Posted by:

Admin

Date:

January 7, 2026

Category:

blogs

VAT on Imports: How It Works and What You Need to Know

VAT or value added tax is a consumer tax. It is added at each step of production, from manufacturing to final sale. It indicates the addition of value on each step. VAT on imports is a tax that you have to pay if you import goods in the UK from outside the kingdom. VAT on imports also applies on services that are provided in the UK from outside. It is also effective upon the services that a vendor from the rest of the world provides in the UK. Businesses should understand the impact of VAT on imports owing to its effects on costs and cash flow. So, here is all you need to know about the UK import VAT.

Importance of Import VAT in the UK

This tax plays a very significant role since it affects different aspects of the economy. Here are some of the ways in which it affects the economy.- Ensuring trade prices that are fair

- Maintaining tax uniformity and balancing markets across borders

- Generating revenue

- Regulating the goods that can be brought into the country

“Tax revenue mobilization is important for economic development, particularly in countries with low levels of state capacity. The value added tax (VAT) is a large and growing source of government revenue in most countries of the world.”

Peter Morrow

How does VAT on import work?

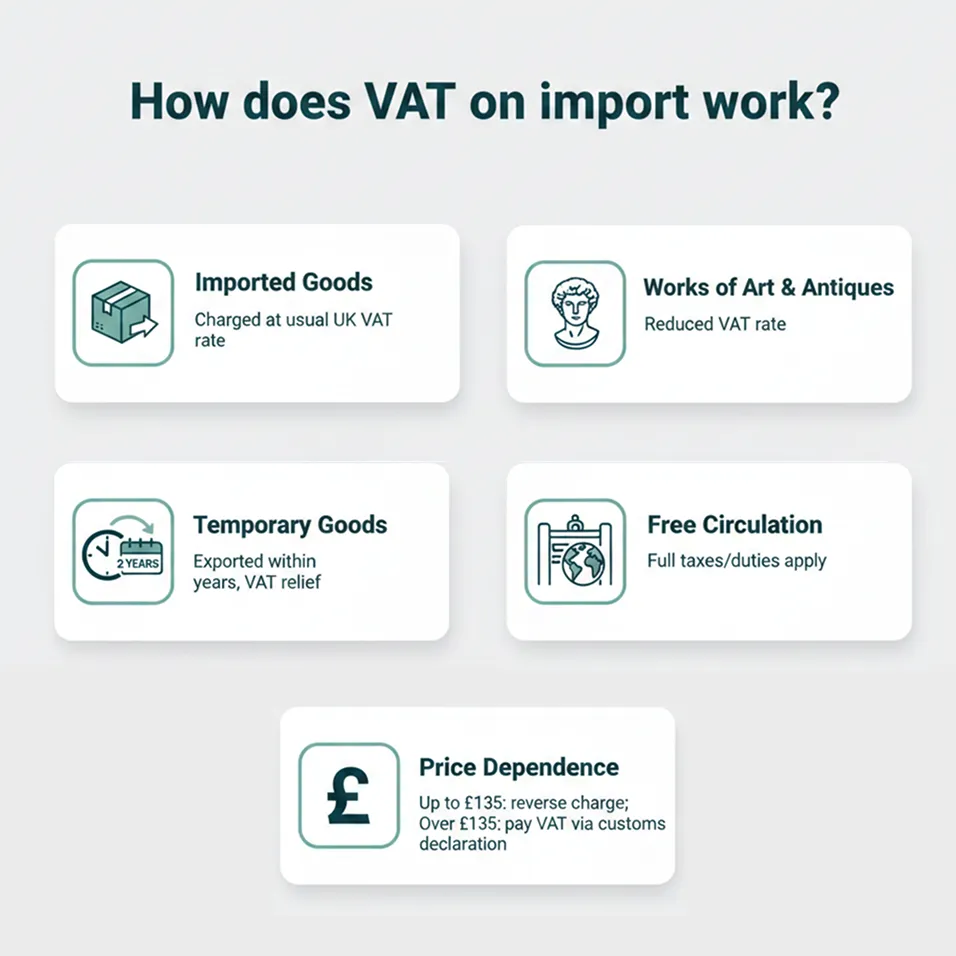

The implication of VAT on import depends upon the types of goods. On most goods, the rate of import VAT in the UK is the same. However, goods such as works of art, collector items, and antiques have VAT on import applied differently. Here are the details on its implications.Types of goods:

The types of goods you are importing are important in deciding this tax.Here is how it works on different types of goods.Imported goods

They are charged at the usual amount i.e., the one you pay when supplying them in the UK.Works of art

On any type of antiques or collectors items, you pay a reduced rate.Temporary goods

Temporary goods mean goods that you’ll export in the next two years. Relief is provided in this situation.Free circulation of temporary goods

If your goods are temporary, but they are put in free circulation, you’ll have to pay all kinds of taxes and duties depending on the type.Price Dependence:

The amount of import VAT also depends upon the price of the goods.Up to £135

The tax is reported to HMRC as a reverse charge. This means that you don’t pay the tax but you make HMRC aware of the transaction.Over £135

Over this amount, you pay the VAT on import depending upon your customs declaration.

How To Calculate Import Duty And VAT UK?

Calculation of VAT on import is fairly simple. Custom value of the goods form the basis of this tax. This includes- Purchase price

- Transportation

- Insurance costs

- Custom duties

Standard formula

Formula for calculating import VAT is:Import VAT= (Price of goods + Duty) * rate of VATHow to pay VAT on imports

For paying VAT on import, use any of the following.Make a duty deferment account

If you already have one, you can make a payment once a month. This can be done by direct debit and frees you from paying on each assignment. If you don’t, you can apply for one at the website of the UK government.Cash accounting

This warrants an access to Customs Declaration Service. You can use its cash accounting service to pay this tax.Authorise someone on your behalf

You need access to Custom Declaration Service for this too. After having access to it, you can authorize someone else to pay on your behalf using any of the above options.Immediate payment

You can make immediate payments if you have declared your imported items using the Custom Declaration Service. You can pay online, through bank transfer or through debit or credit (corporate) card.Other methods:

Other methods include getting an import VAT certificate or declaring import VAT on VAT returns.If you want to learn more about obtaining a VAT certificate, you can read our blog: How do I get a VAT Certificate: A Complete GuideWhat if I am not VAT registered?

If you are not registered for VAT, you still have to pay it. You just won’t be able to reclaim it. You can do either of the following.Use an agent:

If you are not a UK based trader, you can hire an agent based in the UK to import and sell goods. The agent’s services to you will have VAT tax of 20% which cannot be reclaimed. Under section 47 of the VAT act, your agent can act as a principal. This allows them to do the following:- They can import goods in their own name.

- They can reclaim the VAT on import.

- They can charge you for their services. This includes VAT that you cannot reclaim.

Use of delayed declaration:

You can also use delayed declaration. This means a customs entry is made in your own records. If you have made an import record earlier without authorisation, you have to file a declaration later. On filing this you’ll pay the VAT on import. You still cannot reclaim the VAT.Import VAT on Services

Import VAT in the UK also applies on services if you are buying them from another country. This is paid through reverse chargeFor this to work, you have to act as both supplier and customer. Import VAT is then charged on you by yourself. You then claim it back as input tax. The amounts are the same and cancel out each other.The reverse charge applies on services described in the Notice 741A. It implies that reverse charge is only applicable if the following conditions are fulfilled:- You live in the UK and run a business here.

- The provider of the services lives outside the UK.

- The services fall under the general rule for place of supply of services

- Land services (such as construction, demolition, etc)

- Transport services (such as cars, trucks, ships, boats, etc.)

- Intermediary services (patents, advertising, etc.)

Do I have to pay import VAT on gifts

You may have to pay it depending on the value of the gifted items.Qualification for a gift:

For an item to be qualified as a gift, it should fulfil the following conditions.- It should be sent by a private person to a private person.

- It should be occasional.

- The receiver in the UK should not have paid for it in any way.

- Customs declaration should be done.

Threshold value

If your gift costs more than £39, then you have to pay VAT on import. If the costs go over the threshold value of £135, you’ll also have to pay customs duty.

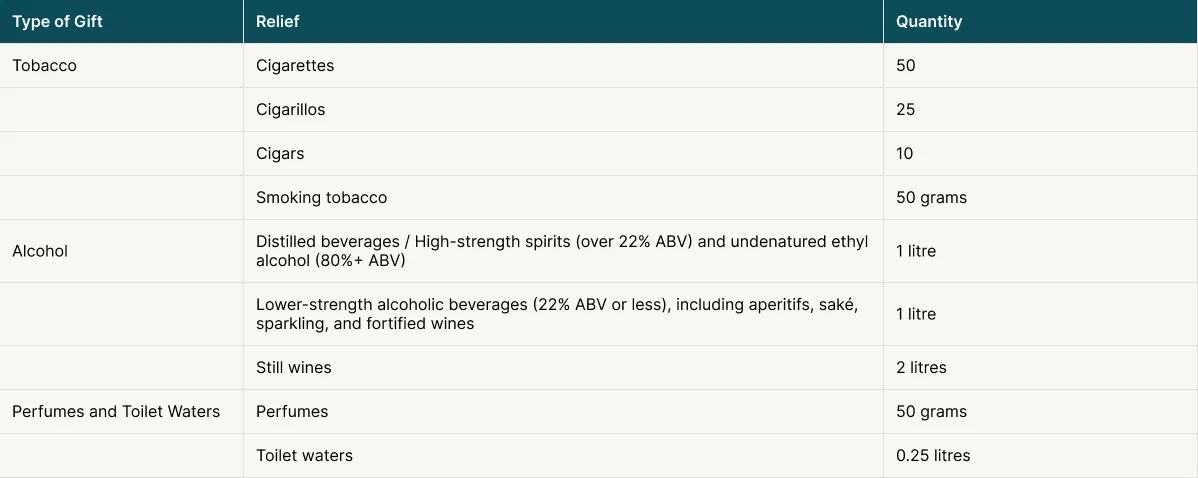

VAT on different types of gifts:

Excise duty is payable in all types of gifts regardless of the value. Custom duty relief is applied on the following quantities:

If these quantities are exceeded, then custom duty is payable so you won’t get the benefit of VAT on import relief.

Claiming relief

Re-imported exported goods

You can claim back the VAT on these. If you exported them out of the UK for some time and then brought them back, you don’t have to pay VAT. If you did pay, you can get Returned Goods Relief.Postponement

You can use your VAT returns to pay it on imports if you have a VAT certificate. This can be done by using postponed VAT accounting.Learn more about getting a VAT certificate here.Deferment

You have to pay full import VAT if- You do not choose to add this tax in your VAT returns

- You are not VAT registered

Suspension

If the goods that you have imported are stored in a customs warehouse, your import duties and VAT can be suspended. Custom warehouse is a type of inventory and a number of goods can be stored there.Need help calculating UK import VAT?

At Sterling Cooper Limited, we offer you expert advice on paying your VAT on imports, its importance and implication on your business. Explore our Taxation services and get expert support today! To avail our help, contact us now.

FAQs

Import VAT and duty are different types of taxes that you pay the government when you import. Each is applicable on goods of varied value.

Yes you can if you are registered for VAT. If you have paid VAT on importation, then you can reclaim it under conditions described above.

If you import from the EU in Ireland, you have to term your goods as “Acquisition.” If the sale is between Northern Ireland and the UK, it is treated as a domestic sale. If the import is from outside these regions, you have to follow the rules applicable in Britain.

If they are for the same person then normal conditions apply i.e., import VAT is applicable above the cumulative value of £39. If it is intended for different people, then their value should be described independently on customs declaration.

Yes, you still have to pay for it. Only difference is that you cannot reclaim it.