driving license)

- Bank account details of yours

- Annual Taxover details

- Unique Taxpayer Reference (UTR)

- Self-Assessment

- Your payslip

- P60

Step 2: Registration

Register online

After you have the information, you have to register on the HMRC website. Here you’ll need

- Government gateway user ID

- password

You then fill out the forms as required for your company.

Registration by Post

There are some cases in which you cannot apply online. For them, the registration will be done by post. Some of these cases are:

- If you need a registration exception. This application may be because your turnover is temporarily above the value of £90,000.

- If you have to register different divisions of your business for different VAT registration numbers separately.

- If you have to register an overseas partnership

Registration through agent

You can apply for registration using accountant services. Your VAT returns will be submitted by them. They will also deal with HMRC. Getting your HMRC VAT certificate is their job.

Contact us for VAT registration.

Step 3: Post Registration

After registering, you’ll get the following by post:

- A VAT registration number that has 9 digits (to be mentioned on all invoices)

- Instructions to set up your account

- Information about submission of first VAT return and payment

- Registration date confirmation

Step 4: Get your VAT certificate

Once you receive the VAT registration number, do this:

- Sign in to the account of Government Getaway.

- Select the options of “Add a Tax, Duty, or Scheme”. Access the MTD enrolment option.

- An option about viewing your VAT account is present here. Choose this.

- Now choose “Manage your VAT”.

- Here, you’ll see an option. It allows you to view your VAT certificate. Choose that.

Keeping VAT registration up to date

You must keep your information up to date. If changes happen, HMRC should be informed in 30 days.These changes can include- Contact details of business

- Details of bank

- Information such as the name of the business

- Dates of return

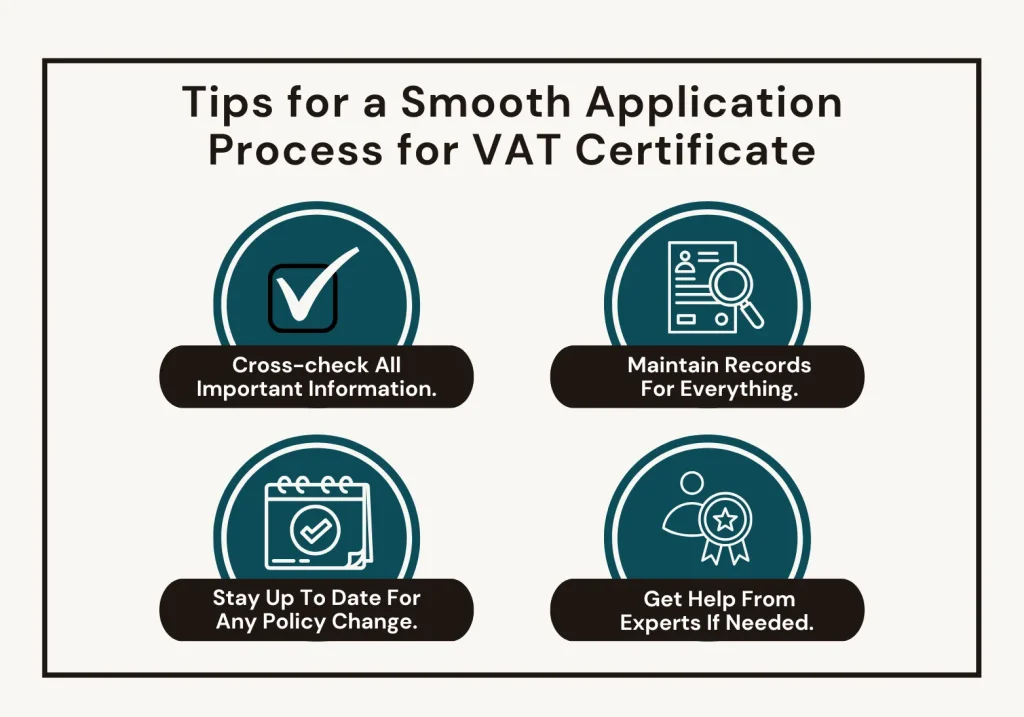

Tips for a smooth application process

You can follow these tips to ensure your application for the certificate is a smooth process.- Cross-check all important information.

- Maintain records for everything

- Stay up to date for any policy change.

- Get help from experts if needed.

Contact Sterling Cooper Consultants for expert advice

VAT registration can be tricky. Whether you have an established company or you are just starting, get advice from us. We, at Sterling Cooper Consultation Limited, are aware of the importance of this important document.

We offer you practical advice on getting your registration and certificate. So, for all your VAT-related queries, contact us now!

Need help with VAT registration?

Sterling Cooper Consultants Limited offers professional guidance to make the VAT certificate process easy and hassle-free. Whether you’re registering for the first time or updating details, our experts are here to assist you.

FAQs

Recent Posts

What Are the Benefits of Automated Payroll Processing?

What Is a Payroll Report and Why Is It Essential for Every Business?