Posted by:

Admin

Date:

January 5, 2026

Category:

blogs

How Digital Bookkeeping Is Transforming UK Startups?

Globally, over 50 million start-ups are established every year. On average, 137,000 start-ups are launched daily. This gives a rough idea of how competitive the realm of start-ups is. Agility and efficiency are of paramount importance when sustaining your start-up in this fast-paced world. In terms of keeping records, digital bookkeeping can be a game-changer for these small businesses. It replaces the outdated manual processes with a cloud-based platform and real-time automation. It also offers an OCR-enabled data capture. This can be transformative for young businesses that can use this as a tool. This tool can assist them in making faster decisions and staying compliant. When they decide to scale, they can do so with confidence as their records will be in order. So, the numerous benefits of digital bookkeeping indicate the role it can play for UK start-ups. Here is everything you need to know about this.

What Is Digital Bookkeeping?

Digital bookkeeping refers to maintaining records the modern way using cloud-based software instead of paper or spreadsheets. For UK start-ups, it means using faster and smarter tools instead of slow, manual tasks. These tools work online and update in real-time. Basically, what happens in digital bookkeeping is that platforms like Xero, QuickBooks, and Sage help you track all finances automatically. These include income, expenses, invoices and bank transactions. You don’t have to enter a number by hand. These software programs connect directly to your bank account through a process called bank feed. Every time money goes in or out, your bookkeeping software notes it down without you having to enter it.Time-saving through OCR apps

The use of OCR (Optical Character Recognition) apps saves you most of the time. Start-ups can simply take photos of receipts and invoices using their phones. The app then reads this invoice. It extracts information such as date, amount and suppliers and sends it to the bookkeeping system. This makes it very easy to track expenses and record VAT. Since all this is stored on the cloud, the founders and team can access it from anywhere. Thus, digital recordkeeping means a better organised set-up for growing businesses.Why UK Startups Are Adopting Digital Bookkeeping

Here are a few key factors that are pushing small businesses towards adopting digital bookkeeping:Regulatory Drivers

The Rise of Fintech and Cloud Tools

Startup Adoption Is Already Widespread

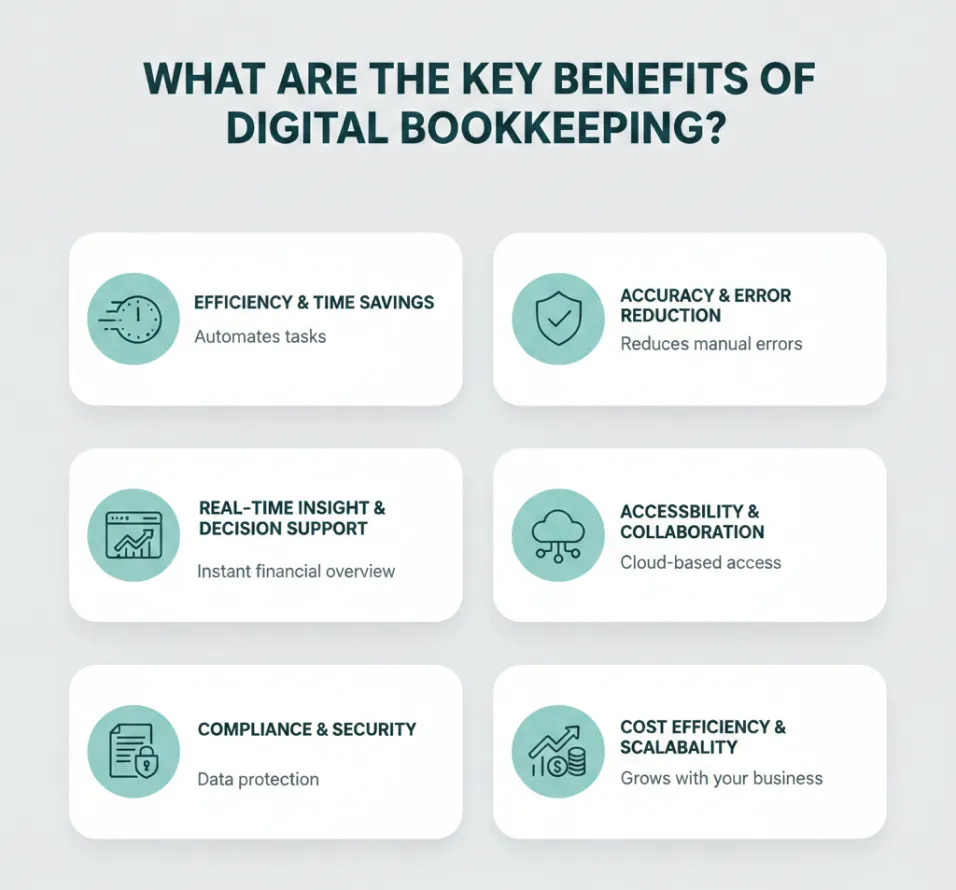

What are the Key Benefits of Digital Bookkeeping?

Here are the key benefits of digital bookkeeping that are transforming UK startups:Efficiency & Time Savings

Improving efficiency

Efficiency means that all your numbers are always up to date. You don’t have to go check your standing at the end of the month. You can view it whenever you want to and act accordingly. Then, whether you have to send a report to an investor or prepare for a tax deadline, you can do it with confidence. You also don’t have to email spreadsheets anymore. Everyone can log in to the same system and view the data whenever they want to. Digital bookkeeping thus makes you efficient enough in this regard so you can spend the rest of your time growing your business.Accuracy & Error Reduction

Real-Time Insight & Decision Support

AI tools for Smart Tips

Many platforms now use AI tools. These tools can give you useful tips about your transactions. For instance, they can tell you if you might run out of cash or if a customer hasn’t paid you on time. They can help you compare your savings to your last month’s. Startup founders can make quick and smart choices using this data. They can cut costs, begin hiring, freeze hiring or launch a product when they know what is in the bank.Accessibility & Collaboration

Compliance & Security

Cost Efficiency & Scalability

Bookkeeping Process Digitalisation: How It Works

Step-by-step Bookkeeping Process Digitalisation

Most of the process is discussed in the headings before, but here is a brief step-by-step summary just in case.Step 1: Automatic Bank Feed Imports

Choose the accounting software of your choice and connect it with your business bank account. Once connected, the software is automatically going to pull in every transaction or payment from your bank. It will appear on the records as soon as it happens. You are up-to-date every moment of your work time.Step 2: Receipt and Invoice Capture

You no longer have to secure every single receipt and then scan them one by one. Using OCR, you can take a picture of your receipt, and it will immediately read all the important information on it. It then stores everything neatly in your records. Documents can be uploaded straight from your device or by email as well.Step 3: Automated Matching and Approvals

Once the invoices and the transactions are both fed into the system, the software matches the two on its own. For instance, if you have a transaction of £200 and an invoice for the same amount, the software will link both of them. This marks the completion of the payment. If it finds a difference, it will flag it so that you can review. You can also set up a workflow of your choice. For instance, you can choose a cofounder to review all the payments.Step 4: Real-Time Dashboards

You have a real-time dashboard available with all important figures available with digital bookkeeping. You keep getting real-time updates of your business, like how much money are you left with or how much a client owes you. You will also know if you are making a profit or a loss. This gives you a chance to make immediate decisions.Step 5: Tax Filing and Compliance

When you are supposed to do taxes, this digitalisation helps you there as well. You can take reports from the software in the HMRC’s preferred format. It can incorporate the requirements of MTD. Either you can file the taxes directly, or you can export the data to your accountant. Overall, you are greatly supported in compliance through this.Tools & Platforms for Bookkeeping Process Digitalisation

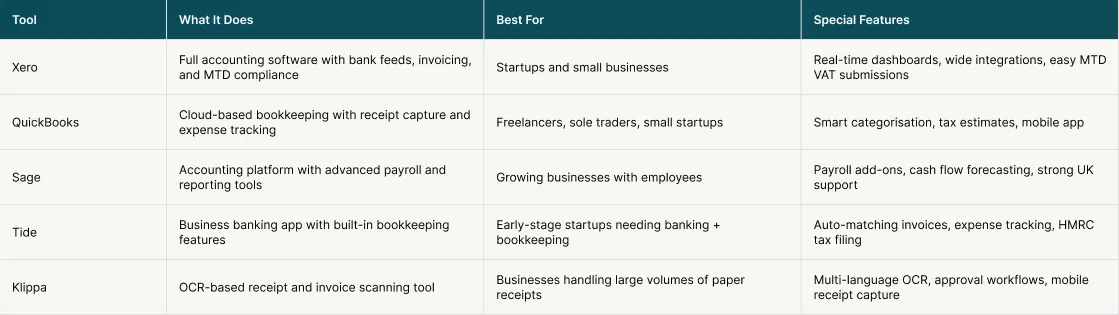

Digital bookkeeping can be managed by a variety of different tools. Some of them are used for basic bookkeeping while others contain advanced features. These advanced features include invoicing and payroll. Some even have mobile apps. Below is a breakdown of the popular software and platforms that can be used:

You can also pair these tools with each other. For instance, you can take a picture of your receipt from Klippa and send it to QuickBooks. This integration makes your work more efficient.

Measurable Impacts & Statistics of Digital Bookkeeping

Digital bookkeeping is about creating real change for small businesses in the UK. Firms that use digital tools for more than 75% of their operations are estimated to have a strong revenue growth of up to 63%. This is a comparison with businesses that have low-tech integration. In the accounting sector alone, 79% of increased revenue reports and 74% of cite improved profits are directly correlated to digital transformation. It is reported by some studies that if UK businesses could just get the value of one hour lost to paperwork and manual work per day, they could unlock £6.6 billion in economic value per annum. Accounting firms are thus investing heavily in technology, with an average of £30,000 per year for improvement.What are the Challenges of Digital Bookkeeping & How Startups Overcome Them

Challenges

There are two major challenges of digital bookkeeping. They are as follows:1. Lack of Digital Skills

This is one of the greatest challenges. Not all small business owners are comfortable using digital software because of this. Some accountants also feel that AI tools may not be that accurate. They think automation is bound to make mistakes and remove the human touch. Many professionals have raised concerns about the quality and fairness of digital bookkeeping systems.2. Resistance to Change

This is another major issue with adopting the new bookkeeping. Teams might be used to working a certain way, so they resist shifting to a new system. They are more used to working with spreadsheets and paper records. But this is not the only reason for resistance. Some people may worry about costs and setup time. Some people may worry about their data safety during the switch, too.

Implementation Best Practices

To make the process simpler and avoid challenges, small businesses can take the following five-step approach.- Understand your needs: You should evaluate your current process in detail. This will help you find any issues or any missing tools that are causing issues.

- Pick the right tool: Choose the software best suited to your needs. For this, assess your size, budget and type of yur business.

- Move your data: Transfer your data very, very carefully into the new system. Put backups in place to avoid any loss.

- Train your team: Make sure all of your team is well-acquainted with the software before transferring. There are videos and tutorials available for all software.

- Check your progress: Evaluate the situation after a few months. Examine accuracy, time savings, and how easy it is to stay on top of taxes or reporting.

Conclusion

Digital bookkeeping is an important transformation for small businesses. It helps them in every aspect, from saving time to making decisions. At Sterling Cooper Consultants, we help start-ups shift towards this type of bookkeeping as smoothly as possible. Our experts guide you through the entire process, no matter what stage your startup is at. We help you automate your systems and remain MTD compliant. We don’t just install a system for you. We explain your numbers to you so that you have a better cash flow and growth plan. To get help, contact us now.Ready to take control of your startup’s finances?

Sterling Cooper Consultants can help you switch to digital bookkeeping smoothly and securely. From choosing the right tools to staying compliant with HMRC, we make the process simple, fast, and stress-free. Book your free consultation today and let’s build a smarter financial future for your business.

FAQs

Digital bookkeeping uses software to track finances automatically. It replaces paper records and spreadsheets with tools that import bank data and match receipts, saving time and reducing errors.

Yes, if you're VAT-registered under HMRC’s Making Tax Digital rules. Even if not required yet, it helps you stay ready and organised as your business grows.

Xero, QuickBooks, and Sage are top choices. Some tools, like Tide, combine banking and bookkeeping. The best one depends on your needs and budget.

Yes. It cuts down on manual work, reduces costly mistakes, and helps avoid late tax penalties. It also gives better control over your finances.

You can get expert help. Sterling Cooper Consultants can set up the system, train your team, and make sure you're fully compliant.