Posted by:

Admin

Date:

January 29, 2026

Category:

How Labour Could Reshape Capital Gains Tax in the UK?

Are you an investor, business founder or property owner? Do you have second homes, shares or assets that you are meaning to dispose of? Then the Labour capital gains tax changes are of great importance to you. The talk around tax reforms is nothing new in the UK. This time, however, it’s different. The current Labour government has decided to sharply reduce the annual tax-free allowance and increase the main rates of most assets. This is done to target wealthy individuals to raise revenue and the longstanding Labour promise of bringing parity between CGT and income tax. Starting from Autumn Budget 2024 and with further legislation, the question will Labour raise capital gains tax has been answered with a yes. The only question now is how far they will go.

While the most directly affected are individuals who own capital assets. As with most UK legislation, some caveats and angles must be explored before a final verdict can be made. In this blog, we will cover all you need to know about capital gains tax and how capital gains tax labour proposals affect individuals and businesses.

Key Changes At A Glance (UK CGT)

Labour capital gains tax policy resulted in the following changes.

- Tax-free allowance: £3,000 (or £1,500 for trusts).

- Most asset sales (shares, funds, business assets): 18% for basic rate taxpayers, 24% for higher rate taxpayers.

- Residential property and second homes: Often 18% or 24%, and it usually must be reported and paid within 60 days of completion.

- Carried interest: 32% (mainly for fund managers).

- Business Asset Disposal Relief (BADR): Lifetime limit is £1 million, and the relief rate has increased (with more change already scheduled).

What Is Capital Gains Tax?

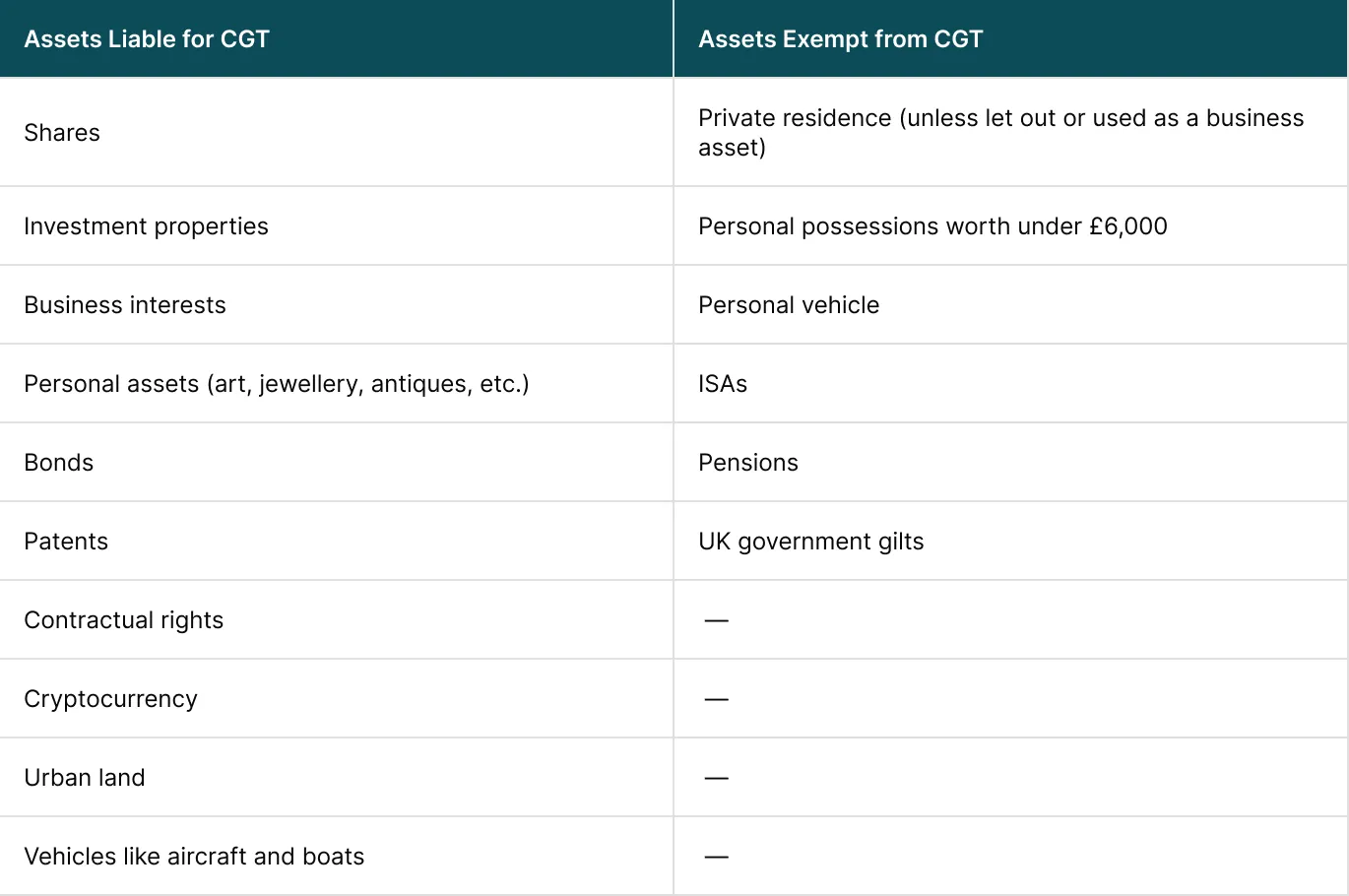

Capital Gains Tax or CGT, is charged when you sell an asset with increased value. The tax is calculated on the gains made from the sale. The assets generally liable for CGT are:

- Shares

- Investment properties

- Business interests

- Certain personal assets ( art, jewellery and antiques, etc.)

- Bonds

- Patents

- Contractual rights

- Cryptocurrency

- Urban land

- Vehicles like aircraft and boats

The CGT does not apply to all assets. Certain assets are exempt from CGT under labour capital gains tax legislation. These include.

- Private residence (unless let out or used as a business asset)

- Personal possessions worth under £6,000

- Personal vehicle

- ISAs and pensions

- UK government gilts.

As of now, the rate for CGT is adjusted based on income level and the type of asset involved. The CGT has lower rates than income taxes. The lower rates encourage investment and entrepreneurship. Critics have argued that CGT is too lower than the income tax rate and that it is unfair to workers. Recent labour capital gains tax policy aims to change that fact.

How Much Is Capital Gains Tax in the UK?

The tax-free annual allowance is £3,000 and £1,500 for trusts. This was reduced from £12,300 in 2022-2023 for the 2024-2025 tax year. If you have sold an asset, you are entitled to the given tax-free allowance. You are charged CGT for any gains made above the allowance limit.

How much CGT you have to pay depends on the gains you have made and whether you are a basic rate or a higher rate taxpayer.

Higher Rate Taxpayer:

As of April 2025, the CGT for higher-rate taxpayers is:

- 24% of gains made from the sale of an asset.

- 32% of your gains on carried interest in case you manage a fund (private or public).

Basic Rate Taxpayer:

As of April 2025, the CGT for basic rate taxpayers is:

- 18% of gains made from the sale of an asset.

- 32% of your gains on carried interest in case you manage a fund (private or public).

Labour and Capital Tax Gains

Labour capital gains tax policy has a long history. Labour has viewed capital gains as benefiting wealthy owners at the expense of the working class. This view has largely steered the capital tax gain labour policy. For a long time the question of will Labour raise capital tax gain has been directed at the core of Labour’s financial decision-making. It has come to be now that labour has increased CGT and it’s expected to rise in the future.

The goal seems to be parity between the income tax rate and CGT rates. While not fully aligned to that goal, Labour capital gains tax policy seems to move in that direction. The full alignment to the universal tax rate has gained support, but it is considered politically risky. This would mean raising the current main rate of 24% to 40%. Such a sharp rise can result in significant blowback from the investor community.

A more incremental approach with modest increases seems more likely. The increase from 10% to 18% for basic rate and from 20% to 24% for higher rate taxpayers, supports this indication. This also seems like the more politically viable option. Historically, more incremental raises have gained more revenue. As taxpayers have more incentive to pay quickly rather than delay disposals.

Under this plan, the Labour capital gains tax policy seems more like a gradual reform than a radical shift.

Now that we have covered the basics, we will discuss in greater detail how Labour capital tax policy could reshape CGT in the UK.

To learn more about taxation forecasting, check out our guide on 2025-26 tax year updates.

Residential Property and Second Homes

Residential property has already been affected by the Labour capital gains tax policy. As of 2025, the CGT on residential property stands at 24%. This rate is higher than that on most assets. Although the main home exemption remains in place. However Labour has targeted second home owners and landlords of investment properties.

Affordability has been a key concern in the UK for quite some time. Recent CGT increases on non-primary residencies and properties are an attempt to tackle this problem. This measure is seen as both fiscally important and socially beneficial. There is much speculation going on as to what the future holds for CGT in regards to residential property; however, two very common observations seem to be.

- Likely rate increase: In line with the ongoing trend and labour capital gains tax policy, the CGT for residential property and second homes are expected to increase.

- Property tax reforms: There have been indications of a shift towards a different form of property tax, such as a national property tax.

As of now, the CGT on the sale of a property must be reported and paid within 60 days of its completion.

To learn more about taxation on rental income, check out our guide for reducing taxes on rental income.

Business Asset Disposal Relief

Business asset disposal relief is a reduction relief offered under conditions to businesses that qualify. This relief results in lower tax than CGT on disposal of assets. BADR has been scaled back a lot under the labour capital gains tax policy. The lifetime limit has fallen from £10 million to £1 million and the qualifying gains have increased from 10% to 14%, as of 6 April 2025. This rate is set to increase to 18% as of April 2026.

If Labour capital gains tax policy further decreases the lifetime limit it can generate more revenue. This would allow it to still claim its support for businesses. However the limit has been greatly reduced already. Even though it may allow a person a saving of up to £100,000, the optics may look worse for any further change.

Alternatively, Labour could increase the relief rate itself. This would fill the gap between business disposals and other asset sales. Either approach would affect businesses and form a key component of any capital gains tax labour reform agenda.

The approach is driven by a revenue generation agenda. Expect relief rates to go up further in the future.

CGT and Inheritance

One of the most complex areas involves what happens at death. At present, many assets receive a tax-free uplift for CGT purposes. This means that historic gains are effectively wiped out, and heirs inherit assets at their current market value. This can be very lucrative.

Business assets may also qualify for inheritance tax relief, creating a situation where no CGT or IHT is paid at all. This is viewed as a loophole rather than a policy choice.

Labour has not committed to specific changes here, but reviews of this area are widely expected. Removing or limiting the CGT uplift on death would be a significant reform, though politically sensitive.

If addressed, it would mark one of the most structural changes under any future capital gains tax labour agenda.

Labour capital gains tax policy may result in limiting or removing the CGT uplift where inheritance tax relief applies, particularly for shares in trading companies. While politically sensitive, such a change would align with Labour’s broader narrative around fairness and closing perceived loopholes in wealth taxation.

Timing of Potential Changes

Changes to CGT rates announced in the Budget would take effect from the following 6 April. However, recent years have shown a shift away from this trend.

This matters because advance notice can trigger a surge in disposals. If Labour announces a CGT increase, many asset owners may rush to sell.

As a result, recent budgets have introduced measures that have immediate effect. If Labour announces a significant CGT increase, there is a big chance that changes could apply from budget day itself.

Anyone asking will labour raise capital gains tax must also consider the risk that advance planning opportunities could be limited.

Administration and Compliance

Changes to CGT rates mean complexity increases often when different rates apply within the same tax year. Taxpayers may need to apportion gains by date, apply multiple rate bands, and deal with transitional rules.

From HMRC’s perspective, implementing labour capital gains tax reforms would likely require system updates, revised guidance, and additional support for digitally excluded taxpayers. For individuals, especially those with diverse portfolios, compliance costs could rise even if headline rates increase only modestly.

Economy and Behaviour

While CGT reform will have a direct impact on behaviour. Higher rates may discourage disposals and encourage people to hold on to assets.

Labour will need to balance revenue goals with the risk of dampening investment or entrepreneurial activity. This is why many analysts expect capital gains tax labour changes to focus on small reforms rather than radical change. Labour capital gains tax seems to align with that direction

Who Is Most Likely to Be Affected?

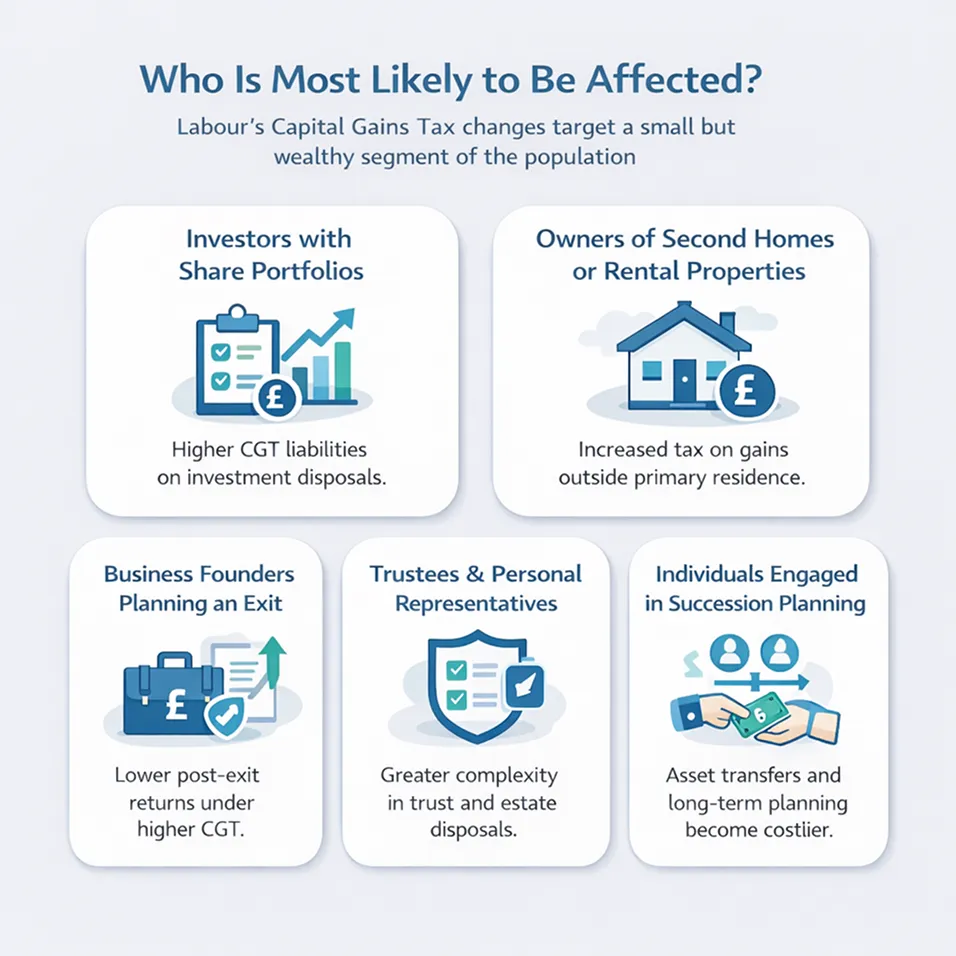

Labour raises CGT as it affects a small but wealthy subset of the population. The results of labour capital gains tax policy could be far-reaching.

Any changes to labour capital gains tax policy would primarily affect:

- Investors with shared portfolios.

- Owners of second homes or rental properties.

- Business founders looking for an exit.

- Trustees and personal reps.

- Individuals engaged in succession planning.

While CGT is paid by a small subset of taxpayers, the amounts involved can be huge. Even small amounts can translate into tens of thousands of pounds in additional tax.

Knowing where you sit is critical when assessing the impact of capital gains tax labour reforms.

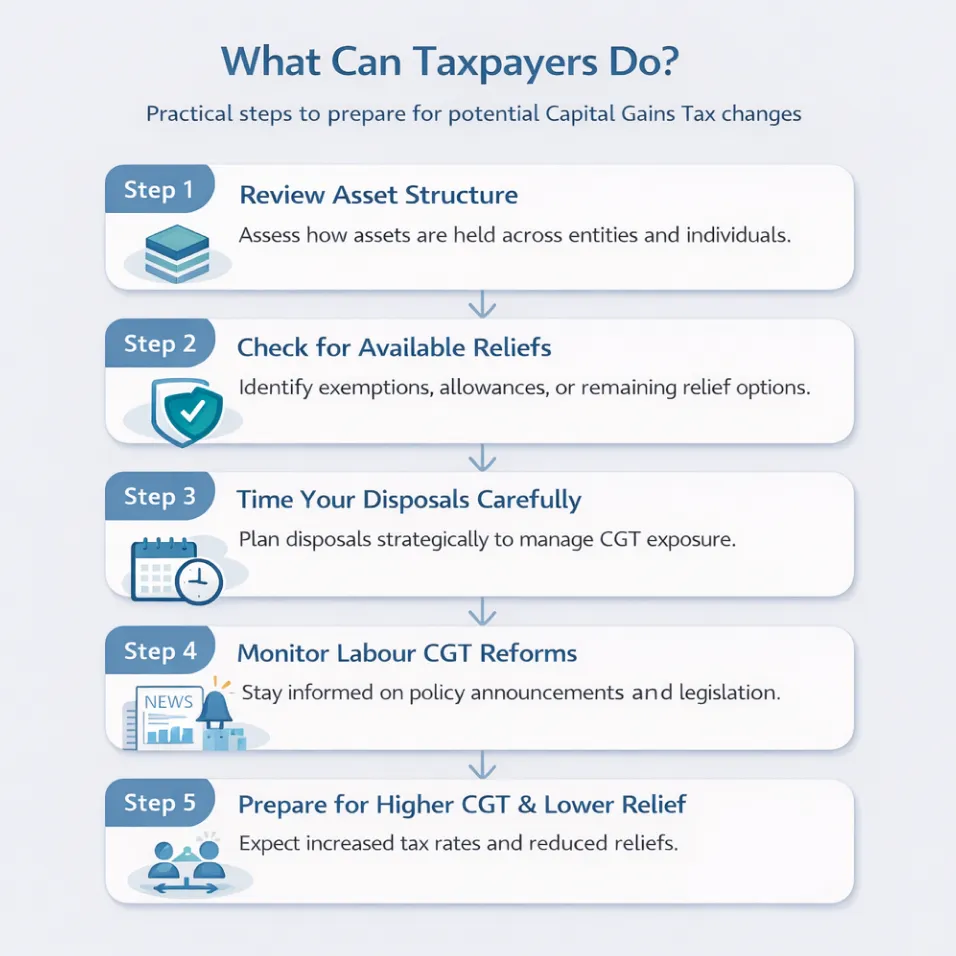

What Can Taxpayers Do?

Inaction is the worst approach. There is much uncertainty, but waiting does not make it any better. A right approach would be:

- Review asset structure.

- Check for relief.

- Time your disposals.

- Monitor labour capital tax gains reforms.

- Expect high CGT and low relief.

While no policy is final, the current trend does seem to result in increased CGT. So the taxpayer should plan ahead for that.

Conclusion

The labour capital gains tax reforms aim to create revenue and fairness. The role of wealth taxation for equity has been clear in the capital gains tax labour policy. While the road remains certain, a direction can be mapped out. Rather than asking will labour raise capital gains tax, a better question is how quickly raises will come. Inaction serves no one. One must prepare for the capital gains tax in the UK. That’s where we come in. At Sterling Cooper Consultants, we provide the most relevant and comprehensive financial advice. Be it taxation or asset management, we specialise in knowing and acting out your financial will. Contact us now to get started today.