Posted by:

Admin

Date:

December 11, 2025

Category:

Using Losses to Reduce Your Corporation Tax Bill

Eligibility of corporation tax losses for relief:

You might often wonder,’ do you pay corporation tax on losses?’. Well, no, you don’t. However, to be eligible for corporation tax refund on losses, your business must have paid corporate taxes on profits. Then, in the present accounting year, it should have suffered losses. It is then eligible for relief. If your business is terminated, then corporation tax losses on cessation can also counted for corporation tax refund on losses.“While profits are taxed, no immediate tax refund is granted if a corporation suffers losses. Losses can only be used to offset profits generated in other periods or by affiliated companies. The tax loss offset rules, however, significantly differ between countries. Almost all countries offer the opportunity to carry losses forward to subsequent periods.”

Daniel Dreßler

How to work out corporation tax losses:

Before working out corporation tax refund on losses, we must calculate corporate tax losses. To calculate corporate tax losses, adjust the accounting loss. It is shown in your company’s profit and loss statement. You have to use the rules of HMRC to do this. These changes bring the loss into line with what is tax-deductible. You should add the following while calculating your corporation tax loss.1. Capital allowance

These are tax reliefs for the purchase of corporate assets. They can contribute to corporation tax refund on losses. It includes machinery, equipment and vehicles. In your tax calculations, these allowances replace depreciation. The effect of capital losses is to increase the tax losses. This is because depreciation is disallowed and capital allowances are deducted instead.2. Balancing charges

When an asset is sold for more than its tax write-down value (but less than the initial cost), it gives rise to balancing charges. It is a taxable profit, and it has to be added back. The effect of balancing charges on corporation tax losses is to reduce the loss since the gain is treated as taxable income.3. Trade charges

These include certain types of insurance premiums and payments for registered pension schemes. Any kind of charitable donations that are qualifyable by the HMRC are also included. Trade charges increase corporation tax losses. This is because they are considered allowable expenses under corporation tax rules. They can be carried back to a previous accounting period to generate a corporation tax refund on losses.4. What not to include:

You cannot include the following while calculating these losses:- Capital Gains or Losses: They are profits or losses that you get when selling fixed assets. These assets include land, buildings, or shares. They are dealt with under the chargeable gains regime.

- Non-trade Income or Expenses: This type of income and expenses includes investment income or fines and penalties. These monetary aspects are not linked to the company’s trading, so they are not included in calculations.

Claiming corporation tax losses:

There is a CT600 form that your company has filed with the HMRC. You have to fill it the following way to obtain the corporation tax refund on losses. Certain boxes need to be filled out in a particular manner. It depends on whether you’re claiming the loss for the current accounting period or a later one.Latest accounting period:

If you are claiming corporation tax losses for the present year, do it in the following way:Box 155:

This box is for trade profits inside and outside the UK. Write ‘0’ in this box. It shows there are no taxable profits for the year. This lets HMRC know that your business is reporting a loss rather than a profit.Box 780:

This box is for losses and deficits. Enter your full amount in this box. This figure should reflect all the allowable expenses. These expenses include the ones the company is carrying forward or the ones they are claiming this year.Box 275:

This box is for trading losses of the accounting period. In this box, put in the amount that you can claim. It can be the full amount. You can choose to claim the partial amount as well. It all depends on your tax planning strategy.Later accounting period:

If the corporation tax losses are from a later accounting period, the CT600 should be filled in the following way.Box 155

Put ‘0’ in this box. Again, this box reports that no profits are being reported. This lets HMRC know that your company is losing money and plans to use losses from a different time period.Box 780:

This box is for total deficits for this accounting period. Put the corporation tax losses for this year only, and not the losses that are to be carried forward in the future year.Box 275:

This box indicates the trading losses used. Here, you have to put the total corporation tax loss that you are using for this and future year. It can contain the amounts carried back or set off against other profits in future years.Trading losses and groups:

Having a group means you have a parent company and subsidiaries. HMRC defines it as one company owning 75% of the other. If your company is part of a group, it can give away its trading loss to another company in the group. This is offset against the profits of the other company, and their tax can be reduced.Carrying back a tax loss:

You can carry back your tax loss to 12 months. It is not necessarily supposed to be an accounting year. It helps you get your tax refund sooner.Rules for carrying back a loss:

The rules for carrying back a loss are:- You can only carry back the loss for 12 months prior to the loss.

- The trade should be the same as what you are doing now.

- If your accounting period is longer than 12 months, your losses can only offset the profits from that 12 months.

Making a claim:

To make a claim, you can use any of the following ways:- You can write a letter to HMRC

- You can amend your CT600 form (that you have already submitted)

- You can file a new CT600 form.

Time limit:

The time limit to carry back a loss is 2 years from the accounting period when the loss was made.What to include in the claim:

The carry-back claim for the tax loss must include the following:- Your company’s name

- The timeframe in which the loss occurred

- The total loss amount

- How are you going to use the loss

Aftermath of the claim

You can get a repayment from the HMRC in case you have paid tax on the accounting year. If you still owe corporation tax, they’ll deduct it before sending you the repayment.Carrying a trading loss forward

Carrying a trading loss forward means you can save your tax losses. You can use them when your company makes a profit.Restrictions from 1 April 2017:

Before this date, you could use all of your losses to offset your profits. Now, you cannot do this. The new limits state:- £5 million of losses can be incurred every year without limit.

- Above £5 million, you can only cover 50% of the profit with the losses.

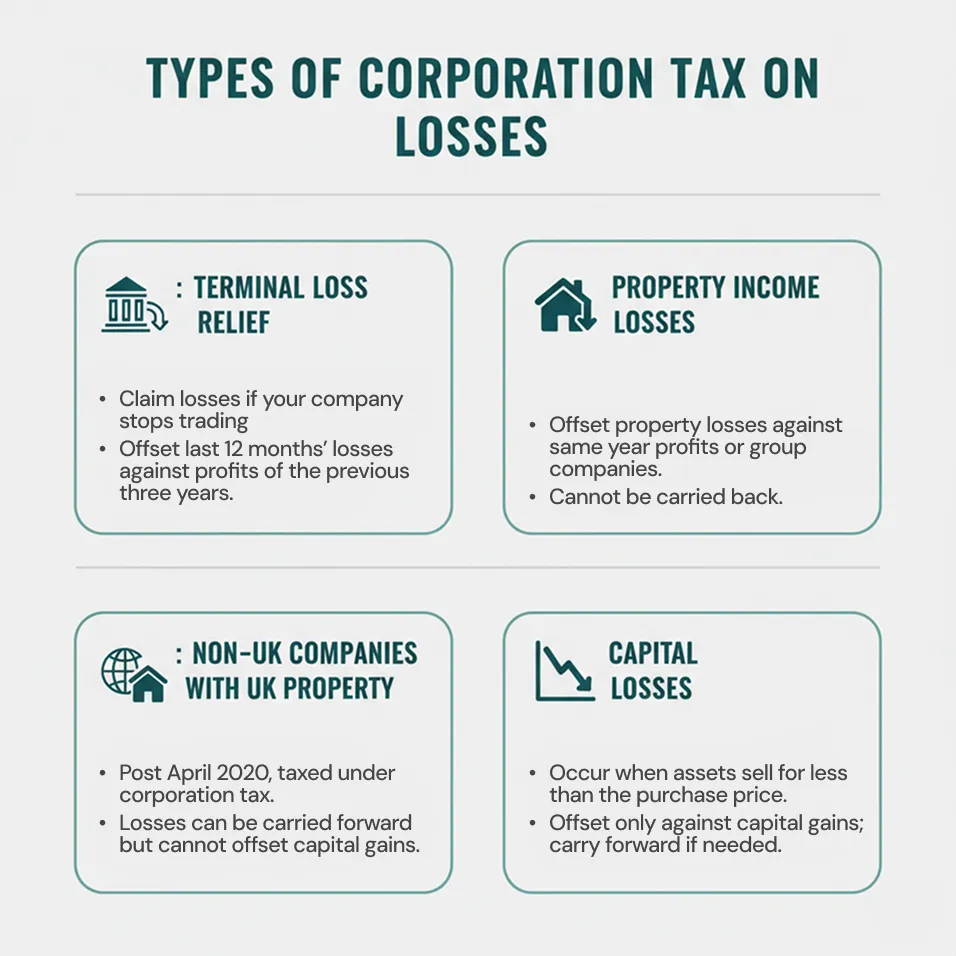

Types of corporation tax on losses:

Here are some of the corporation tax losses that you can claim relief on:Corporation tax losses on cessation relief:

You can claim corporation tax losses on cessation if your company stops trading. You can take corporation tax losses on cessation for the last 12 months, and you can offset them by the profits of the three years before them.Corporation tax losses on cessation can be compensated for by profits on the following conditions:- The previous trade was the same as now

- If the accounting years are not aligned, then the profit should be split. Corporation tax losses on cessation should be applied only on the part of the profit falling in the three years.

Property income losses

Property income is earned by companies making money through owning and renting out property. With property losses, you can,- Offset against them some other profits (such as trading profits) of the same year

- Can give it to other companies in the group(only if the loss is greater than your own profit)

Non-UK companies with UK property

After 6 April 2020, your income is taxed under corporation tax instead of income tax. The old property losses:- Can be carried forward

- Used now, but until any new losses occur

- Cannot offset capital gains

Capital losses

Capital losses occur when your company’s assets are sold at a lower value than they were bought at. Capital losses cannot compensate for trading profits. This implies they cannot be used for lowering corporate tax bills. These losses are offset in the following ways:- They are compensated against any capital gains in the same year.

- They are carried forward if there are not enough gains that year.

New businesses:

If you are a new business, you can use your loss to be offset in the first four years. If the loss happens in four years, you can claim tax relief against profits of the first three years. If you are looking for tax relief using any of these losses, look no further. At Sterling Cooper Consultants, our expert accountants help you understand the implications of your loss on your tax bills. With our corporation tax return preparation and submission to HMRC services, you can make the most out of your losses.

Don’t wait for your losses to pile up.

FAQs

Recent Posts

Understanding s455 Tax: When HMRC Taxes Your Company Loans

Understanding the 40% Tax Bracket in the UK