Posted by:

Admin

Date:

February 3, 2026

Category:

Common Errors on VAT Returns and How to Avoid Them?

Did you know that 24% of UK businesses have faced a VAT audit for mistakes? Even small slip-ups can cost hundreds or thousands in fines! VAT return errors are mistakes businesses make when calculating, reporting, or claiming VAT to HMRC.

VAT may look simple, but it involves a lot of regulations, rates, and plans for imports, exports, and expenses. People often make blunders like utilising the wrong VAT rate, registering too late, or claiming VAT incorrectly. These VAT errors waste time and make you feel stressed.

The good news is that you can prevent most VAT errors. Make sure your records are organised, utilise software that works with MTD, and check every bill. Learn the VAT rules and train the people who handle your invoices and returns. That simple habit can cut mistakes, reduce risk, and help you avoid penalties.

This guide explains common VAT return errors in the UK. It also shows what to check, what to fix, and how to stay compliant with fewer surprises.

Introduction to VAT

Value Added Tax (VAT) is a UK tax charged on many goods and services. If a business is VAT-registered, it usually adds VAT to sales and pays that VAT to HMRC.

VAT applies to taxable supplies, but not everything is treated the same. Some supplies are:

- Standard-rated (20%)

- Reduced-rated (5%)

- Zero-rated (0%)

- Exempt (for example, some financial and postal services)

Zero-rated and exempt can look similar because both can show “no VAT charged,” but they are not the same in VAT terms.

A business must register for VAT if its taxable turnover goes over £90,000 in any rolling 12-month period. This is not based on a calendar year. If the threshold is crossed, the business must register within 30 days of the end of the month in which it went over the limit. Smaller businesses can register voluntarily if it suits their situation.

Note: This is general UK guidance. VAT rules can change, and some cases are tricky, so check HMRC guidance for edge cases.

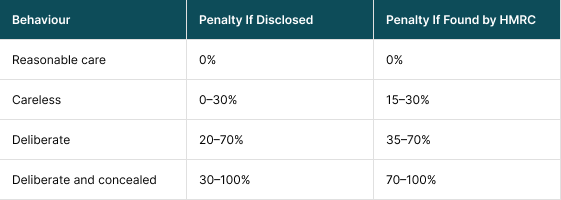

VAT Penalties for Errors

VAT mistakes can be expensive if HMRC finds them. The penalty depends on what caused the error and whether you tell HMRC before they contact you. In some cases, penalties can range from 0% up to 100% of the VAT due. HMRC looks at the type of mistake and how it was handled before setting a penalty. The main types of VAT penalties for errors are:

What Are the Top 11 Common Errors on VAT Returns & Ways to Avoid Them?

VAT returns can be tough, and even small mistakes can lead to delays, interest, or penalties. Many businesses make VAT errors without noticing at the time. Spotting the common issues early can save time and money later. Below are 11 frequent VAT return errors in the UK, plus simple ways to avoid them.

1. Misclassifying Goods or Services

Many businesses charge the wrong VAT rate. This is called misclassification. Here is why it happens:

- Some items have multiple possible rates.

- Staff are confused by catering and lodging packages.

- Hot and cold foods have different rates.

For instance:

- Hot takeaway food is charged at a normal rate of 20%.

- Takeaway cold food may be 0%.

- Medical supplies and child car seats are charged at the reduced VAT rate of 5%.

Using the wrong VAT rate can lead to VAT being overpaid or underpaid. HMRC may investigate, especially for food and catering, where rules differ for hot takeaway food, cold takeaway food, and eat-in sales under HMRC guidance.

How to Avoid?

Here is how you can correct VAT error:

- Review HMRC VAT guidelines regularly.

- List all items and services with valid rates.

- Changing products? Update your list.

- Consider accounting software for rate tracking.

- Ask a VAT expert if unsure.

2. Incorrect Invoicing

Valid VAT invoices have particular details. Their absence poses problems. Here are some common mistakes:

- No invoice or VAT number.

- Missing VAT rate.

- Incorrect total VAT amount.

- Missing company name or place.

VAT claims and payments might be delayed by errors.

How to Avoid?

Here is how you can avoid such mistake:

- Create VAT-compliant invoices with software.

- Teach staff invoice requirements.

- Check invoices before shipping.

- Hold templates for all goods/services.

3. Late or Missed VAT Registration

VAT registration is necessary for businesses over £90,000 in 12 months. Here’s why such VAT errors occur:

- Businesses rarely track turnover.

- Registration is optional until turnover develops.

- No defined financial year, 12-month barrier.

- Late registration incurs VAT backdates and penalties.

How to Avoid?

Here is how you can correct VAT error:

- Keep track of monthly turnover.

- Alert when VAT threshold approaches.

- Consider voluntary registration for growth.

- Consult an accountant if uncertain.

4. Overclaiming VAT on Expenses

Companies overclaim VAT on costs. This is hazardous and fineable. Here are some common mistakes:

- Client entertainment.

- Items for personal use.

- Uninvoiced VAT items.

- Full business claim for mixed-use commodities.

How to Avoid?

Here is how you can correct VAT error:

- Save VAT invoices and receipts.

- Track VAT on each purchase with software.

- VAT should only be claimed for business.

- Double-check gift and entertainment guidelines.

5. Errors on Imports and Exports

International trade complicates VAT. Post-Brexit mistakes are widespread. Here are some common VAT errors:

- Import VAT accounting delayed due to misunderstanding.

- Missing export zero-rating.

- Incorrect EU sales documentation.

How to Avoid?

Here is how you can avoid such mistake:

- Learn export and import VAT rules.

- Maintain proper import/export records.

- Need help? Ask a VAT or customs specialist.

- Use cross-border VAT software.

6. Failing to Comply With MTD

Making Tax Digital (MTD) requires digital records. Non-compliance leads to fines. Here is why such VAT errors happen:

- Some businesses employ paper methods.

- Staff may not know digital submission rules.

How to Avoid?

Here is how you can correct VAT error:

- Accounting software that supports MTD.

- Teach staff the software.

- Make digital copies of invoices.

- Regularly reconcile records.

7. Late VAT Returns or Payments

Missing VAT deadlines can lead to fines and extra charges.Late submission can build penalty points, while late payment leads to interest and payment penalties.

These issues often happen because:

- Forgetting deadlines.

- Miscalculating payment dates.

- Manual bookkeeping errors.

How to Avoid?

Here is how you can avoid such mistake:

- Mark deadlines in a calendar.

- Use reminders or software notifications.

- Automate payments where possible.

- Submit returns early if you can.

8. Missing VAT Rule Updates

VAT rates and restrictions vary often. Not updating can result in fines and VAT problems. For instance:

- Rate reductions.

- New late submission penalty.

- Export/import rules.

How to Avoid?

Here is how you can avoid such mistake:

- Get HMRC updates.

- Participate in VAT seminars.

- Rules should be reviewed quarterly.

- Ask your accountant for updates.

9. Using the Wrong VAT Scheme

VAT schemes affect VAT reporting. Using the wrong one creates VAT issues. Here are some common schemes:

- Flat-rate plan.

- Accounting for Cash.

- VAT standard accounting.

How to Avoid?

Here is how you can avoid such mistake:

- Review all VAT schemes routinely.

- Quarterly scheme comparisons.

- An accountant can recommend the best VAT scheme or option for the business.

- If cashflow improves, switch plans.

10. Incorrect VAT Calculations

VAT errors are common with manual calculations. Minor mistakes result in large fines. Here are some common mistakes:

- Incorrect totals

- Incorrect VAT amounts

- Rates misapplied

How to Avoid?

Here is how you can avoid such mistake:

- All VAT calculations should use MTD-compatible software.

- Monthly reconcile sales and purchases.

- Check totals before making returns.

11. Claiming VAT Without Proper Evidence

HMRC demands VAT evidence. Missing evidence can defeat your claim. Here are some common VAT errors:

- Lacking invoices.

- Personal cost claims.

- Bad recordkeeping.

How to Avoid?

Here is how you can correct VAT errors:

- Keep paper and digital invoices.

- Use your company name on invoices.

- Sort records by date and vendor.

- Securely back up VAT paperwork.

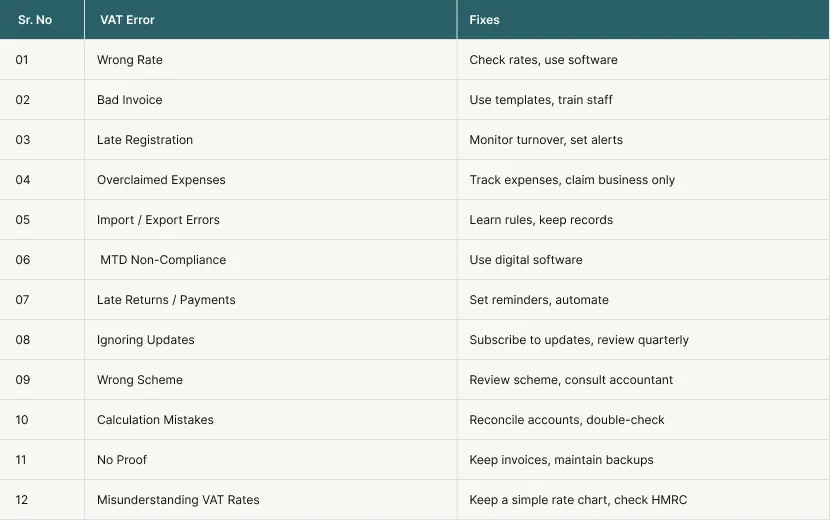

VAT Error Vs Fix Overview Table

Here is the VAT errors and solutions to overview table:

Top 6 Tips for Staying VAT-Compliant

Following the appropriate steps makes it easier to follow VAT rules. These ideas can help you keep your records clear, reduce stress, and easily obey HMRC laws. Here are the six best methods to keep on track.

1. Keep Records Organised

Keeping your VAT documents in order helps your business work smoothly. Clear files help you stay calm during checks. You need to maintain all of your VAT papers for six years. This includes receipts, bills, sales notes, bank slips, and VAT forms. Keep VAT records in labeled, safe files. Avoid losing or destroying important papers by scanning and backing up.

2. Reconcile Accounts Regularly

Every month, check your accounts. Make sure your VAT account matches your sales and purchases. Check for strange amounts or inappropriate dates. Look at the tax rates on each bill. Make sure the VAT code is correct. Little mistakes can add up quickly. A simple scan lets you correct VAT errors before they get worse. This also keeps you from getting large fines.

3. Implement Reliable Systems

Use systems that you can trust to help with your accounts. Choose accounting software that is compatible with Making Tax Digital (MTD). HMRC publishes guidance and a list of software that works with MTD for VAT, which businesses should check before choosing a system. These apps get information from your accounts. They do the maths for you on VAT. They also leave a clean digital trail. You can find out who made each adjustment. This makes it easier for you to believe your numbers. It also lowers the chance of making mistakes.

4. Stay Informed

Keep current with changes to the rules. Every year, the rules for VAT can change. You may get HMRC alerts or read short tax guidelines online. This helps you plan ahead and not be surprised at the last minute.

5. Train Staff

Make sure that the people who record sales or deliver bills know the regulations about VAT. Show them what you do and how you check things. Many VAT errors can be avoided with good training. Your overall VAT process stays seamless and safe when your team knows what to do.

6. Seek Professional Advice

Sometimes, VAT requirements can be hard to follow. When you need help, a VAT pro can help. They can help you with sales across borders. They can find out if you need to utilise the reverse charge. They can aid when the rules change. A pro keeps you safe and on the right path.

You can read our blog to learn how to get a VAT certificate.

Conclusion

Mistakes with VAT happen a lot, but they can be avoided. Businesses may avoid VAT error and fines by keeping good records, using software that works with MTD, checking invoices, and following HMRC rules. Simple things like reviewing VAT schemes and educating staff can help. Being careful and consistent saves you time, money, and stress. These recommendations will help your business stay legal and run effectively.

This guide is general UK VAT information and may not fit every business. For complex cases like cross-border sales or partial exemption, check HMRC guidance or speak to a VAT adviser.