Posted by:

Admin

Date:

February 9, 2026

Category:

What Are Annual Accounts? Everything You Need to Know

Did you know that in the UK, about 98.5% companies filed their annual accounts on time. That shows how important this job is for companies.

Annual accounts show a business’s finances for one year. They show profit or loss, plus what the business owns and what it owes. They also help calculate how much Corporation Tax is due. Limited companies must file annual accounts with Companies House and send accounts to HMRC as part of the Company Tax Return process. This is a legal duty.

What Are Annual Accounts?

At the end of your business’s financial year, you make annual accounts, which are a set of financial statements. Your bookkeeping records, such as invoices, bank transactions, payroll, and expenses, are what they are based on. Companies in the UK usually have to send their statutory accounts to Companies House and HMRC as part of the process of filing their Company Tax Return.

Think of your annual accounts as a ‘financial story’ for that year. They answer simple questions like:

- Whether the business made money or lost money.

- How much cash it had at key points.

- What it owned, like stocks or tools.

- What it owed, such as bills that weren’t paid or loans.

They also help you figure out how much Corporation Tax you owe. The UK Government official webpage on accounts and tax responsibilities for private limited companies lists annual accounts and the Company Tax Return as two important things that must be done at the end of the year.

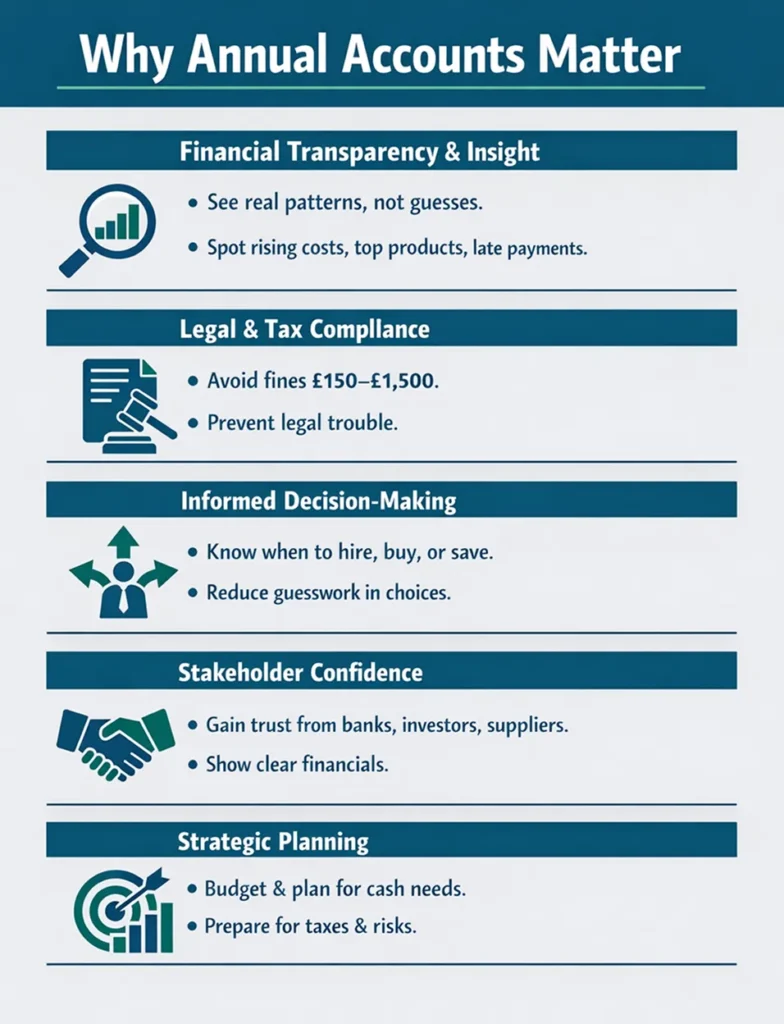

Why Do Annual Accounts Matter?

You don’t just file yearly accounts. They also give you an idea of how well your business is doing. The following points explain why they are important.

1. Financial Transparency and Insight

You can see the business clearly with good annual accounts. You can see patterns, not just guesses.

You might see, for instance:

- Costs went up faster than sales.

- One line of products makes more money.

- Customers are paying late, which is bad for cash flow.

You cannot judge profit just by checking the bank balance. A business can show a profit on paper even when cash is tight. That’s why accounts are important.

2. Legal and Tax Compliance

If you file your accounts late in the UK, you could be fined anywhere from £150 to £1,500, depending on how late you are. Not filing on time can lead to legal action. Directors or LLP designated members may face penalties in serious cases.

3. Informed Decision-Making

When your yearly accounts are correct, it is easier to make choices.

You can choose:

- If you can hire someone.

- If you can afford a new van.

- If you should raise prices.

- If you need to save money.

Without solid accounts, decisions are mostly guesswork.

4. Stakeholder Confidence

People depend on your numbers.

This could include:

- Lenders and banks.

- People who invest.

- Credit from suppliers.

- People who might want to buy the business.

They can trust what they see because of clear yearly financial accounts.

5. Strategic Planning

When planning is based on real data, it works best.

Strong annual accounts help you to:

- Make a budget that you can stick to.

- Make a guess about how much money you’ll need.

- Make plans for tax bills sooner.

- Find risks before they turn into problems.

What Are the Components of Annual Accounts?

There are a few important papers that make up annual accounts. Some are main financial statements, while others are annual accounts reports and accounts that back them up. Let’s make them easier to understand.

1. Core Financial Components

A few main statements make up most sets of annual accounts.

i. Income Statement

The income statement is often called the profit and loss account.

It shows:

- Sales (money made).

- Costs that come directly from things like materials.

- Costs that aren’t directly related to the business, like rent and software.

- The year’s profit or loss.

A simple thought can help here:

- What is left after costs is profit.

- When costs are higher than income, you lose money.

ii. Balance Sheet

The balance sheet shows what the company looked like on the last day of the financial year.

It includes:

- Assets are things that the company owns.

- Liabilities (what the company owes).

- Equity (the value left for owners).

The balance sheet in UK statutory accounts must have a director’s name on it and be signed by a director.

iii. Cash Flow Statement

A cash flow statement shows how money came in and went out.

It usually divides cash flow into:

- Day-to-day trading is an example of operating activities.

- Investing activities, like buying equipment.

- Activities that involve cash movement (loans, repayments).

This is worth noting: UK rules say that a lot of small and micro businesses don’t have to file as many forms. The size of your business and the reporting framework you use will determine the exact annual statements you need to include.

2. Other Key Components

Extra annual accounts reports may also be included in yearly accounts, depending on the size and type of the company.

i. Director’s Report

This is a brief annual accounts report from the directors about the year.

It could have:

- A review of business performance.

- Main risks.

- Plans for the future.

Companies House lets small businesses choose whether or not to send in the director’s annual accounts report and profit and loss account.

ii. Auditor’s Report

There is an auditor’s annual accounts report with your company’s audit if it needs one.

Many private limited companies do not need an audit, unless they meet audit rules or an audit is required by their governing documents or shareholders.

iii. Letter to Shareholders

Some businesses send a short letter to their shareholders. It’s more common in bigger companies or those that get money from investors.

It often explains results in simple terms, such as:

- What worked out well.

- What changed?

- What comes next?

iv. Management Discussion and Analysis (MD&A)

This is a more in-depth ‘plain-language’ explanation of the results.

It often includes:

- Why revenue changed.

- What caused the costs to change?

- What are the main risks?

- What management intends to do next?

Most small private companies do not include MD&A as a formal section, but a clear plain-language summary of results can still help.

v. Corporate Governance

Corporate governance is the system that tells a company what to do and how to do it.

In bigger companies, governance annual accounts reporting might include:

- The structure of the board.

- Rules and policies.

- Managing risk.

Smaller businesses may be able to keep this lighter, but good governance still helps cut down on mistakes and fraud.

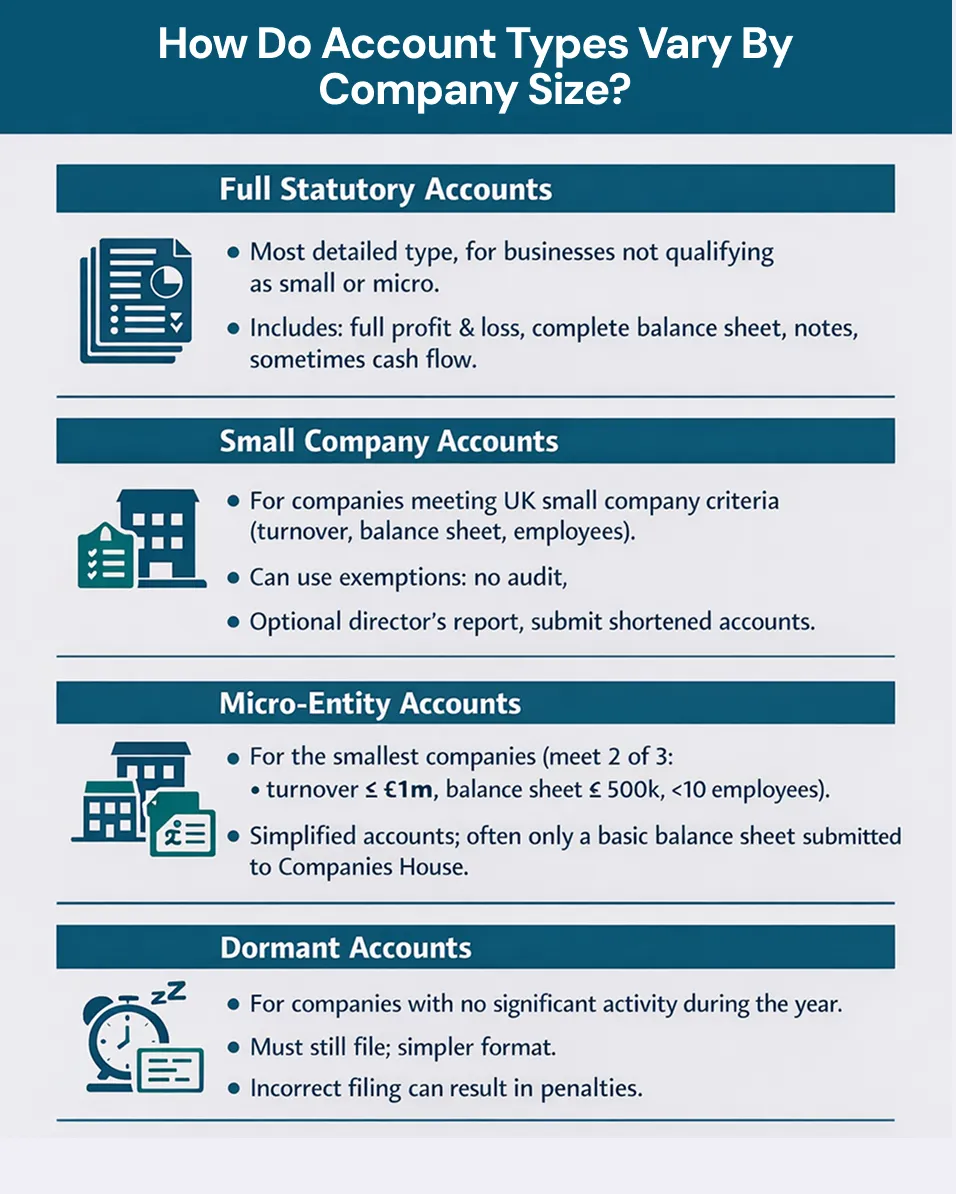

How Do Account Types Vary by Company Size?

Not all businesses file the same kinds of accounts. The rules in the UK let you use different formats depending on the size and type of activity. These are the most common types of accounts you will see.

1. Full Statutory Accounts

The most detailed version is the full statutory accounts.

They are usually needed when a business doesn’t qualify for small or micro rules or when it decides to file full accounts.

Full accounts usually have:

- Account of profit and loss with more information.

- A balance sheet with all the information.

- Notes that explain the rules of accounting and important numbers.

- It might be a cash flow statement, depending on the framework.

2. Small Company Accounts

A company that meets the UK small company criteria is treated as small for reporting. The test is based on turnover, balance sheet total, and employee numbers. Check the current thresholds before filing, as they can change.

You can do the following if your business is small:

- Use the exemption so that your company’s books don’t have to be checked.

- You can choose whether or not to send Companies House a copy of the director’s annual accounts report and the profit and loss account.

- Send Companies House your shortened accounts.

So, for many small companies, what the public sees on Companies House can be less detailed than what you prepare internally.

3. Micro-Entity Accounts

Micro-entities are even smaller than small businesses. UK Government official website says that a micro-entity must meet at least two of the following conditions:

- A turnover of less than £1 million.

- £500,000 or less on its balance sheet.

- Fewer than 10 people work there.

Micro-entities can make simpler accounts and may only send a simpler balance sheet to Companies House.

4. Dormant Accounts

A dormant company is one that doesn’t do any ‘significant’ business during the financial year. Dormant companies still have filing duties. Many people send Companies House dormant company accounts, which are easier to read. It’s better to ask an accountant if you’re not sure. Filing incorrectly can still lead to penalties.

Who Must Prepare and Receive Annual Accounts?

Not just accountants need yearly accounts. A lot of people and businesses depend on them to make decisions, check things, and follow the rules. These are the main groups that are involved.

1. Anyone with a Business Entity

This depends on the type of business.

- Most of the time, limited companies have to make and file statutory accounts.

- Sole traders don’t have to send their company accounts to Companies House, but they still have to keep records and annual accounts report to HMRC in other ways.

So, ‘business entity’ is important. The rules don’t work for everyone.

2. Directors

It is the job of directors to make sure that yearly accounts are made and filed on time. Directors are still legally responsible for the work, even if an accountant does it.

3. Chief Executive and One Director

In smaller businesses, the CEO and a board member are often the same person. The CEO of a large company may not be on the finance team, but they still use accounts to make decisions.

4. Chief Financial Officer (CFO)

A finance manager or CFO often:

- Reviews performance results.

- Checks for risks.

- Helps with forecasting.

- Works with accountants to get ready for the end of the year.

5. Shareholders

Shareholders get statutory accounts. According to the UK Government official website, you have to send copies of your statutory accounts to all of your shareholders.

6. Regulators

Companies House is the main place where UK businesses register and send in their accounts. As part of filing taxes, HMRC gets accounts.

7. Stock Exchanges

If a company is listed, it has to follow more rules about annual accounts reporting. This is mostly about filing for UK companies in general, but listed companies usually have more rules and shorter deadlines.

8. Other Stakeholders

Other people who have a stake can be:

- Lenders.

- Vendors.

- Possible investors.

- People who might buy.

- Agencies that check credit.

A lot of financial information before trusting a business.

If you are improving your finance skills, you may like this guide on how to become a bookkeeper. It helps you understand the basics that sit behind annual accounts.

When to File Annual Accounts?

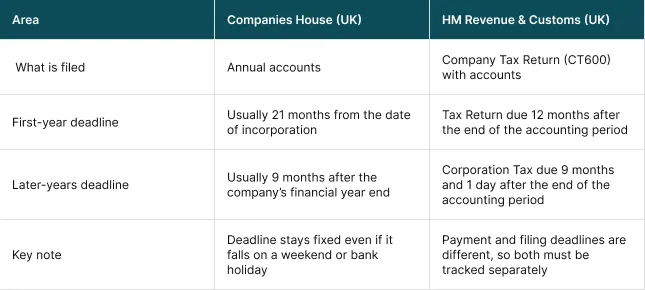

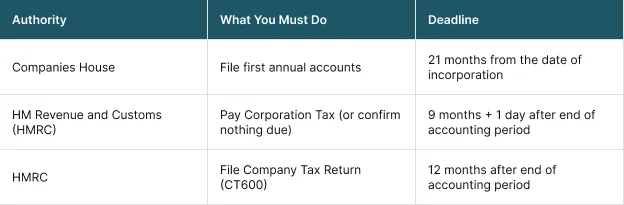

Deadlines can be confusing because Companies House and HMRC use different timelines. The key is to track them separately.

1. First-Year Accounts

In some cases, your first year has different rules and longer timeframes. You still have to keep track of two different deadlines. This is how it works for each body.

i. Companies House (UK)

UK Government official website says this about a private limited company:

- You have 21 months from the date you registered with Companies House to file your first accounts.

It’s also helpful to know your accounting reference date (ARD). The annual accounts filing guide from Companies House tells you how to figure out the filing deadline from the ARD and how new companies get their ARD. On its first accounts guidance page, the UK Government official website also gives clear examples of how first accounts cover an unusual first period.

ii. HMRC (UK)

There are two important deadlines for HMRC:

- Pay Corporation Tax (or tell HMRC you owe none): usually 9 months and 1 day after the end of your accounting period.

- File the Company Tax Return: 12 months after the end of the accounting period to file the Company Tax Return.

People get confused because of this. The deadlines for Companies House and HMRC are not the same.

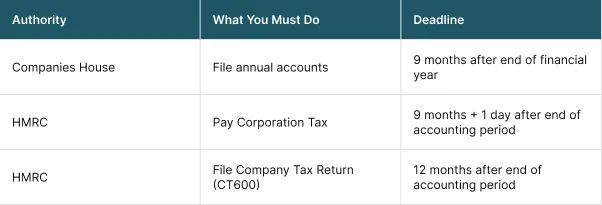

2. Subsequent Accounts

After the first year, the deadlines happen more often. But you still have to meet the deadlines set by both Companies House and HMRC. Here are the usual timelines.

i. Companies House (UK)

A private company usually files 9 months after the end of your company’s financial year, which is after the first year.

Also, if your deadline is on a Sunday or a bank holiday, you still have to file by that date. The Companies House accounts guidance makes this very clear.

ii. HMRC (UK)

The deadlines for HMRC stay the same:

- Corporation Tax Payment: 9 months and 1 day after the end of the accounting period.

- Company Tax Return: One year after the end of the accounting period.

How to File Annual Accounts?

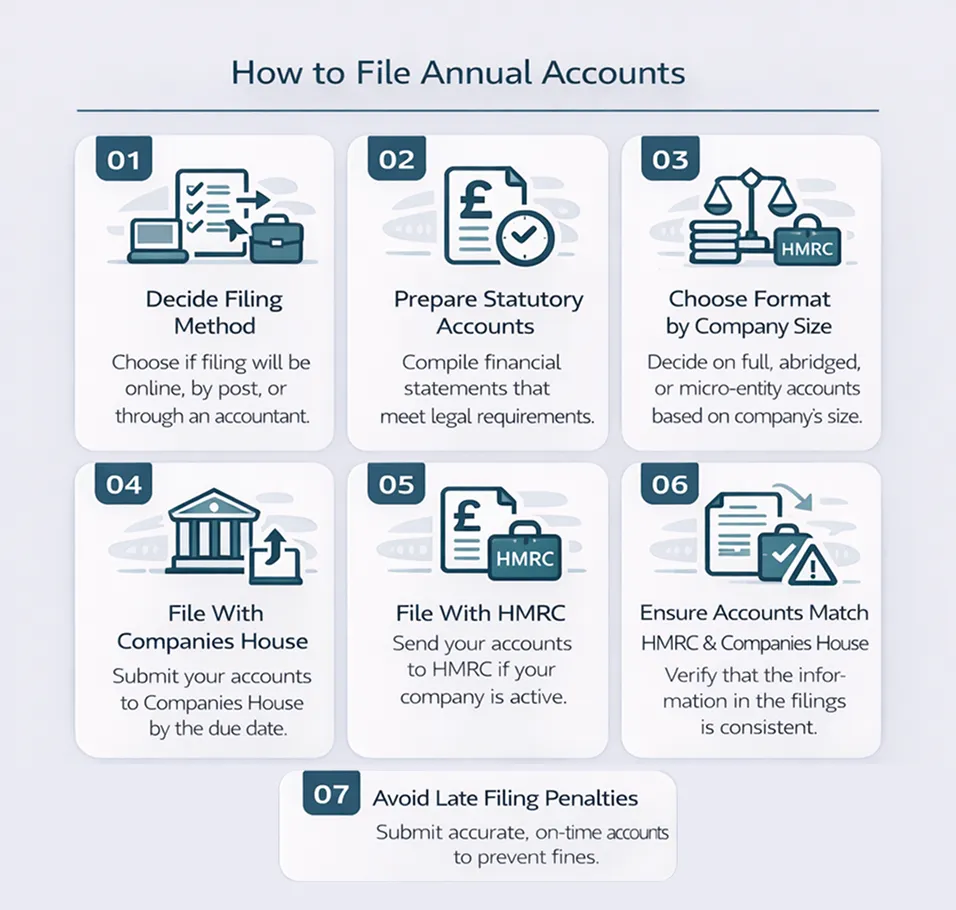

Filing may seem hard, but if you follow the steps in the right order, it’s not too hard. The process usually starts with making sure the records are clean and ends with sending them to the right places. Here is the easy-to-follow flow.

1. Decide Filing Method

There are a few ways you can file:

- You can file directly with Companies House using software or the internet.

- As part of the Company Tax Return process, send this to HMRC.

- Use the joint filing service to file your accounts and tax return at the same time.

The best way depends on how your business is set up and what tools your accountant has.

2. Prepare Statutory Accounts

You need to get the accounts ready before you file.

That means:

- Balance your bank accounts.

- Make sure that all sales and expenses are in order.

- Check your payroll and VAT if you are registered.

- Check on debtors and creditors.

- Make note of year end accounts changes, such as depreciation.

This is the part where a lot of small businesses need professional help.

3. Choose Format by Company Size

Use the right size for your format:

- All accounts.

- Accounts for small businesses.

- Accounts for micro-entities.

- Accounts that are not active.

4. File With Companies House

Companies House keeps track of when it gets acceptable accounts. You don’t get more time if you file close to the deadline and your accounts are turned down. The Companies House accounts guide on the UK Government official website makes this very clear.

5. File With HMRC

When you file with HMRC, how you format it is important. According to HMRC, most companies’ accounts that are part of an online Company Tax Return must be in iXBRL format, but there are some exceptions. If you use the government’s joint filing service, it says that the service will change your accounts to the right iXBRL format.

6. Ensure Accounts Match HMRC and Companies House

Try to keep one ‘source of truth’ clean.

Some common reasons for mismatches are:

- Used the wrong year-end dates by accident.

- Changes made late after one filing.

- Different ways of depreciating are used.

- Missing changes to the director’s loan.

- Matching your numbers lowers risk and saves time later.

7. Avoid Late Filing Penalties

Late filing fees can add up fast. Companies House charges private companies:

- £150 for being less than a month late.

- £375 for being late more than a month but less than three months.

- Late by more than three months but less than six months: £750.

- £1,500 if you’re more than six months late.

If you file late in two consecutive financial years, the fees double in all cases.

What Are the Benefits of Proper Annual Accounts?

Keeping proper accounts does more than keep you legal. They can help you run your business better and lower your risk. The benefits below are divided into two groups: business benefits and compliance benefits.

1. Business And Financial Benefits

These benefits are about making the business work better every day. They concentrate on planning, doing things well, and making better choices. Let’s look at each one.

i. Informed Decision-Making

Clean annual accounts help the companies show:

- What is profitable.

- Where costs are high.

- Where cash gets stuck.

ii. Budgeting And Planning

It’s easier to make a budget once you know the real numbers from last year.

You can make plans:

- Spending each month.

- Getting hired.

- Tax savings.

- Goals for growth.

iii. Improved Financial Performance

You can make things better by measuring them.

You could, for instance:

- Stop wasting things.

- Talk to your suppliers again about prices.

- If your margins are too low, raise your prices.

iv. Increased Access To Funding

Banks and lenders often want to see recent accounts.

Strong yearly accounts can help:

- Applications for loans.

- Overdrafts go up.

- Talks with investors.

v. Enhanced Operational Efficiency

Accounts show where money and time are being wasted. For instance, if the cost of running the business keeps going up, you might want to automate invoicing or collect debts faster.

vi. Fraud Detection And Prevention

Fraud often hides in messy records. Regular checks and reconciliations make it less likely that mistakes or fraud will go unnoticed.

2. Legal And Compliance Benefits

These benefits help you follow the rules. They also make doing taxes and annual accounts reporting less stressful. Here are the main benefits.

i. Regulatory Compliance

Filing correctly is important for following Companies House rules and staying in good standing. You could be charged with a crime if you don’t file.

ii. Simplified Tax Preparation

Filing taxes is easier when your books are clean. You don’t have to worry about missing receipts, panicking at the last minute, or rushing to get numbers.

iii. Proof Of Active Status

Filing on time shows that your business is still open and following the rules.

That can be important when:

- Putting in bids for contracts.

- Getting money.

- Trusting your suppliers.

iv. Legal Evidence

Your annual accounts can show what the business did and when. This can help with business sales, due diligence, and disagreements.

Conclusion

Annual accounts are more than just paperwork. They show how much money your business makes each year. They help you file your taxes, make sure you follow the rules, and run your business clearly. Knowing what goes into them makes the whole thing less stressful. You can also find problems sooner, make better plans, and talk to lenders, investors, and partners with confidence. The easiest way to make the process feel easy is to keep it simple. Keep good records all year, then get ready and file on time.

Worried your annual accounts might be late or incorrect?

That is exactly where we can help. Sterling Cooper Consultants can support you with tidy bookkeeping, accurate year-end reporting, and smooth filing. Explore our accounting and bookkeeping services for ongoing support.

Ready to get started? Contact us and we will talk you through the next steps.

FAQs

Recent Posts

New HMRC Interest Rates Explained

Common Errors on VAT Returns and How to Avoid Them?