Posted by:

Admin

Date:

January 13, 2026

Category:

blogs

The Ultimate Guide to Business Start-Up Loans

New businesses often face financial difficulties. Here is when start-up loans come in handy. These loans are personal loans that are intended for new businesses to cover up certain costs. They are different from other business loans. You do not have to keep any asset as security to get them.It has been reposted by the government that over 890,000 businesses have been registered in 2023 till 2024. However, the stats observe a failure in 70% of the start ups in the UK. The major reasons for these failures are financial, legal and admin issues.Here is everything you need to know about business start-up loans.

Eligibility criteria for start-up loans

The following criteria determines eligibility for a business start-up loan.- You should be 18 years or above of age

- Your residence should be in the UK.

- You should have obtained permission legally to work in the UK.

- You should have a UK based business.

- You should not have a business older than 36 months.

Ineligible businesses

Most of the businesses pass the eligibility criteria for this loan. Here are the kinds of businesses that cannot apply for this loan.- Charities

- Any type of investment firms

- Any business that is engaged in any illegal activities (e.g., drugs, weapons, chemical production)

- Businesses involved in money transfer services or banking

- Betting or gambling business

- Businesses involved in pornography

What can business start-up loan be used for

You can use a start-up business loan for the costs of initial set up. These might include a guarantee that you have the funds necessary to pay for your initial expenses.This is important for small businesses to deal with invoices and payment delays.What cannot be done with the start-up business loans

The following activities cannot be performed with these loans.Repayment of debts

You cannot use these loans for repayment of any other loan.Training programs

Any kind of training or education program can also not fall under these loans.Investment

You cannot invest the money from these loans as a third party.Application for the loan:

Required documents:

You need the following documents for filling application for this loan:1. Your business plan

Your business plan contains the main essence of your business idea. It contains all the research done in support of your concept.This is the document that sells your idea to your financers. There are multiple templates and guides to help you create it. You can also take help from financial advisers.2. Forecast for cashflow

This is important to explain if your business is viable. In essence, it is a spreadsheet that lists all of your company’s incomings and outgoings.3. Bank statements

Your bank statements should show up to 3 months of your banking history. This is vital to analyze if you are trustworthy and have financial foresight for the business.Survival budget for yourself

Your survival budget should show your personal finances. It is supposed to explain how you are going to sustain yourself while starting your business.Get some insights on How to Become a Bookkeeper in 2025?Steps for application

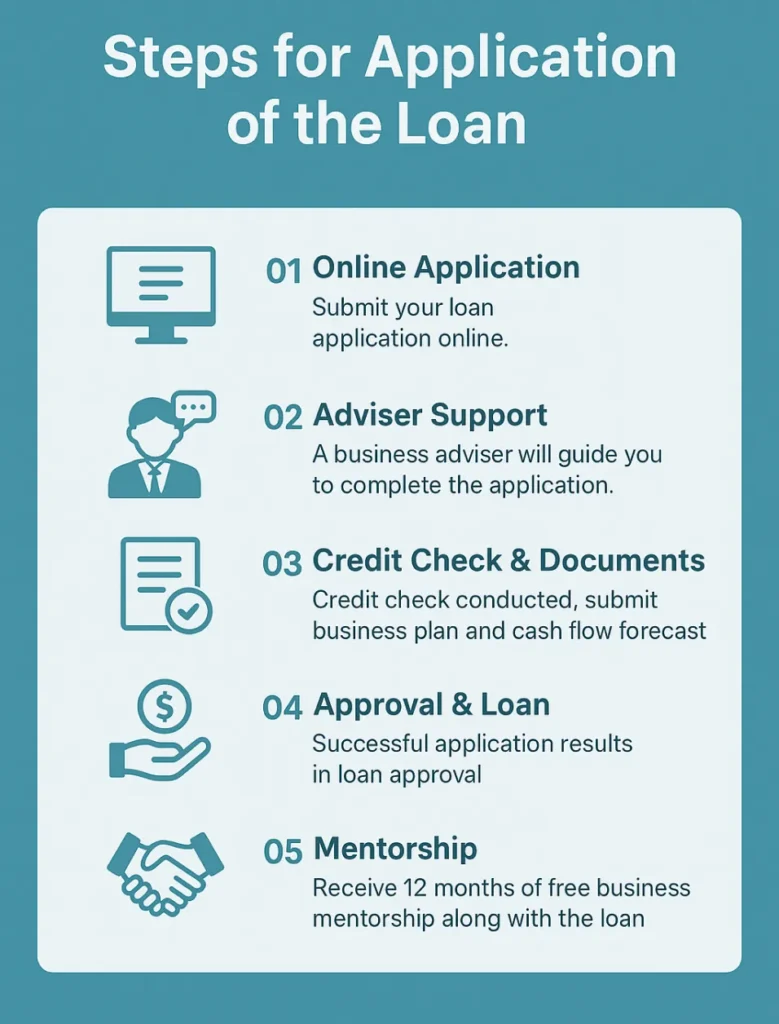

Take the following steps to apply for start-up business loans- Submit an application online initially.

- You’ll be provided a business adviser. Complete the application with their health.

- A credited check will be carried out. Your business documents(business plan/ cashflow forecast) are needed to assess.

- Successful application will result in a loan.

- In addition to the loan, you’ll be offered free mentorship for 12 months.

Features of the business start-up loan

You should understand the following key features of a business start-up loan before getting it.1. Structure:

Start-up business loans are not from the government. They are personal loans that you obtain from institutions recognized by the government. You don’t need to provide anything as a guarantee. However, failure of payment can result in legal procedures regarding debt recovery.2. Value:

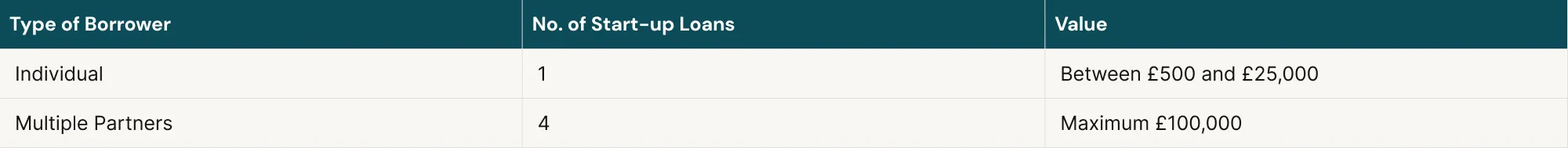

The amount that can be borrowed is as follows.

3. Interest:

6% is the fixed interest rate.4. Repayment:

The repayment period is 1 to 5 years. Application and early repayment do not have a fee.5. Second Loan

You can obtain a second loan subject to following conditions.- Displaying reliable growth

- Regular payments of the first loan

Benefits and drawbacks of Start-up Business loans

These loans can have certain advantages and disadvantages.Benefits:

Obtaining the funding:

The loans provide you with ample funds for initial operation costs. In this way, you can overcome any initial hurdles that you face with your finances.“Often, but not always, the provision of start-up support has been multifaceted, com-bining capital and soft support in recognition of the fact that finance or business skills development on their own are much less effective in driving survival and growth”

Marc Cowling

Security waiver:

Individuals with new businesses might not have substantial assets. Security not being conditions of this loan is very helpful to these people. Though, you have to pay the loan you secured.Ownership retainment:

When you seek investment, you have to give equity i.e., a portion of your company. Unlike investments, these loans allow you to keep your entire company.Drawbacks:

Credit ratings:

Since this is a personal loan, your credit will be checked. This can impact your credit report. Your credit score may also be impacted if you are unable to pay back your debt.Strict Criteria:

The eligibility criteria is strict and you need to meet it in order to secure the loan.Common Mistakes Applicants Make

Avoiding these pitfalls will increase your approval chances:- Borrowing without a proper business strategy

- Poor or unrealistic cash-flow forecasting

- Applying with inaccurate personal information

- Ignoring personal credit issues

- Requesting a loan amount that does not match the business model

Get Expert Advice on Your Start-Up Loans by Sterling Cooper Consultants

We at Sterling Cooper Consultant navigate the drawbacks and benefits better. We help you judge your eligibility and then ease the application process. With our advice, you can get the start-up business loan hassle-free. To get our services, contact us now.Simplify your business registration in the UK with expert legal support.

Ensure compliance with our business formation services.

FAQs

Yes, you get a mentorship for up to 12 months if you are successful in getting start-up loans.

You can get grants, third party investments, lines of credit, traditional businesses loans, etc.

You can apply for a start-up loan without income but it will be harder for you to get it. This is because your business plan and cash flow forecasts would be harder to produce.

It depends on how early the application is approved. It can be anywhere in the timeframe of 5 days to 18 months.

There are 23 partners who do the delivery. There are regional and national partners as well. You can either contact the Start Up Loans Company or the delivery partners themselves.

Recent Posts

Cash vs. Accrual Accounting: Which Method Is Right for You?

January 8, 2026

VAT on Imports: How It Works and What You Need to Know

January 7, 2026