Posted by:

Admin

Date:

February 12, 2026

Category:

What Is a Payroll Report and Why Is It Essential for Every Business?

Payroll is one of those jobs that sounds simple: pay people, send payslips, done. In practice, it is easy for errors to slip in. Starters, leavers, overtime, bonuses and changes to the tax rules make things more complicated. This is why payroll reports matter.

When you look at guidance from most payroll and accounting platforms, they all land on the same core points. A payroll report is a record of what you paid, what you withheld, and what you owe. It helps you pay staff correctly and stay compliant.

Some payroll platforms note that small businesses can spend up to 5 hours each pay period on payroll tasks before automation. That adds up fast over a year. This guide explains what a payroll report includes, the main report types, and why it helps UK businesses stay accurate and organised.

What Is a Payroll Report?

A payroll report is a document that summarises pay data for a chosen time period. It can be a week, a month, a quarter, or a tax year.

Most reports include:

| What the Report Shows | What It Means |

|---|---|

| Employee names and pay periods | Who was paid and for which pay period |

| Hours worked and pay rates | Hours worked and the rate paid, for hourly staff |

| Gross pay | Pay before any deductions are taken |

| Taxable pay | The amount of pay that is subject to tax |

| Deductions | Pension, student loan, salary sacrifice, and other deductions |

| Tax deducted | Income tax taken from pay |

| National Insurance | Employee and employer National Insurance, where shown |

| Net pay | The amount of pay that is subject to tax |

| Employer costs and payroll liabilities | What the business owes in total |

In the UK, payroll reporting is closely linked to PAYE and RTI submissions. HMRC guidance explains that employers report an employee’s pay, deductions, and any payrolled benefits through a Full Payment Submission (FPS) on or before payday, and an Employer Payment Summary (EPS) is used for things like reductions (for example statutory pay) and can be due by the 19th of the following tax month.

HMRC also shows the kind of ‘pay and deductions’ data that is reported per period, such as taxable pay, tax deducted, and student loan deductions.

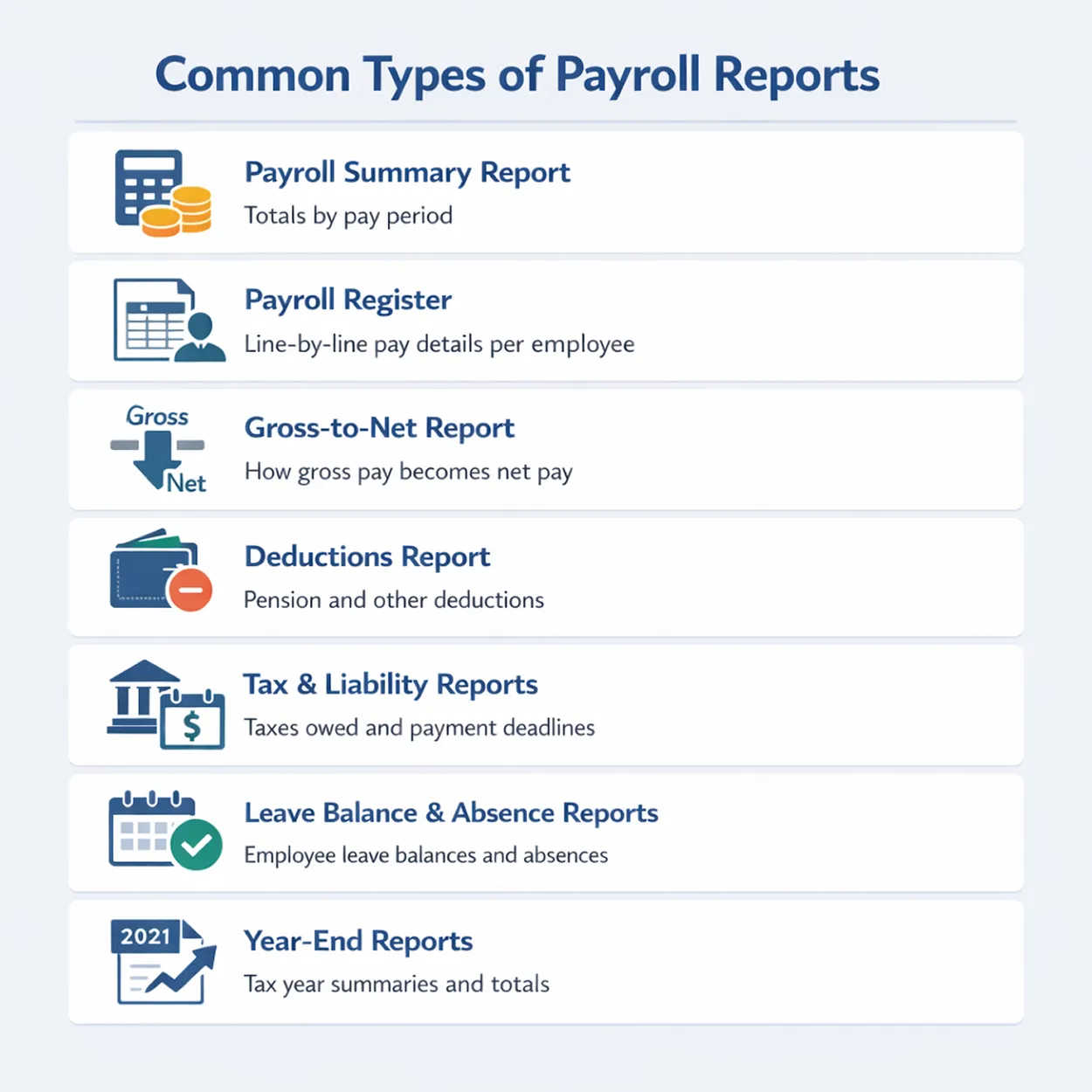

Common Types of Payroll Reports

Different businesses use different payroll reporting types, but these are the ones you will see most often:

- Payroll summary report (totals by period).

- Payroll register (line-by-line pay details per employee).

- Gross-to-net report (how gross pay becomes net pay).

- Deductions report (pension and other deductions).

- Tax and liability reports (what you owe and when).

- Leave balance and absence reports.

- Year-end reports (tax year summaries and totals).

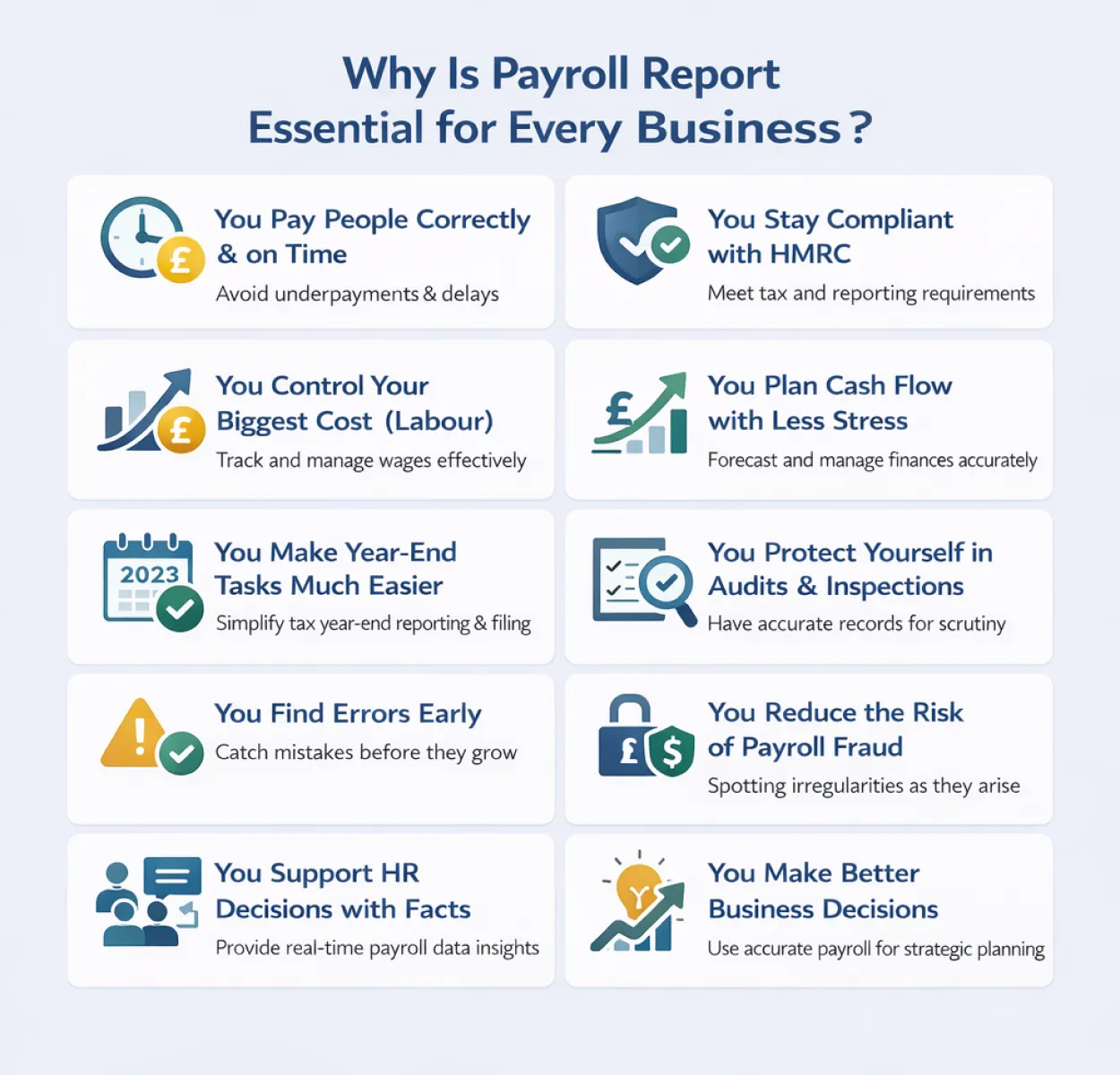

Why Is Payroll Report Essential for Every Business?

Below are 10 clear reasons payroll reports matter for UK businesses:

1. You Pay People Correctly & on Time

The first thing payroll reports do is easy. They help you pay individuals the correct amount.

Common payroll mistakes include:

- Unpaid overtime.

- Missing hours.

- Wrong rate (overtime rate).

- Duplicated payments.

- Wrong deductions.

A payroll register or gross-to-net report. It makes it easy to see each employee’s numbers. You can spot unexpected drops in net pay or unusual differences. That gives you time to fix issues before payroll is processed. That also helps with cash flow. One wrong payroll can mean having to make emergency bank transfers, make changes quickly, and waste time on paperwork.

2. You Stay Compliant with HMRC

‘Doing payroll’ is not the same as compliance. Compliance shows that payroll has been done correctly.

In the UK, RTI reporting means that firms have to provide payroll information through FPS on or before payday. They also have to use EPS when necessary, such as when they don’t pay anyone in a tax month.

This is where payroll reports come in handy. They back up your RTI numbers. They also help you answer questions like these:

- What taxable pay did we report this period?

- How much tax did we deduct?

- What student loan amounts were taken?

HMRC provides examples of the data reported for each pay period, such as taxable wages, tax that was taken out or returned, and student loan deductions. You are less likely to need last-minute corrections or send in the wrong reports if you keep your reports neat.

3. You Control Your Biggest Cost (Labour)

For many firms, payroll is the most expensive thing they do every month.

A clear payroll summary shows you exactly where your payroll money is going, including:

- Total wages.

- Total employer costs.

- Overtime spend.

- Department or location totals (if your system supports it).

This helps you make smart choices, like:

- Do we need more staff, or better rota planning?

- Are overtime costs climbing for one team?

- Are we paying too much in one role compared to output?

This is where payroll reports become more than basic administration. They turn into tools for business.

4. You Plan Cash Flow with Less Stress

There is a set date for payroll. It doesn’t wait.

A payroll summary report or payroll liabilities report might assist you figure out when and how much money you need to take out of your bank account. It also helps you separate:

- What goes to employees?

- What do you owe as deductions?

- What do you owe as employer contributions? (where applicable)

This is particularly more important when money is limited or when your income changes with the seasons.

Your management accounts and budget should reflect real payroll costs, so planning stays accurate. This is one reason some businesses use payroll support or outsource payroll.

5. You Make Year-End Tasks Much Easier

When records are sloppy, the end of the year is hard. You often need to know the exact amount of payroll for:

- Annual accounts.

- Benefits and expenses reporting.

- Pensions records and checks.

- Audit trails.

For instance, HMRC sets deadlines for expenses and benefits reporting and warns about penalties for late submissions. Dates can change, so confirm the current deadlines for your reporting duties before year end.

When you keep your payroll reporting in order every month, the end of the year is a time to check and confirm, not to worry and start over.

6. You Protect Yourself in Audits & Inspections

Not every ‘audit’ is a real audit. Sometimes it’s just:

- An HMRC check.

- A pension provider query.

- An employee dispute.

- A bank asking for proof of payroll costs.

This is when payroll reports come in handy as proof.

In the UK, employers must keep PAYE records for the required period. Poor records can lead to penalties and extra HMRC questions, so keeping reports organised is a practical safeguard. It also warns that poor record keeping can lead to penalties, and HMRC may assess what is due based on the information available. So, reports are more than just ‘nice to have.’ They help protect your business.

7. You Find Errors Early (Before They Get Expensive)

People generally don’t notice payroll mistakes until they happen again. That means that one mistake can affect a lot of pay runs.

Some such examples are:

- Wrong tax code carried forward.

- Pension not applied correctly.

- A deduction continuing after it should stop.

- Wrong leaver date causing overpayment.

A simple check routine goes a long way:

- Run a payroll summary report.

- Compare it to last period.

- Review the biggest changes.

- Review exceptions (new starters, leavers, sick pay).

Many payroll systems also recommend reconciling payroll totals with your accounts and budgets.

8. You Reduce the Risk of Payroll Fraud

Payroll fraud does exist and can come from both internal and external sources. Some examples are:

- Fake employees.

- Inflated hours.

- Changed bank details.

- Unauthorised bonuses.

- Payroll diversion scams.

Use payroll reports in a controlled way to reduce risk:

- Restrict access.

- Use approval steps.

- Run ‘change reports’ (bank detail changes, new employees).

- Check overtime spikes.

- Match headcount to HR records.

The Government of the UK has an official way to report tax fraud (both an online payroll report facility and a phone line) if you think someone is cheating on their taxes or not paying their payroll taxes. If an employee has concerns, Acas (the Advisory, Conciliation and Arbitration Service) explains whistleblowing as the disclosure of wrongdoing in the public interest and provides guidance on the relevant legal framework.

9. You Support HR Decisions with Facts (Not Guesses)

Payroll data is strongly related to HR. It depicts what is really going on, not what people think.

Reports can assist you answer questions like:

- Who is doing repeated overtime?

- Which role has the highest turnover cost?

- Are absences affecting payroll costs?

- Are allowances and deductions consistent?

Your payroll system might also let you see how much leave you have left. For instance, QuickBooks Advanced Payroll has a report option for leave balances. This makes it easier for HR and finance to work together. It also helps you make rules about equitable pay.

For people growing into finance roles, it also helps to understand the basics of bookkeeping and record keeping. If that is you, our guide on becoming a bookkeeper is a useful next read.

10. You Make Better Business Decisions (Pricing, Hiring, Growth)

Lastly, payroll reports provide you the confidence to make major choices.

Here are some basic business decisions that payroll data can help with:

- Pricing: ‘If labour costs go up, can we still afford this contract?’

- Hiring: ‘Is it cheaper to hire someone full-time than to work overtime all the time?’

- Hours of Operation: ‘Are we overstaffed when it’s quiet?’

- Raises and Bonuses: ‘How much does it all cost, including what the employer has to pay?’

- Planning for Growth: ‘How much does payroll go up with 10 more workers?’

You don’t have to be a data pro. You only need numbers that are accurate and reliable. That’s why companies use payroll services and experienced help when things get hard. A structured payroll management service can help make sure that reports are correct, consistent, and ready for an audit.

Case Study of HMG Paints (UK)

HMG Paints in the UK shared a big win. Payroll that once took three days was reduced to around three hours.

What Happened?

They moved to an all-in-one HR + payroll system and said their monthly payroll run dropped from a three-day process to a three-hour process (over 80% faster). They also said reports became easy to access and they were no longer hunting for them.

Why Does It Support Payroll Reports?

It shows that easier access to reports can save time and reduce back-and-forth during payroll.

What’s the Key Takeaway?

HMG Paints shared that their monthly payroll used to take around three days. After changing their payroll setup, they said it dropped to around three hours. They also said payslips and reports became easy to access, so they stopped wasting time searching for information. This shows how payroll reports help you work faster and spot problems sooner.

Conclusion

A payroll report is more than a spreadsheet or a software download. It gives you a clear record of pay, deductions, and employer costs. It also helps you check payroll, stay organised for HMRC reporting, and reduce avoidable errors.

When your payroll reports are clear, you pay people right, meet HMRC requirements, manage cash better, and reduce risk. You also make smarter business decisions using real data, not assumptions. If you want a calmer payroll process, start with the reports. Then build a simple routine around them.

Want payroll to feel simpler and safer?

Sterling Cooper Consultants can take payroll off your plate and keep your reporting accurate and compliant through our Payroll Management service.

If you are ready, contact us today and tell us what you need help with.

FAQs

A payroll report is a record of employee pay for a time period. It normally shows earnings, deductions, taxes, and net pay. In the UK, payroll records also support RTI submissions like FPS and EPS.

If you use QuickBooks Online Payroll, QuickBooks explains a simple route:

i. Go to the Payroll section in Reports

ii. Select Payroll Summary

iii. Set the date range and apply

iv. Customise if needed, then run the report

If you use QuickBooks Online Advanced Payroll (UK), QuickBooks shows steps like:

i. Go to Payroll → Reports tab

ii. Pick the report (for example Gross to Net, Employee payment history, Deductions)

iii. Set filters (date range, employees, pay schedule)

iv. Run and download the report

The core calculation and reporting flow:

i. Correct pay inputs (hours, salary, overtime)

ii. Correct deductions and tax treatment

iii. Clean reports that match what was paid and what is owed

In the UK, that also means RTI-ready reporting (FPS and EPS).

A detailed payroll report usually means a payroll register or a gross-to-net report. It shows line-by-line detail per employee, like:

i. Gross pay

ii. Taxable pay

iii. Tax deducted

iv. Deductions (pension, loans, other items)

v. Net pay

For UK payroll reporting fields like taxable pay and tax deducted, HMRC gives examples of 'pay and deductions' data reported per period.

Recent Posts

How Capital Gains Tax Is Changing in April 2026?

What Are Annual Accounts? Everything You Need to Know