Posted by:

Admin

Date:

January 26, 2026

Category:

What Is Double Taxation Relief? A Complete Guide for Individuals & Businesses

Have you or someone you know paid tax abroad but got taxed again in the UK? The Double Taxation Relief can save you from being taxed twice on the same income. The UK has tax treaties with dozens of countries, thus, this problem is not as rare as it might seem. One rent payment or dividend from overseas can set it off. This guide enables it to become more knowable and understandable.

What Is Double Taxation Relief & How Does It Occur?

Double Taxation Relief (DTR) means relief from UK tax when tax has already been paid in another country on the same income or gain, also known as double taxation relief. It is made to stop the same money being taxed twice.

Double Taxation Relief in Simple Terms

Double Taxation Relief (DTR) is a UK tax relief that helps when the same income or gain is taxed in another country and then taxed again in the UK. It can apply to individuals and businesses. In most cases, it works by reducing the UK tax bill to reflect tax already paid overseas, so the same money is not charged twice.

Double taxation occurs when income is earned in one country, but the person or business is resident somewhere else.

Many people think double taxation only happens to big companies. That is not true. It can hit normal people too, like someone renting out a small flat overseas, or getting a pension from another country. When two tax systems touch the same income, the bills can start to feel heavy.

Double taxation usually starts because countries tax using two different ideas. One idea is “where the money comes from”. The other idea is “where the person lives for tax”. To get more practical tips for efficient taxation check out our guide on tips for saving on tax billing.

How Double Taxation Usually Starts

Country of Source

The country where the income is earned may tax it because the income is connected to that country. Rent is linked to the location of the property. Wages can be linked to where work is done. Interest and royalties can be linked to where the payer is based. This is why a foreign country may tax income first.

Sometimes it is a clear tax bill. Sometimes it is withholding tax. Withholding tax means the tax is taken before the money even reaches the person or the business. It can feel unfair, but it is a normal rule in many places.

Country of Residence

The UK may also tax the same income if the person is a UK resident for tax. Many UK residents are expected to declare foreign income in their annual Self Assessment tax return. This includes foreign rent, foreign dividends, foreign bank interest, or profit from an overseas business. So the same income can be taxed again, just because the person is resident in the UK. This is a common point in double taxation relief uk, and it is also where HMRC double taxation relief becomes important in real filings.

This is where DTR becomes important. It gives a way to reduce the double charge.

Examples That Make It Easier to Understand

Example 1: Overseas Rent

A UK resident rents out a property overseas. The overseas country taxes the rent because the property is there. The UK may also tax the rent because the person is a UK resident. Without relief, there is a double charge on the same rent.

To learn more about paying taxes on rental income, check out our blog on taxation on rental income.

Example 2: Foreign Dividends or Bank Interest

Money comes from foreign shares or a foreign bank. The foreign country may take tax first by withholding. The UK may also charge tax when the income is declared.

Example 3: A UK Company Earning Abroad

A UK resident company earns foreign income. It might suffer foreign tax, like withholding tax on royalties or interest. Or it might have profits from an overseas permanent establishment (PE). The UK can still tax global profits, unless a branch exemption election excludes some PE profits. So double tax can still happen.

Why Is Double Taxation Relief Important?

Double taxation relief matters because it stops tax from becoming a punishment for having cross border income. Many people today work across countries, invest abroad, or have family links overseas. Without relief, the same income can be taxed twice, and that can reduce savings, slow down plans, and create stress. This is often where people ask what is double taxation relief in a simple sense, and why it matters so much in double taxation relief uk cases.

1. It Protects Fairness

A tax system feels more fair when the same money is not taxed two times. DTR helps bring balance. It tells both countries, in a clearer way, who taxes what, and how relief should work when two systems overlap.

2. It Reduces Stress And Fear

When foreign income is involved, people often feel scared of getting things wrong. There can be fear of penalties, fear of letters from HMRC, and fear of paying too much. DTR gives a proper route. It shows that foreign income does not always mean double tax, as long as it is declared properly and relief is claimed correctly.

3. It Helps Businesses Grow

Businesses need confidence to trade across borders. If a UK company earns money abroad and loses too much of it to double tax, it can become hard to expand. Double taxation relief supports growth and makes cross border work feel more possible.

What Mechanisms Exist for Relief?

Relief usually comes through tax treaties and through UK rules. Relief can work in different ways, depending on the country, the income type, and the tax paid.

1. Double Taxation Agreements

The UK has double taxation agreements (DTAs) with many countries. A DTA is a treaty that explains which country has the right to tax certain income. Sometimes the right is only with one country. Sometimes both can be taxed, but relief is given so the income is not taxed twice. There are more than 3,000 double taxation treaties worldwide and the UK has the largest network of treaties, covering around 120 countries.

2. The Treaty Can Decide Who Taxes

Some treaties say the income is taxed in the country where it is earned. Some say it is taxed in the country of residence. Some say it can be taxed in both, but with limits.

3. Credit Relief

Credit relief is a common method. Foreign tax paid can be used as a credit against UK tax on the same income. This is one of the key types of double taxation relief used in double taxation relief uk cases, and it is also a common part of HMRC double taxation relief claims.

4. How Credit Relief Feels In Simple Words

If tax is already paid overseas, the UK tax bill can be reduced by that amount. But the credit is not always unlimited. It is usually capped, so the credit cannot be higher than the UK tax on that same income.

5. Exemption Relief

Some treaties give exemption for certain income types. That means the income may only be taxed in one country.

6. When Exemption Can Happen

Some income is treated as taxable only in the source country. Some income is treated as taxable only in the residence country. This depends on the treaty and also on what type of income it is.

7. Deduction From Profits

Sometimes foreign tax is not claimed as a credit. In some situations, it may be deducted as an expense, so the taxable income becomes smaller.

8. Credit Or Deduction

Credit is often more helpful than deduction, but the better option depends on the details. This is why careful planning matters. For many people, these details are the most confusing part of what is double taxation relief, because the route changes depending on the facts. The OECD also notes that there is a network of more than 3,000 tax treaties globally, which is why treaty rules and relief routes can vary so much.

Who Is Eligible for Double Taxation Relief?

Eligibility depends on residence, income type, and whether a treaty exists.

1. Individuals Who Are UK Tax Resident

A UK resident usually declares worldwide income in Self Assessment. If foreign tax has been paid on foreign income, relief can often be claimed so the same income does not face double tax.

2. Individuals Living Abroad With UK Income

A person living abroad can still receive UK income, like pension or interest. UK tax may be taken, but a tax treaty may allow reduced tax or a refund. The relief route here is often different from the UK resident route.

3. UK Companies Earning Overseas

A UK resident company can face foreign tax, and also UK corporation tax on the same profits. Relief can be claimed, often by crediting the foreign tax, within limits.

4. Permanent Establishment Situations

If the company has an overseas PE, foreign tax can be charged on PE profits. The UK may also charge tax unless the company is under the branch exemption election. This is a big planning point for businesses.

Foreign Tax Credit Relief and Self Assessment (UK)

For many UK residents, the most common route is Foreign Tax Credit Relief through Self Assessment. This is used when foreign tax has already been paid on income that is also taxed in the UK, such as overseas rent, dividends, bank interest, or overseas work income.

In simple terms, the foreign tax paid can reduce the UK tax on the same income. But it is not always unlimited. The credit is usually capped, so it cannot be higher than the UK tax due on that income. This is why matching the foreign tax to the correct income matters.

Foreign income is normally reported on the Foreign pages (SA106) in the Self Assessment return. This is where the foreign income is shown and where the foreign tax credit relief is usually claimed.

This route is often smoother when records are clear, the income is put in the right category, and proof of foreign tax paid is kept in case HMRC asks later.

How Can You Claim Double Taxation Relief?

Claiming relief depends on the scenario. Choosing the right method matters a lot.

1. If UK Resident With Foreign Income

Foreign income is normally declared in the Self Assessment return. The Foreign pages (SA106) are used to show foreign income and claim foreign tax credit relief. This is a routine step in double taxation relief uk, and it is also where HMRC double taxation relief is often applied in practice.

HMRC may not ask for foreign tax records immediately, but they can ask later. It is safer to keep foreign tax certificates, assessments, and proof of tax paid.

Records to Keep (So The Claim Is Easier Later)

Keep these documents in case HMRC asks for evidence in the future:

- Foreign tax certificate or tax assessment showing the income and tax charged

- Withholding tax statement (from the bank, broker, tenant agent, or payer)

- Proof of payment (bank receipt, payment confirmation, or official receipt)

A breakdown that matches each foreign tax amount to the related income (rent, dividends, interest, wages) - Any treaty forms or confirmations used to reduce tax at source or claim a refund

2. If Living Abroad With UK Income

Treaty relief may be claimed using HMRC claim forms such as DT Individual, or other country specific forms in some cases.

The form process often works like this. The form is filled in, then sent to the tax authority in the country of residence. They confirm eligibility, then they send it to HMRC or return it to be sent on. This is used to claim a refund, or to reduce tax taken in future.

3. Certificate Of Residence

Sometimes a certificate of residence is needed. This helps prove UK tax residence for treaty benefits, especially when a foreign country will only reduce withholding tax if residence proof is provided.

4. For Companies

Companies usually claim through their corporation tax process. Foreign tax suffered must be recorded and matched to the correct income. Withholding tax documents matter. PE tax records matter too.

A small mistake in matching can cause a big problem later. It can slow the claim or lead to questions.

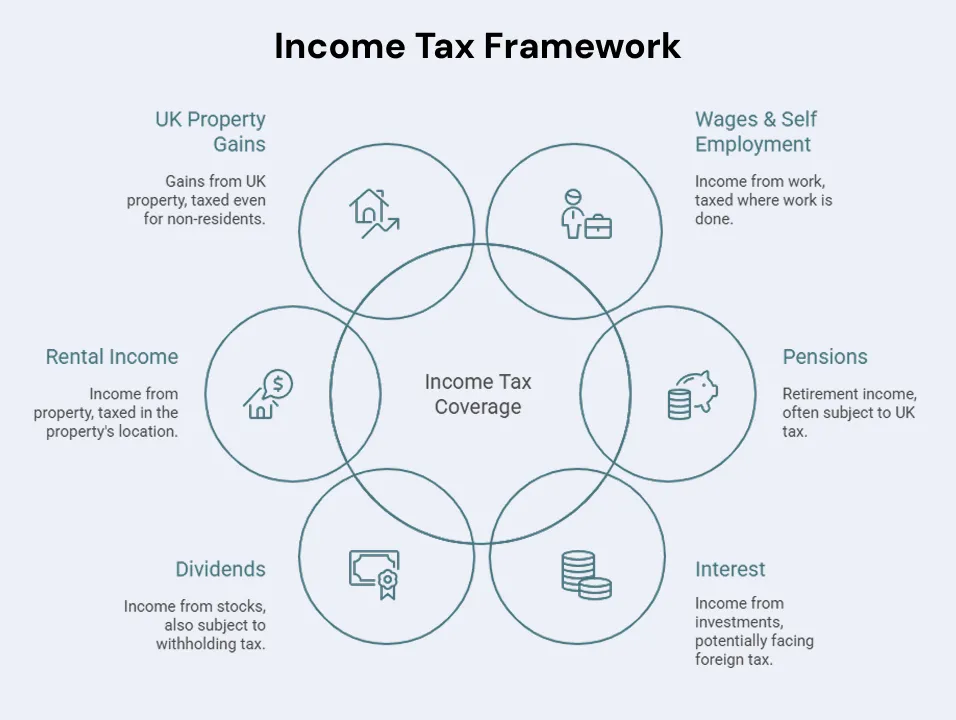

What Types of Income Are Covered?

DTR can apply to many types of income and sometimes gains too. But the rules depend on the treaty and UK law.

1. Wages And Self Employment Income

Wages can be taxed where work is done. If the person is a UK resident, the UK can still tax it too. Treaty rules often decide how the taxing right is shared, and when relief should be applied.

This is common for people who travel for work or work overseas for part of the year.

2. Pensions

Pensions are common in DTR cases. Many treaties have special pension rules. Some UK government pensions are often taxed only in the UK. Other pensions can be treated differently depending on the treaty.

3. Interest

Interest can face foreign withholding tax. UK tax may also apply if the person is a UK resident. Relief can reduce the double charge, but the foreign tax credit limits still matter.

4. Dividends

Dividends can be tricky. Foreign withholding tax can apply. The UK can tax dividends too. Some special rules exist, and HMRC guidance also talks about residence and remittance basis topics that can affect the bigger picture.

5. Rental Income

Property income is usually taxed where the property is located. But UK residents often still declare it in the UK. Relief can then apply so the same rent is not taxed twice.

6. UK Property Gains

The UK can tax gains on UK land and property even for non residents. Treaties often allow the UK to tax gains from UK “immovable property”. So treaty relief may not remove UK tax the way some people expect. Relief might instead be relevant in the other country, depending on their rules.

What Should Businesses Consider About Double Taxation Relief?

Businesses should not treat DTR as a last minute problem. It should be part of planning, especially for cross border payments.

Withholding Tax Risk

Withholding tax can reduce cash flow. The tax is taken before money arrives. A UK business might expect full payment and then receive less. This can cause stress and also change profit numbers.

Royalties and Interest

Royalties and interest are common payment types where withholding tax appears. Treaties may reduce the rate, but paperwork is often needed. Without paperwork, the higher rate can apply.

Permanent Establishment Planning

A business with an overseas PE should think about how PE profits are treated. If PE profits are taxed overseas and also taxed in the UK, relief may be needed. Branch exemption elections can change the position. But it also affects losses and future planning, so it needs careful thought.

UK Withholding Obligations

Sometimes a UK company has to withhold tax when paying certain types of income to someone abroad. Not every payment triggers it. It depends on the payment type and the rules. This should be checked carefully.

Strong Records and Clear Matching

Foreign tax must be linked to the correct income. This matching is important for relief claims. If records are weak, even a valid claim can become slow and frustrating.

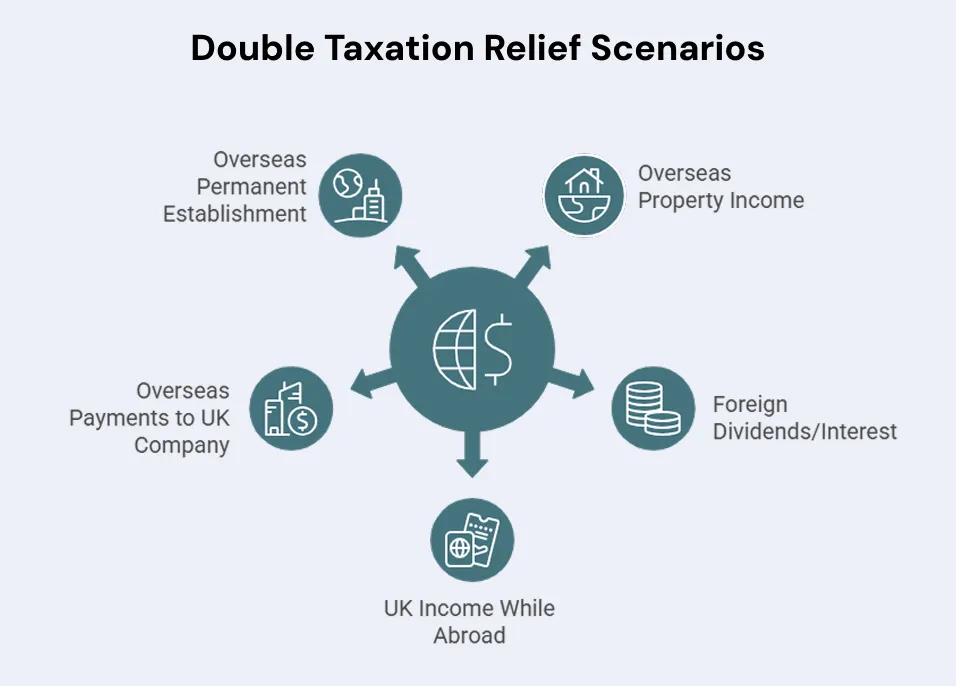

What Are the Common Scenarios for Double Taxation Relief?

DTR appears in many repeating situations. These situations happen every year for individuals and businesses.

1. UK Resident With Overseas Property Income

Overseas rent is taxed overseas. It may also be taxed in the UK. Relief helps reduce the double charge so the rent is not taxed twice.

2. UK Resident With Foreign Dividends Or Interest

Foreign withholding tax is taken. UK tax may also apply. Relief helps stop double payment, within limits.

3. Living Abroad But Still Receiving UK Income

UK tax may be deducted from pension or interest. A treaty may allow reduced tax or a refund. This is often handled through HMRC claim forms and the residence certification process.

4. UK Company Receiving Overseas Payments

Royalties or interest received from overseas may suffer withholding tax. UK corporation tax may also apply. Relief can reduce the total burden, but the UK credit limits still apply.

5. UK Company With Overseas Permanent Establishment

The overseas country taxes PE profits. The UK may also tax them unless branch exemption applies. Relief or exemption planning becomes very important here.

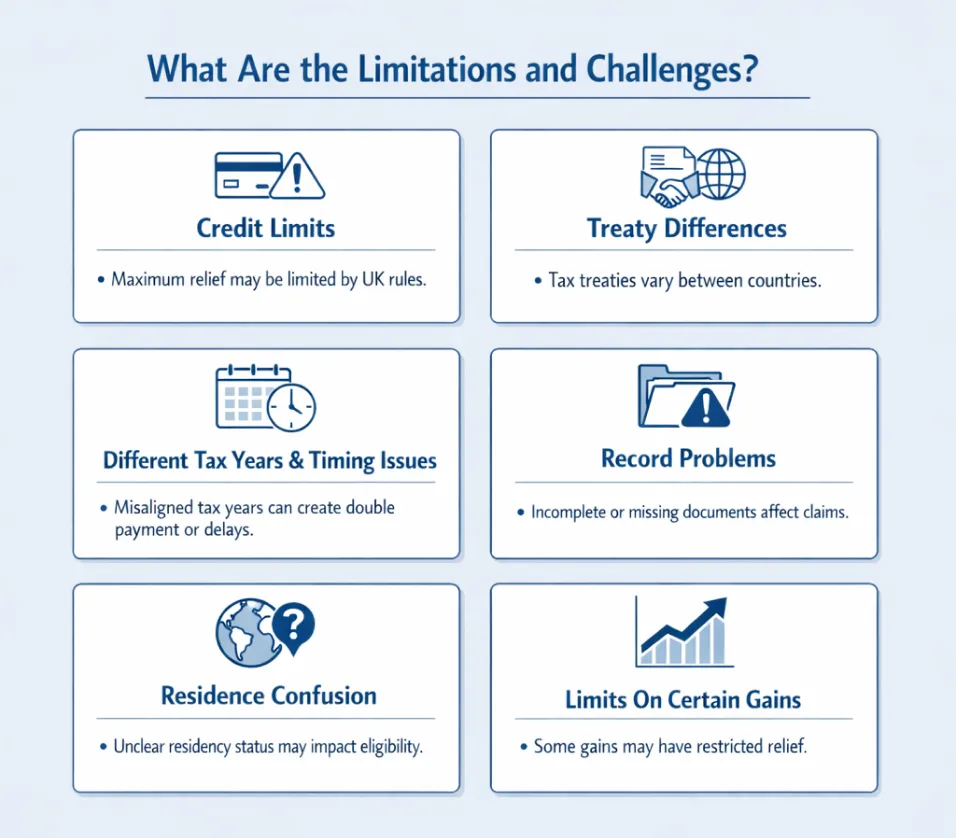

What Are the Limitations and Challenges?

DTR is helpful, but it has limits. It can also be hard to manage without good organisation.

1. Credit Limits

Foreign tax credit relief is usually capped. If foreign tax is higher than the UK tax on the same income, the extra foreign tax may not be usable in the UK. This can still leave a higher total tax cost. This limit is often stressed in HMRC double taxation relief thinking, and it can matter a lot in double taxation relief uk cases.

2. Treaty Differences

Treaties are not all the same. A rule in one treaty can be different in another treaty. Even small wording changes can change the result. That is why general advice is not always enough.

3. Different Tax Years And Timing Issues

Tax years differ across countries. Foreign tax might be paid in a different time period than UK tax. This can delay relief and create confusion during filing.

4. Record Problems

Relief needs proof. Foreign tax certificates, assessments, and evidence of payment matter. They might not be needed at the start, but they can be requested later. Without them, the claim can become hard.

5. Residence Confusion

The rules for UK residents with foreign income are not the same as the rules for people living abroad with UK income. Using the wrong method can cause mistakes and delay relief.

6. Limits On Certain Gains

Some gains remain taxable in the UK even for non residents, especially UK property gains. Treaties often do not remove the UK taxing right in those cases. Relief might still be possible in the other country, but it depends on that country’s rules.

Conclusion

Double taxation relief exists because life and business can cross borders now. Income can come from one country and be taxed there, while the person or business may also be taxed in the UK. Without relief, that same income can be taxed twice, and it can feel unfair and stressful. This is why double taxation relief uk planning matters, and why people often rely on HMRC double taxation relief routes when they file and claim.

DTR gives a fairer path. Tax treaties help decide who taxes what. UK rules allow relief through credits, exemption in some cases, or deduction in some situations. The key is to stay organised. Foreign income should be declared correctly. The correct route should be used, like SA106 for foreign income in Self Assessment, and treaty claim forms for people living abroad with UK income. Records should be kept even if they are not asked for immediately. This is also why the types of double taxation relief should be understood early, because the best route depends on the details.

DTR is not always easy. The rules have limits, and the details can be tiring. But it still helps a lot. When handled with care, it can reduce stress, protect fairness, and make cross border work and investment feel safer for both individuals and businesses. If you want this handled end to end, Sterling Cooper Consultants can help. Contact us now to get your audit today.