Posted by:

Admin

Date:

December 18, 2025

Category:

Your Guide to VAT Accounting Schemes: What They Are and How They Work

When Should You Register for VAT?

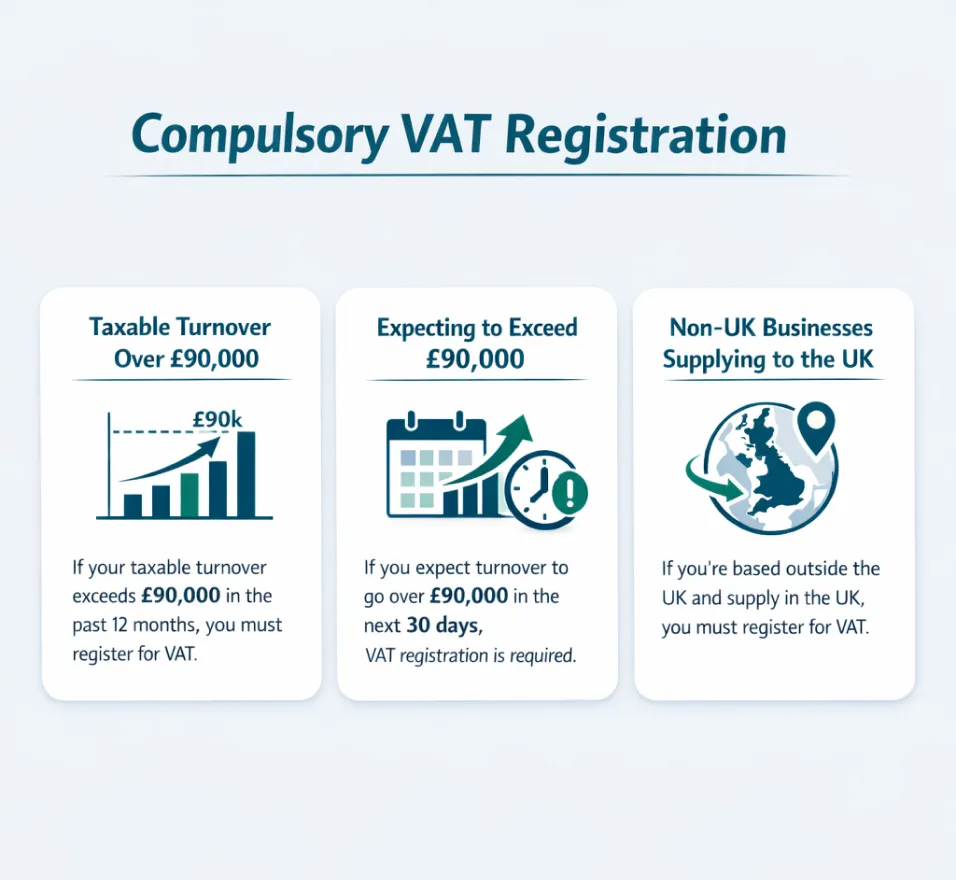

Registering for VAT can be compulsory or optional for your business based on your situation. Before you register for VAT accounting schemes, you need to know if you are eligible for it or not. Here is a detailed insight into the prerequisites for compulsory and optional registration:Compulsory VAT registration:

Your registration for VAT is compulsory if either of the following applies to you:Your taxable turnover is more than £90,000

You expect taxable turnover to exceed £90,000

Non-UK Businesses Supplying to the UK

Voluntary VAT Registration

You can choose to register for VAT voluntarily, even if your turnover is below the £90,000 threshold. It can be beneficial to you in many ways. You can reclaim VAT on purchases. You can also improve how professional your business appears to clients. It also helps you avoid missing the threshold unexpectedly.

Overview: What Are VAT Accounting Schemes?

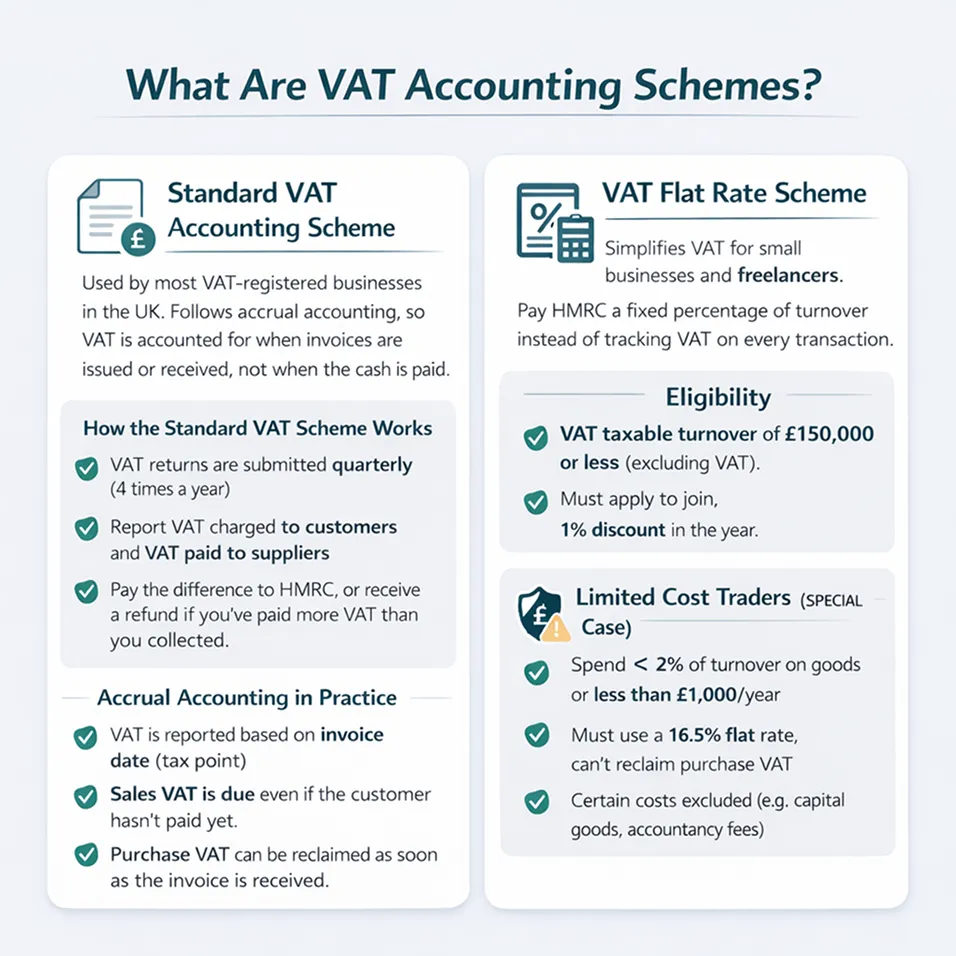

VAT accounting schemes are offered by HMRC so that you know how much VAT you have to pay and how much is left. These schemes simplify the calculation process. Here is a breakdown of the few common ones. Based on your business type or size, you may be eligible for any of these accounting schemes.1. Standard VAT Accounting Scheme

The Standard VAT Scheme is the method through which most registered businesses in the UK pay VAT. This VAT accounting scheme is based on the accrual accounting method. This means that you account for VAT when raising or receiving an invoice. It is not accounted for when money is actually in hand.How the Standard VAT Accounting Scheme works

Your standard VAT accounting scheme will require you to file a VAT return under this plan four times a year, or every quarter. This return includes the details of the VAT you have charged your customers when selling. It also contains the details of VAT you have paid on goods and services from suppliers.If you collect more VAT from your customers and pay less to your suppliers, you have to pay the difference between the two to the HMRC. Furthermore, if you have paid more VAT to the suppliers but you have received less from the customers, HMRC will pay the difference to you.Regardless of whether you have paid your supplier yet, this method enables you to claim VAT on your purchases as soon as you receive the invoice. However, it also implies that even if your customer hasn’t paid you, you will still be required to pay VAT on your sales invoices as soon as they are issued. This VAT accounting scheme is, thus, not ideal for you if your clients don’t pay on time.Accrual Accounting in Practice

Transaction time under the Standard VAT Scheme is linked to the invoice date, which is also referred to as the tax point. For example, you send an invoice to your client on March 29th. The client does not make the payment till the mid of April. You still have to report the VAT in your January to March return. The same goes for your expenses. You claim VAT in the quarter you receive the invoice, not when you pay it.If you are in the retail business or your clients pay you quickly, this is a good VAT accounting scheme for you. Since this scheme is based on invoices, it is important to keep a track of documents.2. VAT Flat Rate Scheme

This VAT accounting scheme makes VAT accounting easier for small businesses and freelancers. In the Flat Rate Scheme, you pay a fixed percentage of your total turnover to the HMRC. This percentage varies based on what industry you work in. If you want to reduce admin time and paperwork, this VAT accounting scheme suits you really well. You won’t have to track VAT on every single purchase.How does the VAT Flat Rate Scheme Work

You continue to charge VAT on your invoices at the standard rate, which is typically 20%, under the Flat Rate Scheme. However, instead of determining the actual VAT you owe based on sales and purchases, you pay HMRC a fixed percentage of your gross (VAT-inclusive) revenue. The fixed rate of VAT depends on what industry you work in. Check the VAT Flat Rate Scheme for these percentages.One advantage is that if the VAT you collect from clients exceeds the flat amount you are due, you retain the difference. However, there is a catch: you cannot normally refund VAT on purchases unless you are purchasing capital assets worth more than £2,000.Eligibility for Flat Tax Rate Scheme

To be eligible, your VAT taxable turnover must be £150,000 or less (minus VAT). You have to apply to join this VAT accounting scheme. If you are accepted, you can start using it from your next tax period. You also get a 1% discount in your first year.Limited Cost Traders: A Special Case

Some businesses are classified as limited cost traders. This means they are spending very little on goods. If you spend the following amount on your goods, HMRC requires you to pay a flat rate of 16.5% no matter what your industry is:- You spend less than 2 % of your total turnover on goods

- You spend more than 2% but it is still less than £1,000 per year

3. What is the VAT Cash Accounting Scheme?

The VAT Cash Accounting Scheme aims to assist businesses in improving cash flow by modifying when they report and pay VAT. In this VAT accounting scheme, you have to pay VAT only after you are paid by the customer. VAT Cash Accounting Scheme UK is a huge relief to you if your clients make late payments regularly.

How does the VAT Cash Accounting Scheme Work

Unlike most VAT accounting schemes, where you have to pay VAT based on invoice date (tax point), this scheme works differently. You only have to pay HMRC once your clients have paid you. This means you can only reclaim once you pay your suppliers. This approach is more indicative of your actual cash flow than other VAT accounting schemes.

The VAT Cash Accounting Scheme is beneficial for you if you are a small business trading on credit. It is also ideal for you if you often experience late payments. It reduces financial strain on you since it helps you avoid paying VAT before you get actual payment.

This scheme might not be good for you if your business buys a lot on credit. Because you cannot reclaim VAT until you have paid your suppliers, this may delay your ability to collect VAT on purchases.

Eligibility for VAT Cash Accounting Scheme

To use this VAT accounting scheme, you must follow the criteria given below:

- Be VAT-registered

- Have an expected VAT taxable turnover of £1.35 million or less over the next 12 months

- Stay under £1.6 million to remain eligible

You are not eligible for it in the following cases:

- You already use VAT Flat Rate Scheme

- You are behind on VAT returns

- You have a VAT-related offence on your records in the past 12 months

4. VAT Annual Accounting Scheme

The VAT Annual Accounting Scheme makes it simple for small businesses to manage VAT. Through this VAT accounting scheme, you only have to submit one VAT return annually instead of filing four. This is beneficial in a number of ways. It reduces paperwork. It also gives you a clearer picture of tax obligations over the year.

If you are looking to improve your budgeting and cash flow, this scheme is ideal for you. Especially if you want to reduce the burden of quarterly filing and spread out your VAT payments, this scheme is useful. However, if you reclaim VAT, this scheme is not ideal for you. This is because refunds are only processed once a year.

How does it work

Based on your prior return (or an estimate if this is your first time utilising the system), you will make advance VAT payments throughout the year. These can be made as either 9 monthly instalments or 3 quarterly instalments.

Once the annual 12-month period ends, you’ll submit your annual VAT return. If you had paid more in advance payments, HMRC will return the difference. If your advance payments were too low, you’ll have to pay more.

Eligibility for VAT Annual Accounting Scheme

You can join this scheme if you fulfil the following criteria:

- You are VAT registered

- You make a maximum of £1.35 million in taxable turnover.

- Your turnover stays below £1.6 million

5. VAT Margin Scheme

The VAT Margin Scheme is intended for companies that sell collectables, antiques, art, or secondhand products. Businesses only pay VAT on the profit margin, which is the difference between the item’s purchase price and sale price, rather than the whole selling price.

This scheme is especially helpful in the resale industry. Antique stores, art galleries, and other businesses that deal in used goods can find this scheme particularly helpful. It helps lower the VAT burden on goods that have already had VAT paid on them at some stage in their lifespan. It also simplifies VAT calculations. VAT costs can be reduced in sectors where goods are often resold.

How does the VAT Margin Scheme Work

VAT is not calculated on total sales. Instead, it is only applied to the margin, which is the selling price minus the purchase price. The margin is then multiplied by the applicable VAT rate. The standard rate is 16.67%. The answer you get from this calculation is the amount you owe to HMRC. To use this scheme, businesses must keep detailed records of each item (e.g., invoices and a stockbook). ility for VAT Margin Scheme

You are eligible for the VAT Margin Scheme if you fall under the following conditions:

- You are VAT registered

- Your trade is based on qualifying goods (art, second-hand items, collectables, antiques, etc.)

- You bought these goods in the UK or the EU without VAT

- VAT couldn’t be reclaimed on these goods when they were bought.

However, it cannot be used in the following cases:

- VAT was charged and reclaimed on the items

- The trade items include gold, stones, or precious metals

- You are involved in the trade of second-hand vehicles, horses and ponies, auctions, or pawnbroker items (there are separate rules for these)

6. VAT Retail Schemes

VAT Retail Schemes are intended only for UK retail companies with less than £130 million in annual VAT-exclusive retail sales. These schemes simplify calculations. They also simplify record-keeping since retailers can report VAT as a whole instead of each individual sale. This can reduce the complexities of managing VAT.

How VAT Retail Schemes Work

You must still include your VAT on your VAT return, which is typically due every quarter, if you are using the VAT Retail Scheme. But rather than computing VAT on each transaction separately, you do it all at once using a method that works for you. This makes your records more organised and eliminates the need to send out separate VAT invoices for every transaction.

You still need to figure out how much VAT is included in your retail prices and record it accordingly. For goods that have VAT included, subtract the VAT portion. For goods that are sold exclusive of VAT, you have to add the VAT based on the applicable rate. Here are the three standard VAT retail schemes to choose from:

Point of Sale Scheme

This is great for businesses that can identify and record VAT right at the time of making a sale. For instance, using a till system that separates VAT automatically. This scheme is ideal for you if you sell different products with different VAT rates. If you need to track your products’ VAT rate in real time, then this also works for you.

Apportionment Scheme

This is great for you if you buy a large amount of goods for resale, but you are unaware of their VAT rate at the time of sale. By this scheme, you can calculate your sales that are related to zero-rated goods and standard-rated goods. You have to do this at the end of each VAT period and apportion the VAT to the goods accordingly.

Direct Calculation Scheme

This scheme works right for you if most of your sales are at one rate and a small number at a different VAT rate. For instance, 90% of your sales are zero-rated and 10% of your sales are standard-rated. Through this scheme, you can directly calculate VAT at 10% without tracking everything.

These schemes can be used with the Cash Accounting Scheme and the Annual Accounting Scheme as well. This offers you further flexibility.

Eligibility for VAT Retail Schemes

To use a VAT Retail Scheme, you don’t need permission from HMRC. As long as your turnover is below £130 million, you can keep using it. But if your turnover surpasses this threshold, you’ll have to stop using these and work with HMRC for a custom scheme.

7. Capital Goods Scheme

This VAT Accounting scheme is designed for businesses that acquire assets of high value. This scheme allows VAT recovery on these assets over several years based on how the asset is used. This reflects the fair usage of the asset, especially if it changes over time.

How does the Capital Goods Scheme Work

A business may not forever keep using an expensive asset for taxable business purposes after purchasing and reclaiming VAT. If the asset’s usage changes, the CGS permits modifications to the initial amount of VAT reclaimed. This change can mean going towards a non-business or exempt use. In this case, VAT needs to be recalculated annually. The adjustment period for land and property is 10 years, while it is 5 years for qualifying assets.

For example, if you are using your asset entirely for your taxable business, you can reclaim 100% of the VAT. However, if you are using it partially for business only, then you have to work out the partial exemption calculation. In this case, you can only claim a part.

VAT adjustments are made over a set adjustment period. This means VAT can be broken into intervals. This allows businesses to reclaim more or repay VAT based on how the use of the asset has changed. For more specific scenarios, businesses should refer to HMRC Notice 706/2.

Assets Covered Under the Scheme

To be included in this VAT Accounting Scheme, the assets must follow the following criteria:

- Any civil engineering work, including land and buildings, is valued at £250,000 or more (excluding VAT).

- Computers and computer-related equipment cost £50,000 or more.

- Vessels such as aircraft or boats where purchase, upgrade or construction costs more than £50,000.

CGS does not apply to assets that are solely used for non-business or resale purposes.

Consult Sterling Cooper Consultants for further guidance

Choosing the right VAT Accounting Scheme is crucial to paying VAT and managing your finances efficiently. It might be a hassle for you to choose which scheme is better for your business. We, at Sterling Cooper Consultants, are there to take your worries away. Our VAT preparation services will look at your particular conditions and choose the right VAT Accounting Scheme for you accordingly. We further ensure that we follow up on this scheme so you are never at odds with the HMRC.