Posted by:

Admin

Date:

April 30, 2025

Category:

What Is Tax Code BR and How Does It Impact Your Pay?

A tax code defines the amount of PAYE tax, decided by HMRC, to be cut from salary or pension. The BR tax code is one of these and it indicates that the basic income tax rate of 20% is applied on all income. In this case, tax-free personal allowance is not applicable. In more general terms, if you hold a second job for say £20000, you will pay a 20% pay under tax code BR.

How do you get a tax code

You receive a tax code by either of these ways:

- It is calculated by HMRC and sent to you and the company you work for.

- The employers calculate it on their own using the rules of HMRC.

In case of job change, your new employers should use your existing tax codes. They can obtain it from:

- A P45

- Get a starter checklist filled if a P45 is not available.

Do self-employed people receive a tax code?

People who are self employed, do not get a tax code. They have a Unique Taxpayer Reference (UTR) which helps them pay taxes. UTR is also a unique number which stays the same through lifetime.

The tax of these people is calculated by a self-assessment tax return that they are supposed to submit at a fiscal-year’s end. Since they don’t receive salaries, their PAYE payments cannot be calculated.

UTR does not change even if a person is self employed, then goes to a regular job, and then becomes self employed again.

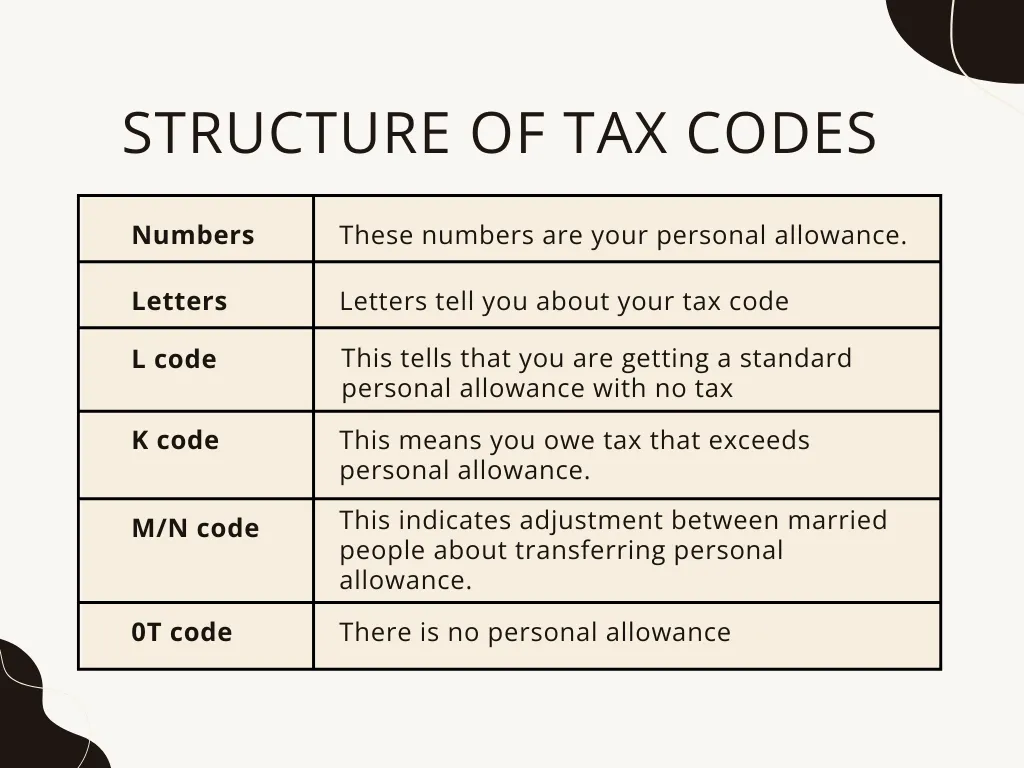

Structure of tax codes

If you are wondering ‘what is tax code BR’, you first need to know tax codes. A tax code constitutes some numbers and letters.

Here is some information that they indicate:

Numbers:

These numbers are your personal allowance.

Letters:

Letters tell you about your tax code:

L code:

This tells that you are getting a standard personal allowance with no tax.

K code:

This means you owe tax that exceeds personal allowance.

M/N code:

This indicates adjustment between married people about transferring personal allowance.

0T code:

There is no personal allowance.

Understanding Emergency Tax Codes

Emergency tax codes are not forever. They are only applied when HMRC does not have enough details. Emergency codes can have you paying more tax than you are obligated to.

They don’t account for your circumstances.

They can be:

- W1/M1 (weekly/ monthly income taxed without background of whole income)

- BR (all income is taxed on basic rate)

Income tax on earned income is charged at three rates: the basic rate, the higher rate and the additional rate. For 2022/23 these three rates are 20%, 40% and 45% respectively. Tax is charged on taxable income at the basic rate up to the basic rate limit, set at £37,700.

Antony Seely et al.

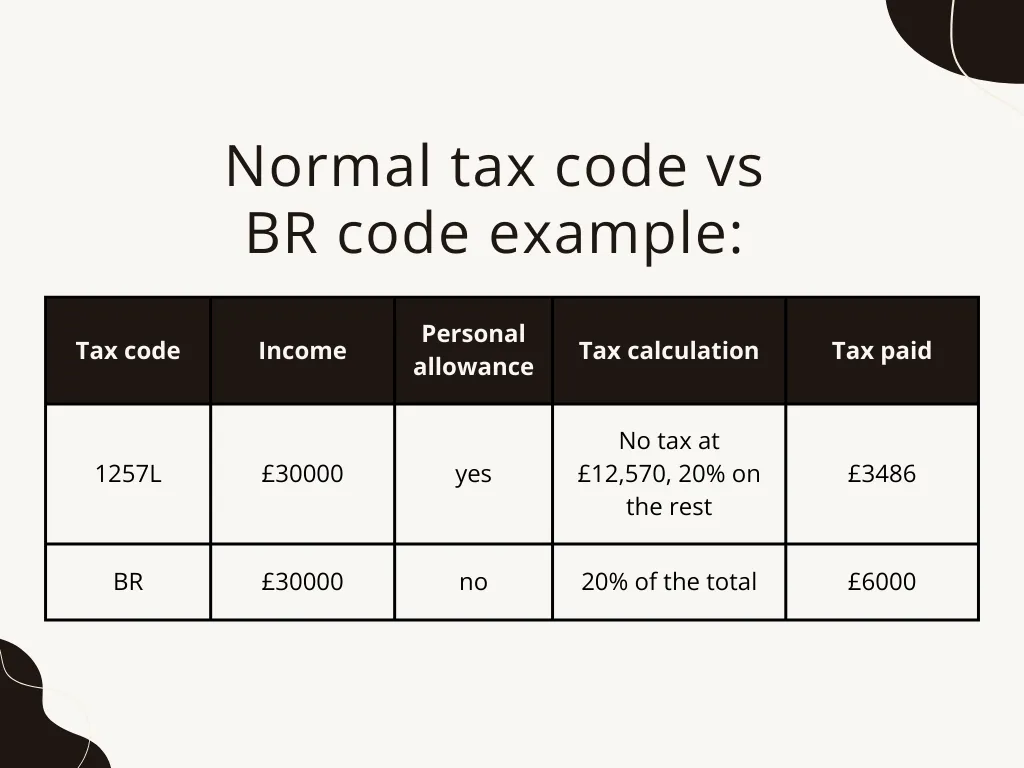

Normal tax code vs BR code example:

Here is an example of how much tax you have to pay if you have an emergency vs a normal tax code.

Cases of tax code BR

This tax code is applied in the following cases:

More than one job/pension:

In this case, you get a personal allowance on your first job/ pension. The other sources of income are then taxed under the basic rate.

New Employers:

New employers may use BR tax code for you in case of incomplete information. Once HMRC gives them updated details, this might be corrected.

Incomplete Information:

This code might be applied if you have not updated your information at HMRC. Your income and employment details need to be up to date for the right tax code to be applied.How to check for tax code BR

Check these documents or applications to know if you fall under this category:- Payslip

- Any correspondence from HMRC

- Tax account

- HMRC app

Concerned About the BR Tax Code on Your Payslip?

Our advisors at Sterling Cooper Consultants offer expert guidance to help you correct your tax code and reclaim any overpaid taxes from HMRC.

How does the BR tax code affect earning?

It is useful for employees to learn the effect of the BR tax code. It might make things hard for workers with more than one source of income. Net pay can decrease by a noticeable amount. Employees should learn how their different incomes will be taxed to smoothen their budgets.

Effect of BR tax code on other fiscal matters

The BR tax code can impact important fiscal matters apart from income. Some of these include:

- Contributions to pension

- Loan (student) repayments

- Benefits eligibility

Recommendations for employees:

- Employees should take the following actions for improving outcomes:

- Consult resources from HMRC so their tax codes align with their job status

- Engage with employer and HMRC actively while changing jobs

- Consult tax professionals for better understanding.

To understand taxation matters, get in touch with our accountants.

Recommendations for employers

While the employers are giving tax codes, they should ensure these as well:

- Perform audits of payrolls. This helps in pointing out mistakes in tax status.

- Train staff for filling correct application in case of code changing

- Use payroll softwares for accuracy

- Stay in touch with professionals

How to get BR tax code changed

Understanding what is a br tax code can make you realize you are wrongfully put in the category. Now take the following steps to get the status changed:

1. Contact HMRC:

HMRC can be contacted and you can provide them with all the important details. These may include income and personal allowance details.

2. Contact your employer

You need to talk to your employer urgently to update your details.

3. Check for updates

Check your status on payslips regularly. Also visit HMRC website to check for your changed status.

Refund on BR tax

You might be due for a refund if you have overpaid. Mostly, you’ll get paid by the HMRC on their own. You can also claim your payment by filing for it. This is done in these case:

- Correction of tax code after getting overtaxed

- After leaving a job

Contact Sterling Cooper Consultants for advice

At Sterling Cooper Consultants, we help you understand and manage these tax codes. We offer you expert advice on all tax matters. We help you adjust your tax code based on your situation. You can avoid misconceptions and avail the refunds. Only pay the correct tax that you owe.

To get advice on BR code and related matters, contact us now.

FAQs

You pay a 20% tax on BR code. This means on a £50000 income, you’ll be paying £10000 tax.

If you have been paying the wrong tax amount due to wrong code, you might be due for a tax rebate.

Recent Posts

What Are the Benefits of Automated Payroll Processing?

What Is a Payroll Report and Why Is It Essential for Every Business?