Posted by:

Admin

Date:

November 25, 2025

Category:

Top Tax Saving Tips to Reduce Your Bill Legally

You have to strategically plan your way around tax paying. Else, it is going to cost you thousands of pounds annually. There are schemes, tips and ways that can legally reduce your bill. Here are some of the tax saving tips that can help you.

1. Tax allowances and reliefs

One of the best tax saving tips is to avail the tax allowances and reliefs available to you.

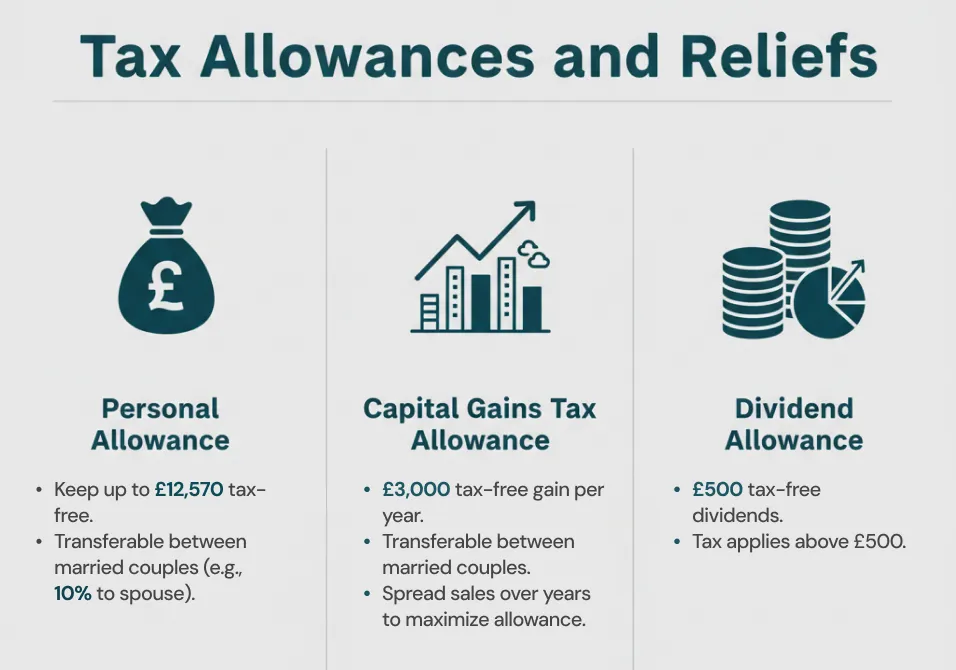

Personal allowance:

You can keep up to £12,570 of your salary tax-free. It can be transferred among married couples. For instance, you earn £50000 and your spouse earns £40000. You can transfer your personal allowance (10%) to your spouse. This can be one of your key income tax saving tips.

Capital Gains Tax allowance

Selling any investments, properties, or assets can make you liable to capital gains tax. This can be reduced by availing capital gains allowance. This allowance allows £3000 gain every year. Married couples can transfer assets among each other to avail both of their allowance. Sales should be distributed over a number of tax years in order to maximise the tax-free allowance..

Dividend allowance

Owning a share in a company can let you have a dividend if the company performs well. Dividend allowance is £500. You have to pay tax over this amount but any dividend below it is tax free.

Learn more about Tax Planning & Compliance with us.

2. Investment in ISA

An account type known as an Individual Savings Account (ISA) allows you to save up to £20000 tax-free.So, investing in it is one of the best tax saving tips.

The following taxes do not apply on ISA:

- Capital gains tax

- Dividend tax

- Income tax (on interest)

This makes ISA one of the key tax saving tips for individuals.

Types of ISA

The main types of ISA are :

Cash ISA:

This type of ISA allows you interest on your cash that isn’t taxed.

Stocks ISA:

In stocks ISA, returns are generated through dividends.

Lifetime ISA

In this case, a 25% government bonus is given on savings of up to £4,000 per tax year. This can be used to save for your first home or retirement. It can be opened at the age of 40.

Junior ISA

In junior ISA, up to £9,000 per tax year can be saved by a parent or guardian for a child’s future.

3. Tax relief on pension funds

Tax saving tips also include investing in pension funds. Pension saving allows you a significant tax relief, boosting your contributions as a result.

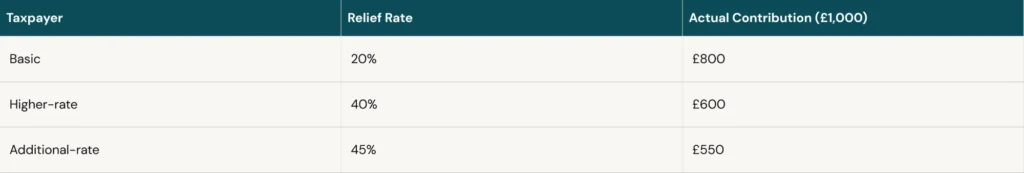

Contributions at different tax rates:

Different taxpayers receive different tax reliefs.

4. Tax planning for self employment and business

Planning your taxes is crucial when you are self employed or managing a business. This is due to the fact that tax planning can maximise your earnings.Tax saving tips for small businesses:

“If you run a business, you need to navigate corporation tax and VAT efficiently. For the UK to remain internationally competitive for business, it needs a tax system that is sufficiently clear for business to be able to operate within with confidence.”

Tracey Bowler

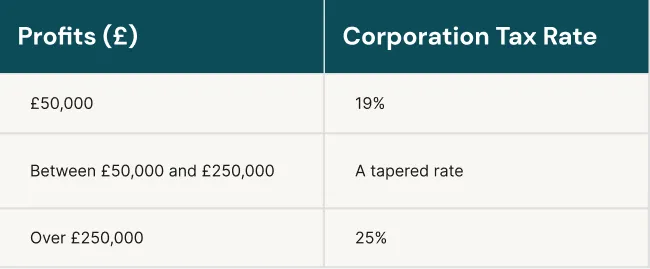

Corporation tax:

It is one of the major business’ costs. Here is how it applies to profits.

One of the best tax saving tips for businesses is reducing corporation tax. To minimize this:

- You should invest in business assets such as vehicles, software, etc.

- You should make pension contributions.

- You should make an efficient payment of dividends.

VAT:

Even though it only applies if your turnover is more than £85000, you should still need a good scheme.

Some of these schemes are:

- Cash accounting scheme

- Flat rate scheme

Learn more about How to get a VAT Certificate: A Complete Guide

Tax saving tips for self employed

If you are self employed, you can use the following tax saving tips:

Claim business expenses:

You can claim costs of home office, travel, training, etc.

Pension contributions:

You can make pension contributions since they allow you significant self relief.

Income spread

You can keep the tax rates lower by structuring income over multiple years.

Get detailed insights on 2025–26 Tax Year Updates.

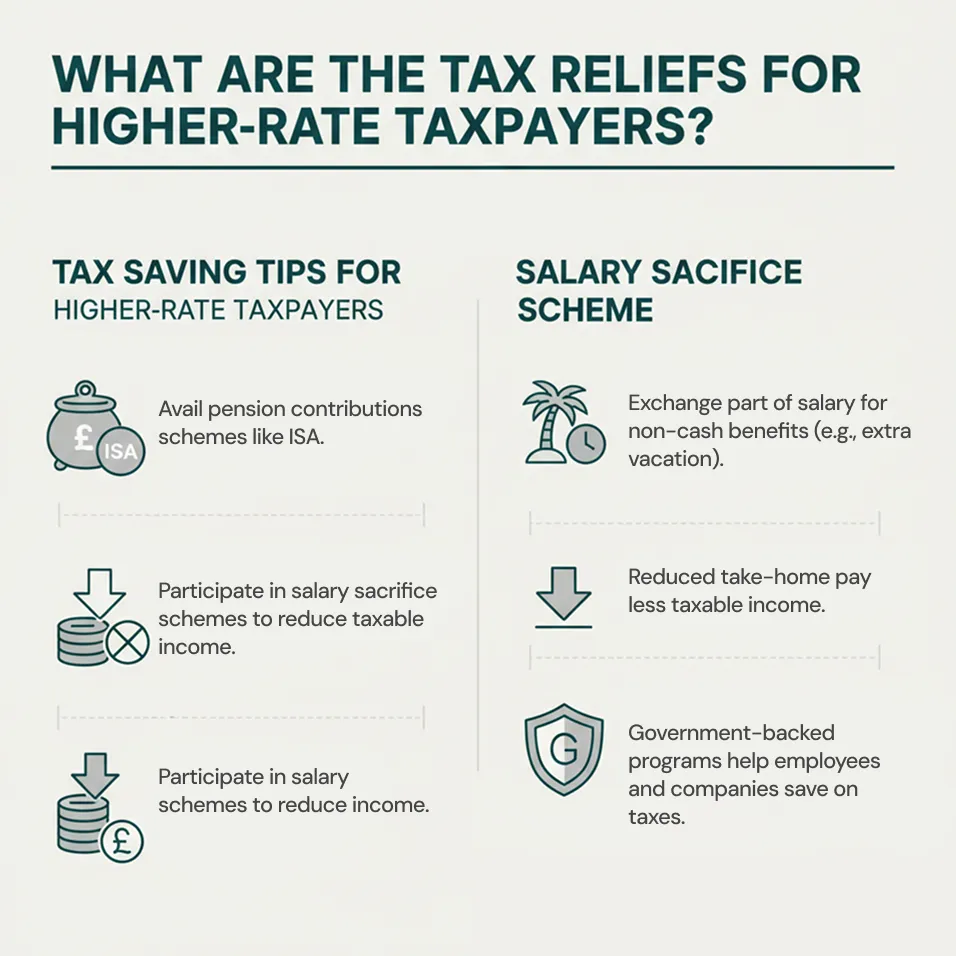

5. What are the tax reliefs for higher-rate taxpayers?

Some saving tips for higher-rate taxpayers include availing pension contributions and schemes like ISA. They can also take part in salary sacrifice schemes.

Salary sacrifice scheme

Through salary sacrifice schemes, individuals can buy non-cash benefits from their employers, such as more vacation time. The employee will receive less money from the employer in return.

Since reduced take-home pay translates into less income that needs to be taxed, government-backed salary sacrifice programs assist both companies and employees in saving money on taxes.

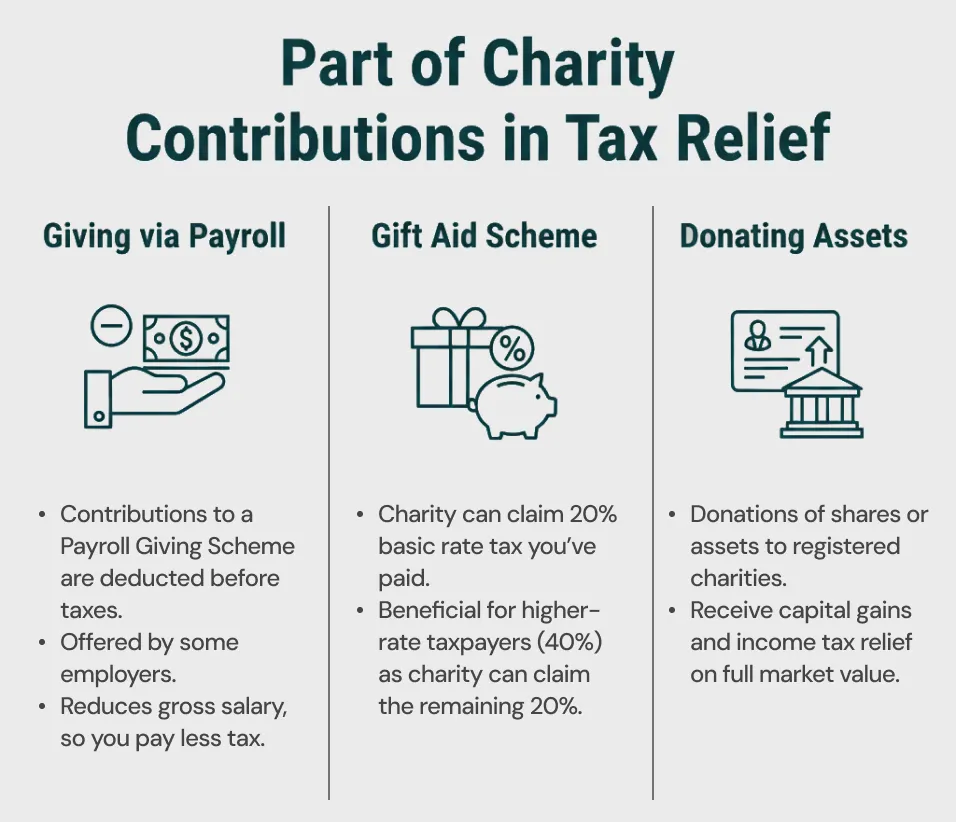

6. Part of charity contributions in tax relief

Another one of the best tax saving tips is charitable contribution. This is because you can get tax relief on charitable donations you make. Here is how it is done.

Giving payroll

Your contributions to a charitable Payroll Giving Scheme are subtracted before taxes. These schemes are offered by some employers through a payroll.You can donate more money this way and your gross salary will be reduced. You’ll have to pay less tax on it.Gift Aid scheme

When you donate through this scheme, the charity can claim the 20% basic rate tax that you have paid . This is especially beneficial for higher-rate taxpayers who pay 40% in taxes. This is because the charity has claimed 20%, they can claim the rest of 20%.Donating assets to charity

While donating assets such as shares to a registered charity, you can get capital gains and income tax relief on full market value.How to claim a tax refund

In case you have missed your tax reliefs, you can contact HMRC and claim them back. This tax relief can be backdated up to 4 years. Make sure to claim this tax directly with HMRC. If you use any tax refund agency, read their terms and conditions carefully because you may have to pay agents’ fee and other charges. You can claim back tax on the following:- Expenses of job (fuel, work clothes, working for home, etc.)

- Pensions

- Interests from savings

- Interests from payment protection insurance (PPI)

- Redundancy payment