Posted by:

Admin

Date:

January 1, 2026

Category:

blogs

Gross Pay vs. Net Pay: Understanding the Key Differences

Have you ever glanced through your payslip and asked yourself why the amount that you take home is lower than the amount you get paid? The solution is simple: to know the difference between gross pay vs net pay. It is a critical distinction that could often be a source of confusion among those who are just starting out in the workforce or those whose jobs are changing. Gross pay is, essentially, what you earn annually before deductions, and net pay is what you can receive after payment of taxes, pension and other deductions. The knowledge of how to read and interpret gross vs net salary is required in situations where one has to carry out budgeting, tax planning, and make some important decisions when negotiating the offering of a job.

Understanding Gross Pay

Your gross pay would be the first figure you would see when revising your payslip. This is what you earn before any deductions such as tax, National Insurance contributions, student loan repayment and pension contributions. It forms the basis of the amount of net salary that you will finally get in your net salary. It includes all of the income you earn in a pay period, for instance:- Salary

- Hourly wages

- Overtimes

- Bonuses

- Commissions

How to calculate gross pay

The method of calculating gross pay depends on the way you are paid. It can be salaried, or you might be paid hourly. Here is how you calculate both:1. Calculation of gross pay for salaried employees

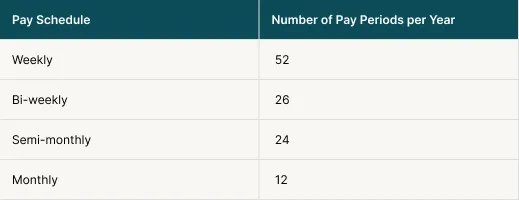

If your salary is fixed for a period of time, then you can find your gross pay by dividing your annual salary by the number of pay periods in a year.Gross pay frequency

You need to understand how your salary is spread over the year. Here are the frequencies by which you can be paid gross pay:

Formula:

Based on the annual salary and pay periods, gross pay is calculated by the following formula:Gross Pay = Annual Salary / Number of Pay PeriodsExample

Suppose you earn £48,000 annually. You are paid your salary per month. Here is how you can find your gross pay.£48,000 ÷ 12 months = £4,000 gross pay per monthThis amount can vary if you receive any of the following along with your regular pay:- Bonuses

- Commissions

- Overtime

2. For hourly employees

If you work on an hourly basis, your gross pay is found out in the following way:Gross pay = Hourly Wage × Number of Hours Worked in the Pay PeriodExample

Suppose you work for 35 hours per week. Your hourly working rate is £12 / hour. Your gross weekly pay is calculated as follows:35 × £12 = £420 gross weekly payOvertime

If you work overtime, i.e., more than your designated hours, these would factor in too in your gross weekly pay. It is calculated a little differently from your hourly pay. There is a threshold of hours, for most areas 40 hours, below which your overtime is calculated like your hourly salary. Over this threshold, the calculation changes. Now, it is 1.5× the normal rate.Example with overtime

Suppose you worked 45 hours a week. Your pay would be calculated as follows:- Regular pay: 40 × £12 = £480

- Overtime pay: 5 × (£12 × 1.5) = £90

- Total gross pay = £570

How to Calculate Gross Annual Income

To calculate your gross pay when you are paid hourly, multiply your weekly pay by the number of pay periods in a year.Suppose you earn £900 per week. You work all 52 weeks. Here is how your annual salary will be calculated:£900 × 52 = £46,800 gross annual income.What is a net income?

The net pay is the money that the employees receive when all necessary and extra deductions are completed and are deducted from the gross pay. It is the last number that you check on your payslip, the money that is deposited into your bank account.Also known as the take-home pay, the net pay provides employees with a more accurate understanding of their actual income. It is important since this is the amount of money that they can spend, save or plan with.The Formula for Net Pay

Based on the gross pay and deductions, net pay is calculated by the following formula:Gross pay – voluntary and mandatory deductions = net payHow to calculate your net pay

Suppose you earn a £30,000 gross salary. Your tax code is 1257L. Your tax and other deductions are £4800. Then your net salary is calculated as follows:Net salary = 30,000 – 4,800 = £25,200How to monitor your net pay

Use the following ways to keep track of your net income:- Check your payslip; your deductions are clearly listed there.

- Verify your tax code.

- Use a net pay calculator.

- Correspond with your HR.

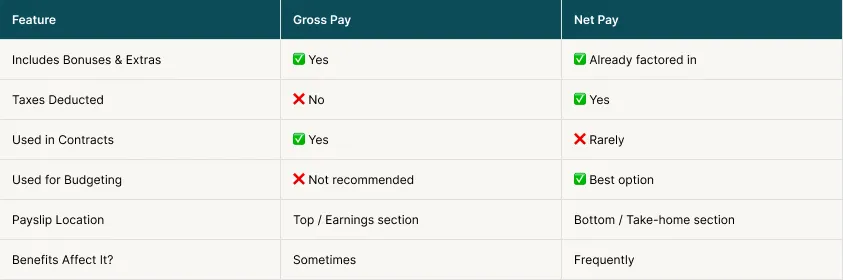

What is net pay vs gross pay: Looking at key differences

Here are a few key differences in gross vs net salary:1. Gross pay vs net pay: What is included in each one?

Since gross pay is the total salary before the deductions, it includes:- Base salary or hourly wages

- Overtime

- Bonuses and commissions

- Stipends

- Paid leave and holidays

2. Gross pay vs net pay: Deductions

The gross pay is the starting point salary that is used to calculate taxes and benefits. No deductions are applied in this.Net pay has the following deductions:1. Mandatory deductions:

These deductions are required by the law. They are automatically taken out of your salary. The following are a few mandatory deductions:- Income tax

- National Insurance

- Student loan repayment

- Wage garnishments

2. Voluntary Deductions

These deductions are the ones that you voluntarily opt for with your employer. These include the following:- Health & Life Insurance

- Pension Contributions

- Charitable Donations

- Other Deductions

3. Gross pay vs net pay: Visibility on payslips

Gross pay and net pay both appear clearly on your payslip. However, they are written in different places on your payslip. Here is where you can find them:- Gross pay appears at the top of your payslip

- Net pay is usually at the bottom of your payslip as the final amount you are receiving

4. Gross pay vs net pay: Financial planning

While you do your financial planning, remember that gross pay is used for:- Salary negotiations

- Benefit calculations (e.g. statutory sick pay)

- Tax bracket determination

- Budgeting and expense planning

- Loan applications and affordability checks

- Estimating actual disposable income

5. Gross pay vs net pay: impact of benefits

Benefits impact gross vs net salary in different ways. Here are two examples:- Pre-tax benefits, such as pensions or some insurance plans, lower taxable income. This, then, lowers net pay but leaves gross pay the same.

- Bonuses and taxable stipends are examples of taxable benefits that raise gross pay. However, they may lower net pay because of increased deductions.

This maximum amount is payable if the family’s net income (after income tax and NICs) is lower than a threshold (£77.15 per week in 1997-98). Net income in excess of this threshold reduces entitlement to Family Credit from the maximum by 70p for every £1 of excess income.

Gross Pay vs Net Pay: Why It Matters More Than You Think

It is crucial for both employers and employees alike to understand gross pay vs net pay. The difference may seem slight at first glance, but you need it for better financial planning, transparency and understanding trends of your industry. Here is how it matters:1. Expense management

Gross pay vs net pay has an impact beyond payroll. It can shape all of your finance-related issues. Some of them are:Budgeting

Many times, you may mistakenly plan your budget according to your gross income. This causes money wastage or unmet savings targets.Loan applications

Lenders should evaluate your net income for loan applications, but if you are unaware, they can use gross income. This would lead to wrong assumptions about affordability.Retirement goals

Your retirement goals, i.e, contributions to pensions and saving plans, are deducted when you receive your net salary. This is imperative for your long-term financial health.2. Industry-specific impact

Based on what sector you work in, you may experience gross pay vs net pay differently. This is because different sectors have different:- Structure

- Deductions

- Compensation Models

Freelancers and contractors

Public sector workers

- Union dues

- Government pension schemes

- Student loan repayments

Corporate employees

- Bonuses and stock options (included in gross)

- Pre-tax benefits (affecting net pay)

- Flexible savings plans or wellness stipends

3. Employer’s responsibilities

Employers need to clarify gross pay vs net pay to their employees when hiring them. They should make sure to effectively communicate all the relevant information, such as payslip, deductions, tax codes, etc..They can also use the gross pay vs net pay to their advantage while structuring salaries:- Provide pre-tax benefits such as childcare vouchers or pensions, which lower the losses in net income.

- Balance the salary and benefits so as to offer a more competitive take-home value.

Consult Sterling Cooper Consultants to learn more about gross pay vs net pay

The difference between gross pay vs net pay UK is necessary to understand. Its impact on payroll, taxes, benefits and deductions can, however, be very hard to navigate. This is where we come in to help you. We at Sterling Cooper Consultants will make sure that payroll is done in the correct way, deductions are done with current regulations, and financial planning is in line with the actual take-home pay.To get help, contact us now.Need help making sense of gross and net pay?

At Sterling Cooper Consultants, we simplify payroll, ensure accurate deductions, and align your financial planning with your real take-home pay.

FAQs

Your tax code notifies you and your employer how much money you can make in earnings before being taxed. To illustrate, the current tax code is 1150L, which implies that you can receive a tax-free income of not more than 12,500 a year.

The following are the current UK income tax rates:

- £0–£12,500: 0% (personal allowance)

- £12,501–£50,000: 20% (basic rate)

- £50,001–£150,000: 40% (higher rate)

- Over £150,000: 45% (additional rate)

You can request a review from HMRC if you think your tax code is off. A new tax code may also result from changes in your situation, such as getting a larger personal allowance because of your age or disability.

Here are the 3 best practices to manage your payroll more effectively:

- As many payroll procedures as you can should be automated.

- Make sure your records are accurate.

- Continue to abide by UK tax laws.

Employee transparency is ensured and payroll trust is increased when gross pay and net pay are clearly shown in financial statements. Additionally, it assists employers in precisely tracking salaries for regulatory compliance and tax reporting.

A payroll automation solution automates payroll processing by applying tax withholdings, pre-tax contributions, and post-tax deductions, decreasing errors, enhancing compliance, and lowering payroll errors.

Recent Posts

How Digital Bookkeeping Is Transforming UK Startups?

January 5, 2026

The Ultimate VAT Exemption Guide

January 2, 2026