Posted by:

Admin

Date:

January 28, 2026

Category:

Business Asset Disposal Relief: Key Changes Coming in 2025 and 2026

You might have heard about Entrepreneurs’ Relief, but do you know what business asset disposal relief is? To your surprise, it’s the same thing.

The latest changes to this policy have got the attention of business owners across the UK. Also the government continues to revise tax policy in response to economic pressures. In this lieu, many believe that business asset disposal relief 2025/26 will reshape the way investors leave businesses. Knowing these shifts is not just important for compliance. It is also needed for financial planning.

What is Business Asset Disposal Relief?

Formerly known as Entrepreneurs’ Relief, it is a UK tax relief scheme. It allows people to pay a reduced rate of Capital Gains Tax (CGT) when selling all or part of their business. The primary aim is to support startups by rewarding those who build and grow businesses.

In place of the standard CGT rate, qualifying disposals are taxed at a lower rate. In most cases, this can offer huge savings, mainly for those planning a business exit.

BADR applies to those selling:

- All or part of their business

- Shares in a personal company

- Assets used in the business

The current relief limit allows for up to £1 million of lifetime gains to be taxed at the reduced rate.

Who can Qualify for Business Asset Disposal Relief?

Not every business can get this relief. A criteria is set to be met for this. A person must:

- Be a sole trader, partner, or shareholder

- Have owned the business or shares for at least two years

- Hold at least 5% of shares and voting rights if disposing of company shares

- Be an officer or employee of the company

Some conditions still vary based on the type of disposal. For instance, selling company shares requires the business to be trading and not mainly involved in investments.

For example, there is a marketing consultant operating as a limited company for five years. They decide to retire and sell their shares would likely qualify for business asset disposal relief 2025. That too in case all conditions are met.

Get expert financial advisory services from Sterling Cooper Consultants.

Confirmed Changes to Business Asset Disposal Relief

More updates are officially set to take effect in 2025 and 2026. These changes will reduce the tax benefits offered by the scheme and make timing more crucial than ever.

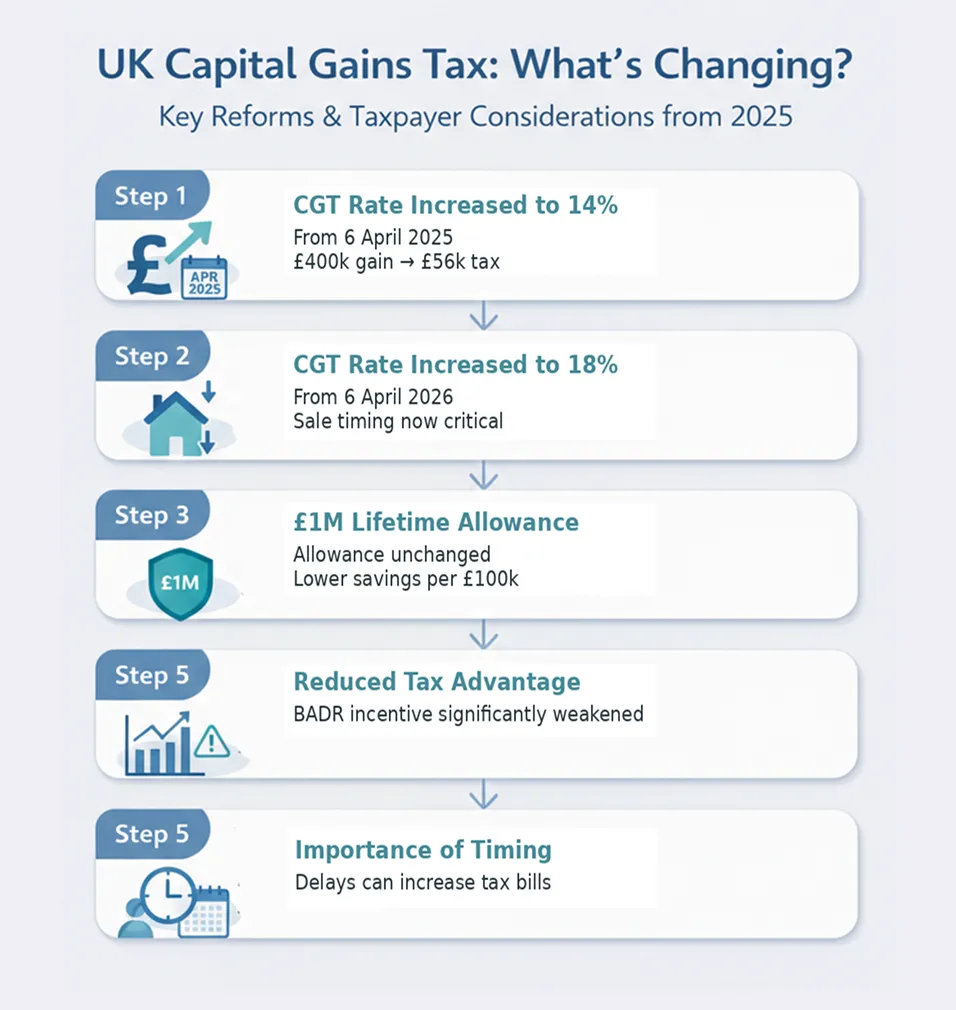

1. CGT Rate Increased to 14% From 6 April 2025

The business asset disposal relief 2025 update increased the CGT rate on qualifying gains from 10% to 14%. This represents a 40% rise in tax liability for sellers. For example, selling a business with a £400,000 gain resulted in a tax bill of £56,000 instead of £40,000 under the current rules.

2. Again, CGT Rate Increase to 18% From 6 April 2026

Another confirmed update is a second rise to 18% from April 2026. This continues the trend towards narrowing the gap between reduced and standard CGT rates. Business owners must have assessed if it is better to sell before April 2025 to benefit from the lower rate.

3. Lifetime Allowance at £1 Million

Even with an increase in the rate, the business asset disposal relief limit will remain at £1 million. But the value of this allowance is reduced as tax savings per £100,000 in gains decline. This could change the appeal of the scheme for those considering larger disposals.

4. Reduced Tax Advantage

As seen previously, BADR provided a strong incentive with CGT at just 10%. With upcoming increases to 14% and then 18%, the relative benefit diminishes. Those who relied on BADR to exit with minimal tax burdens must re-evaluate financial plans.

5. Increased Importance of Timing for Business Disposals

Given the rising rates, business owners planning to exit must think carefully about timing. Delaying until after April 2026 may result in a higher tax bill. Expert advice will be needed in evaluating when and how to proceed with disposals.

Get insights on 2025–26 Tax Year Updates.

Potential Changes to Business Asset Disposal Relief

As these changes are confirmed more drastic revisions or even abolition of the scheme is expected. It is the need of the hour to stay informed about the upcoming tax policies.

1. Possible Abolition of BADR

Some economists and political groups argue that the relief benefits high earners. As a result, complete removal of the scheme in future budgets is a possibility mainly in case economic pressures continue.

2. Reduction of £1 Million Lifetime Limit

The business asset disposal relief budget 2024 included discussions about possibly lowering the £1 million cap. A cut to £500,000 or lower would impact mid sized start ups the most.

3. Elimination of BADR Special Rate

The distinct CGT rate under BADR could be merged with the standard CGT system, mainly as rates rise. This would eliminate the special rate and remove incentives for qualifying sellers.

4. Anti Forestalling Rules

HMRC might tighten rules to prevent gaining tax advantage. This keeps the taxpayers from rushing disposals before rate hikes. It could include more scrutiny on transaction timing and intent. It’s mainly for sales close to the end of year.

5. Strict Eligibility Criteria

Policymakers may revisit the conditions which make business owners eligible. Possibly raising ownership length to 3 or 5 years. This would impact younger or part time business owners in a bad way.

6. Reduced Benefit With Related Reliefs

BADR is sometimes used alongside Investors’ Relief and other exemptions. Future changes may restrict combined usage, mainly where it leads to massive tax avoidance.

7. Other CGT Exemptions and Allowances

More broadly, the government may lower the CGT annual exempt amount, currently £3,000, to align with general tax tightening. This would increase effective tax across the board and not just for business disposal relief.

Boost growth with expert business advisory consultancy from Sterling Cooper Consultants.

Conclusion

How business exits will be taxed in future? Business asset disposal relief 2025/26 is going through major changes. Rising Capital Gains Tax Rates signals towards a shift. The benefits that once made this relief a cornerstone of exit strategy planning are shrinking, and timing now plays a critical role.

Our experts at Sterling Cooper Consultants, help clients assess financial positions. We also guide them to evaluate tax options, and develop exit strategies. This provides a long-term value.

We make sure that your disposal plan is on the same page with business asset disposal relief changes. That’s going to save you money and avoid mistakes. Do not wait until the new rules are made. Reach out to us today for expert advice while planning your business exit.

Need help navigating the 2025 and 2026 changes to Business Asset Disposal Relief?

Our experienced tax advisors are here to guide you through complex updates, ensuring you get the most from your business exit. Reach out to Sterling Cooper Consultants for personalised support and expert advice tailored to your unique situation.

Contact us now to schedule a strategy session.

FAQs

Entrepreneur Relief is the former name of business asset disposal relief. From April 2026, the CGT rate under this relief will increase to 18%.