Posted by:

Admin

Date:

January 8, 2026

Category:

blogs

Cash vs. Accrual Accounting: Which Method Is Right for You?

Has the choice between cash vs accrual accounting also been hard for you? You are not alone. Many sole traders face this dilemma at the beginning. Using the wrong method entangles you in tax and financial reporting that are totally avoidable. If you choose the wrong accounting method, it can trigger unexpected tax liabilities. Your cash flow visibility will be hindered and you will no longer be compliant with the HMRC rules. So, how to choose the right method between accrual accounting vs cash accounting? This blog breaks down the differences and why each one is used.

What Is Accrual Accounting vs Cash Accounting?

Before choosing between accrual accounting vs cash accounting, you need to understand what each method means and what their key features are. Here is a detailed insight into both methods.What is Accrual Accounting?

Accrual accounting means you record income when you earn it and expenses when they happen. It is not recorded when the money is actually received or paid. So even if a customer hasn’t paid you yet, you still count that income. The same goes for expenses; you note them when they happen, not when you pay the bill.Some of the key features of accrual accounting are:- Revenue Recognition Principle: You record money as soon as you make a sale, even if you get paid later.

- Matched Principle: You record your expenses at the same time as the income they helped to create.

- It includes things like unpaid bills, future income, prepaid costs, and money customers owe you.

What is Cash Basis Accounting?

Cash basis accounting is the opposite of accrual. With this method, you only record income when you actually get the money. Similarly, you record expenses only when you pay them. It’s simple and often used by small businesses or sole traders.Here are some of its key features:- You only record sales and costs when cash goes in or out of your account.

- You don’t track things like unpaid invoices, future payments, or bills you haven’t paid yet.

- It’s great for small businesses with simple income and spending, like freelancers.

Accrual vs Cash Accounting: Pros and Cons

Both accounting methods, accrual accounting vs cash accounting, have their benefits and downsides. Understanding the differences between accrual accounting vs cash accounting is thus important. It can help you stay on top of your finances. It can also help you follow UK tax rules. Here’s a clear look at the pros and cons of accrual accounting:Benefits of Accrual Accounting

Here are some of the benefits of this accounting method:Gives a Clearer Picture of Financial Health

Best for Businesses with Complex Operations

Needed to Meet Legal and Industry Requirements

Drawbacks of Accrual Accounting

Accrual accounting has certain drawbacks as well. Here is a brief overview.Involves More Complex Bookkeeping

Cash Flow Management Can Be Challenging

Benefits of Cash Basis Accounting

When comparing accrual accounting vs cash accounting, many small businesses choose the cash basis accounting method because of its simplicity. Here are some of the key advantages:Simple and Easy to Use

See Your Cash Position Clearly

Works Well for Seasonal and Side Businesses

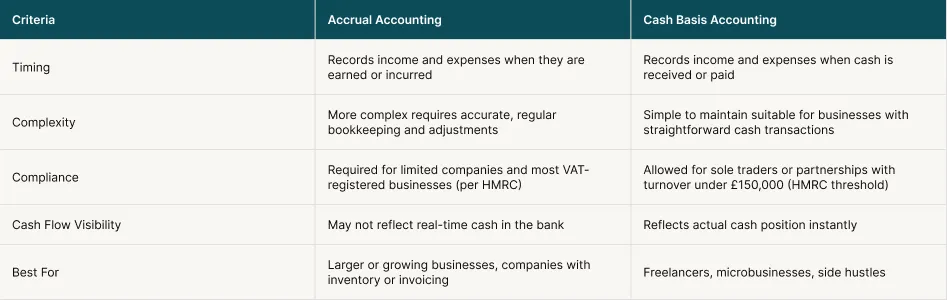

Comparison:

Here is a brief comparison between the two types of accounting.

Get expert accounting & bookkeeping services for compliance, accuracy & growth.

When Should You Use Each Method?

When Cash Accounting Works Best

Cash accounting is mostly preferred by businesses that don’t have to deal with deferred payments or carry stock. These businesses include contractors, freelancers and sole traders. This means that if you are a personal trainer, copywriter, self-employed electrician, etc., you may be receiving payments immediately. Cash accounting keeps everything straightforward for you. Secondly, if your business has a low volume of transactions and no formal credit terms, then cash accounting is very suitable for you as well. For instance, mobile car wash services or dog groomers who take money on the spot don’t need complex accrual reporting. Thirdly, if you are a startup and want to monitor your funds daily, cash accounting is very beneficial for you. It helps you stay lean. It further helps you avoid overextending and control operational spending.When Accrual Accounting Is the Right Choice

When your company’s activities include long-term service contracts or staggered payments, accrual accounting becomes crucial. For example, digital firms working on multi-phase client projects or eCommerce retailers with supplier agreements want accrual to precisely measure revenue against delivery milestones. Secondly, if you are planning to expand your business, your investors will most probably deal with accrual-based reports. The same is the case when securing a business loan and seeking funding. Thirdly, if you are a VAT-registered business or an incorporated company, accrual accounting is non-negotiable. You are bound by the law to use this method. Maintain accurate financial records with our expert bookkeeping services.Hybrid Approaches and Special Methods

While most businesses stick with one accounting method, some businesses might use a blended or specialised approach incorporating both. It is usually dependent on how the company is conducting its business. Mixed-income types, for instance, can call for a blended approach.Modified Cash/Accrual Basis

This is a non-standard or hybrid approach that is not recognised by the GAAP UK. In this method, businesses use cash accounting for income but accrual accounting for expenses or vice versa. This method is often internally used by small businesses. They use it for either budgeting purposes or using it for practising before transitioning to full accrual. Because it eliminates the complexities of accrual bookkeeping, it can be particularly helpful for tax planning. It would do this by allowing more accurate matching of expenses. However, you must be cautious. You are not allowed to officially use the hybrid way to file your taxes. You have to choose either of the methods depending on your legal situation.Percentage-of-Completion Method

This method refers to distributing revenue and associated costs proportionally based on work accomplished to date. This is done in place of reporting all income upon project completion. This method is very useful for long-term contracts. Particularly, the construction, engineering and large-scale consulting industry can use it. This is because the projects in these industries span over months and even years. This approach is recognised in the UK under the IFRS 15 (Revenue from Contracts with Customers). It is often used by businesses for preparing statutory accounts.Adjusting Entries & Year-End Accuracy

For organisations that use the accrual approach, modifying journal entries at the end of the fiscal year is critical. They must accurately reflect earned income and incurred expenses, regardless of cash flow. This ensures that you are compliant with the matching principle. It also helps you align your profit and loss statement with real financial activity. The following are the common adjusting entries in the UK accounting:- Accrued wages: wages received but not paid after the year

- Unearned revenue: deposits made for services that will be rendered later

- Prepaid rent or insurance: advance payments that only partially relate to the current fiscal year

Practical Tips for UK Businesses

Grasping how the cash and accrual accounting work is just the first step. To apply them, you need the right tools and support. Here are some practical tips for UK businesses to help them stay in control of their cash flow.Choosing the Right Bookkeeping Software

Migrating from Cash to Accrual

- Add unpaid invoices as accounts receivable

- Include unpaid bills as accounts payable

- Adjust for prepaid expenses or unearned income

Cash Flow Tools

Conclusion: Which Accounting Method Is Right for You?

Choosing accrual accounting vs cash accounting is a hard choice. You have to weigh the pros and cons. You also have to consider legal requirements under UK tax law. At Sterling Cooper Consultants, we help you assess which methods suit you the best. You can be starting, scaling out or just shifting from one accounting method. We offer you tailored advice to suit your needs. Our ongoing support keeps your records accurate and compliant. To get help, contact us now.Need help choosing or switching your accounting method?

Talk to our expert UK accounting advisors today.

FAQs

In accrual accounting, accounts payable and receivable are essential components. These accounts aid in keeping track of both supplier and customer debt.

Since the product or service has not yet been delivered by the company. Until it happens, the advance payment is not earned income but rather an obligation to the client.

While deferrals postpone the recognition of income or expenses until later (e.g., prepaid rent or unearned revenue), accruals entail income or expenses recognised prior to cash changing hands (e.g., unpaid wages).

In accrual accounting, depreciation spreads the cost of long-term assets over their useful life. It matches expenses with usage. On the other hand, cash accounting accounts for the entire cost at the time of purchase.

Yes, you can switch. Switching is mandatory when your returns go over £300000 or you become VAT-registered.

Recent Posts