Posted by:

Admin

Date:

February 5, 2026

Category:

How Do You Register a Business the Right Way?

Have you considered doing a business in the UK? Get ready to register it with HMRC. You should know that you don’t only have to fill out forms to register yourself in the UK. You have to make legal and financial decisions while you fill out the forms which makes a difference.

It has been reposted by the government that over 890,000 businesses have been registered in 2023 till 2024. However, the stats observe a failure in 70% of the stat ups in the UK. The major reasons for these failures are financial, legal and admin issues.

You must go through the entire business registration process so that you can keep yourself afloat in the long run. This guide covers everything you need to know when you register a business.

Guide on How to Register a Business

Lets go through all the steps that you need to follow for a UK company registration:

1. Decide Your Business Structure

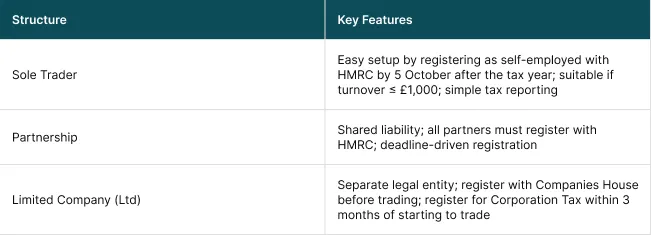

The first step before you register a business is to find the right legal structure. This structure affects some of the most important factors. It decides how you are taxed and the level of your personal liability. This structure also determines your admin duties and the perception of your clients and investors. Here are the structures you can choose from:

Sole Trader: Quick Setup, Full Control

When you start trading, the simplest and easiest way is to register a business as a sole trader. You have to register yourself with the HMRC online. This must be done before 5th October of the tax year you started training in.

For freelancers and sole operators who have low risk, this setup is ideal. Your income will be reported through Self Assessment, and you get to keep all the profits. But this makes you responsible for any business debts and legal issues as well. Registration is not compulsory if your income stays below £1,000.

Partnership: Shared Responsibility and Profits

A business partnership works similarly to sole trading. It involves two or more people running a business together. Each of them has to be registered with HMRC on their own, and the others have to act as ‘nominated partners’. Profits and liabilities are shared equally unless decided otherwise between the partners. Usually, a written partnership agreement is strongly advised so that there are no future disputes. This set-up is ideal to register a business when you want it to be co-owned with shared duties.

Limited Company (Ltd): Separate Legal Entity

The structure of a limited company is more formal and protective. It is a separate legal entity from you. This means that its debts and liabilities are kept separate from your personal finances. To register a business as a limited company, it must first be registered in Companies House. This has to be done before you start trading.

After that, you have to register it with HMRC to pay for Corporation Tax. This is done 3 months into starting business activity. Directors have to comply, submitting annual accounts and final statements. This model is favourable for tax options, but you have a stricter compliance duty.

Which Structure Is Best for You?

There is no direct answer to this question. Your goals, the size of the business and risk level decide the direction you will be going in. 56% of private companies in the UK are sole traders, compared to 38% limited companies.

This indicates a growing trend towards incorporation as businesses expand. Many founders begin their journey as sole traders. Then they shift to limited companies when they grow. You should seek expert advice when you register a business so that you don’t have issues in the future.

2. Choose a Compliant Name & Brand Identity

Choosing a compliant name is the next step to register a business. Here is what you have to consider for this:

Ensure Legal Compliance & Avoid Misleading Terms

When you register a business, your business name should not be misleading or offensive., It has to follow the rules of Companies House under the Companies Act 2006. Your business name cannot use terms such as ‘Bank’, ‘Royal’, or other government indicators.

If you have to, you need explicit permission from the Secretary of the State. If you are a limited company, then your company’s name must have Limited or LTD at the end. If your business name is offensive, Companies House will reject it. Around 700 names were rejected in 2023.

Check Uniqueness Across Registers

Your business name has to be unique. Therefore, you have to check with Companies House name checker to know if somebody has already got that name or not. Differences in punctuation, characters, or misleading wordplay don’t count.

To prevent violating already-existing trademarks you should also look through the UK Intellectual Property Office’s (IPO) trademark registry. If you follow all these, you won’t trigger a rejection based on your business name, at least.

Secure Your Digital Identity: Domains & Socials

Online availability of your brand is just as important as obtaining legal approval. Use Nominet and popular registrars to check for domain names. Some popular examples of domains that you can use are co.uk, .ltd.uk, .org.uk. Limited companies often end up in the .ltd.uk domain.

Along with this, secure your social media handles too when you register a business. You need them to be consistent for brand trust and SEO.

Build a Brand-Reflective & Futureproof Name

When you register a business, choose a short and memorable name. It should reflect your business well. This means that your services or vision should reflect in your name. Branding experts suggest using names that are easy, evoke trust and emote perfectly.

According to the Guardian, brand names like “& Daughters” have surged by 75% in popularity in recent years. Finally, don’t use niche names if you plan to expand globally.

Justify Multiple Trading Names

Under your legal entity, you are free to use other trading names, such as “ACME Ltd trading as Widgets & Co.” But you have to be very careful that your trading name doesn’t mimic another business.

It should also not use sensitive terms or restrictive suffixes. Trading names are generally taken based on what market you are in. You can remain a single legal entity when you register a business for tax and compliance.

Get expert corporate legal services from Sterling Cooper, including business formation, regulatory compliance & contract advisory.

3. Confirm an Official Registered Address

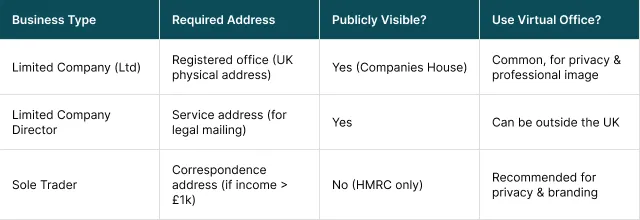

When you register a business, you have to provide an address. The registration address requirement is different depending on what you are registered as a business.

Limited Companies: Legal Requirement & Privacy Considerations

For a limited company, you have to provide a registered office address when you register a business. This is a requirement by the Companies House Act 2006. This address should be in the UK. It will be publicly listed on the Companies House website and used for all legal correspondence. You cannot use a P.O. Box anymore; it has to be a complete physical address.

This rule is enforced under the Economic Crime and Corporate Transparency Act 2023, aimed at transparency. What you can do is use a virtual office or registered office service offered by consultants.

They offer you a real address where all kinds of correspondence can be received. However, for financial services, you need a tangible work office where work happens. You may have a virtual office for formal purposes.

Sole Traders: When You Need an Address

HMRC will need a correspondence address from you when you register a business and then Self Assessment. However, sole traders do not have a public register. You can provide your home address to HMRC.

If you need privacy or branding, you can opt for a separate business or a virtual office. When your earnings exceed £1,000 a trading year, then you have to provide a commercial address to the HMRC. Your submissions should include your complete details.

Director’s Service Address: Optional but Valuable

This is a requirement for Limited Companies. Directors have to provide a service address. It is a public-facing contact for legal correspondence. This can be the same as your registered office or different. This address does not have to be in the UK. Directors are allowed to keep their private residences confidential.

4. Appoint Directors, PSCs & Define Share Structure

You have to choose and formalise your company’s leadership and ownership when you register a business. It sets ownership and duties in your company. Here are some key legal and practical steps in this regard.

Appoint at Least One Director

The Companies Act prescribes at least one director over the age of 16 in a limited company. The duty of a director entails filing accurate accounts and complying with civil duties.

They are supposed to be responsible for overall operations. Directors can reside anywhere. There is no requirement for them to be in the UK. Also, you can hire a company secretary as well.

Identify Persons with Significant Control (PSCs)

You are obligated to maintain a PSC register under UK law. This is for transparency and to combat crimes. The following individuals have to be recorded when you register a business:

- Hold more than 25% of issued shares

- Control more than 25% of voting rights

- Possess the right to appoint/remove a majority of directors

- Exercise significant influence or control

- Exert control over a trust or firm holding a non-legal entity interest

Directors are not automatically considered PSCs. They have to satisfy these ownership or control thresholds. Whenever any changes happen, you have to update your PSC register within 14 days. You have to file this with Companies House within 28 days (14+14 rule).

Define Shareholders & Share Structure

At incorporation, you need to specify your subscription and share capital. The following are important to register a business:

- Number of shares: It is crucial to have at least one subscriber share.

- Nominal value: This means the basic value of each share. It is commonly priced at £1 per share.

- Share classes: Shares can be either ordinary, preference or redeemable. Each of these categories has distinct rights regarding dividends, voting, or redemption.

It is important to define the allocations of ownership clearly. It is especially crucial to do so when you have multiple shareholders. You must record the number and value of each shareholder. In addition, keep tabs on special rights for different classes.

5. Complete the Companies House & HMRC Registration Process

The next step to register a business is completing the filing with Companies House and completing the HMRC registration process. Here are the complete steps of how to do it:

Step 1: Prepare Your Legal Documents

The first step to register a business is presenting the MOA and AOA. This is the legal constitution of your company. There are free samples on the government of UK website. You can tailor them if you require additional governance. Your company’s legal identity is based on this.

Step 2: Incorporate via Companies House

Use the Companies House service to finish the online registration. Currently, the cost is £50, and incorporation usually takes place in a day. It provides you with your Certificate of Incorporation and Company Registration Number (CRN).

Along with your address, you’ll need a dedicated email address. This has been in place since 4 March 2024. You will have to give a lawful purpose too for registering your company.

Step 3: Register for Corporation Tax

HMRC gets notified when you register a business. You still have to formally register for corporation tax within three months. HMRC will send you your Unique Taxpayer Reference that you will use for filing your taxes. If you do not register on time, HMRC will penalise you.

Step 4: Register for VAT

You must register for VAT if your taxable turnover reaches £90,000 in any 12-month rolling period. VAT registration is also a must in cases where you have not yet crossed the threshold, but you are about to in the next 30 days.

On reaching the threshold, you have 30 days from the end of the month to get registered for VAT. After registration, you have to charge VAT on eligible goods and services. You also have to file quarterly VAT returns and maintain VAT records and invoices.

Step 5: Set Up PAYE and Workplace Pension if Hiring

When you start hiring your staff, you have to register for PAYE (Pay As You Earn). This will enable you to handle their income tax and National Insurance contributions before running their first payroll. You will have to set up a workplace pension scheme if any of your employees are automatically eligible for one.

6. Watch Out: New ID Verification Rules

From Autumn 2025, all company directors, PSCs and other key officers must complete a mandatory identity proof. This has to be done via the GOV.UK One Login system. There has been a voluntary period for this registration since April 2025. These are aimed to prevent fraud and money laundering. They are also a protective measure against false registrations.

New companies are subject to immediate checks during a phased rollout. Current officials have a 12-month transition to verify it. It is tied to their annual final statements. ID checks will be crucial for all filings by the spring of 2026.

Tips to Avoid Pitfalls

Here are some tips to stay ahead of this entire registration.

- Verify as soon as you can. There are 200,000 IDs already verified of an estimated 7 million. This means many entities are still unverified. So, you should start now to avoid last-minute panic.

- Watch out for extra costs. The fees for certain expert services range from £45 to £250. The GOV.UK technique just takes a few minutes and is still free.

- Keep your document updated. Acceptable ID proofs include UK-issued biometric passports, residence permits and photo driving licenses. Non-photo options mean you should have certified documents, such as bank statements.

Simplify your business registration in the UK with expert legal support. Ensure compliance with our business formation services.

7. Post‑Registration: Compliance & Set‑Up Essentials

Once your business registration process is done, you have to focus on preparing your business infrastructure and staying compliant. Here are some next steps to take:

Open a Business Bank Account

You must open a business bank account using your Company Registration Number (CRN). You can find easy online setup and integrations in popular Challenger banks such as Monzo, Wise, HSBC, etc.. You can use a traditional bank as well, but that would be slower and less tech-oriented.

Set Up Accounting and Financial Management

Choose a user-friendly accounting software. Xero, QuickBooks and FreeAgent are some great options. You can also hire a qualified accountant for this job. This ensures you meet your legal obligations. Your annual accounts and company tax returns are filed on time. Regular accounting and bookkeeping will make this easier for you and help you avoid penalties.

Arrange Insurance, Contracts & Agreements

You have to set the crucial insurance policies in place to protect your business. Employer’s Liability, product liability, expert indemnity, product liability are some of them from which you can select based on your operations. Draft terms and conditions, contracts, and, if applicable, a shareholder agreement. This will help you avoid disputes in future.

Maintain Legal and Regulatory Compliance

Comply with the following rules:

- Employment law: To comply with this means following laws in regards to minimum wage, holiday and sick pay.

- Health & Safety: If your business has more than 5 employees, you need to have a written policy for safety. You also have to conduct regular risk assessments.

- GDPR: You have to protect the data of your staff or customers. Otherwise, the fines can go up to 4% of your global turnover.

- Local licences: This is for retail, hospitality or food services. You will have to obtain local council licenses.

Ensure corporate compliance with our expert company secretary services. We handle your documents, filings, and legal requirements.

How can Sterling Cooper Consultants Help

It may feel stressful to register your business in the UK. But it should not feel this way. At Sterling Cooper Consultants, we share your burden so that you don’t feel stressed about it. We take care of every step to register your business with HMRC. Meanwhile, you can work for the growth of your own business.

Along with this, we also manage your accounts, taxes, and compliance obligations. We have a team of experts that take every financial decision for you. We stay educated with the evolving rules so you are always ahead of your competitors. Contact us now to get the help you need the most!

Need help registering your business in the UK?

FAQs

Recent Posts

Common Errors on VAT Returns and How to Avoid Them?

A Complete Guide to the 0T Tax Code