Posted by:

Admin

Date:

February 2, 2026

Category:

A Complete Guide to the 0T Tax Code

Being on the 0T tax code can mean more tax is taken from your pay than expected. Even a short period on 0T can cost you hundreds of pounds. Many people only notice when their take-home pay drops, which can feel confusing and frustrating.

The tax code 0T means you won’t get any pay that isn’t taxed. So, all your income is taxed from the first pound. There are a few reasons why this might happen. It could happen when you get a new job. If you have more than one job, it can also happen. This could also happen if you make a lot of money.

The good news is that this usually doesn’t last long. You can easily check it by following these steps. If it’s wrong, you can also fix it. You might get your money back if you paid too much in taxes.

What is a 0T Tax Code?

A 0T tax code means you have to pay taxes on your pay. This could be for a job or a pension. This code is usually only temporary. It might be used by HM Revenue and Customs (HMRC). HMRC may use it until your details are updated. It helps collect the right tax.

Why Do You Get a 0T Tax Code?

In some cases, HMRC uses the tax code 0T. It can happen when you start a new job, have multiple sources of income, make a lot of money, or don’t have all the information you need. If you know why it happens, you can plan for it and avoid surprises.

1. Starting A New Job Without A P45

Start a new job without a P45 from your former work and you may obtain the 0T tax code. P45s reveal what you’ve paid in taxes. Your employer may request a Starter Checklist if you don’t have one. Your employer will use 0T tax code until HMRC updates your code. Every pound earned is taxed immediately.

2. Multiple Sources Of Income

In multi-job or pension situations, only your principal income gets the tax-free allowance. Many second jobs and pensions use 0T tax code. To ensure accurate total tax across all incomes, HMRC does this. You may pay too little tax on your combined earnings without this.

3. High Income

Your Personal Allowance starts to go down if you make more than £125,140 a year. If your income is higher than this, the allowance will eventually go down to zero. The 0T tax code is right when this happens. This makes sure that people who make a lot of money pay taxes on all of it, with no exceptions.

4. Missing Or Delayed Information

HMRC sometimes uses 0T tax code because they don’t have enough information. This could be because the forms were late, missing, or the information about your job or pension isn’t clear. The 0T tax code is only a temporary fix until the right code is found.

5. Administrative Errors

A tax code 0T can also happen because of mistakes. When HMRC and employers talk to each other, enter data, or process it, mistakes can happen. If your code suddenly changes to 0T, get in touch with HMRC. If necessary, they can look at your record and change your tax code.

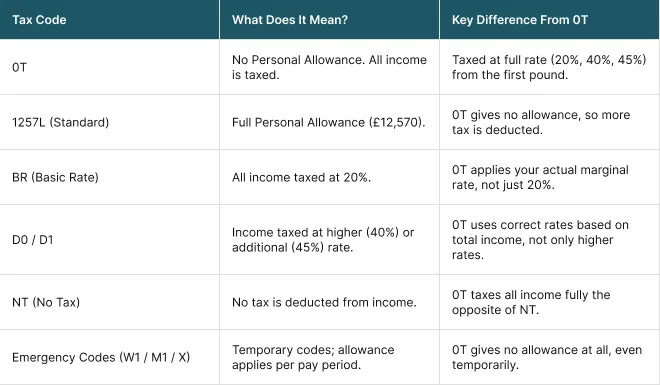

How 0T Tax Differs From Other Tax Codes?

The 0T tax code is not like most other tax codes in the UK. You don’t get a tax-free Personal Allowance with 0T tax code. This means that you have to pay taxes on every pound you make. Other codes usually give some allowance or use flat rates. They lower taxes at the beginning or treat all income the same. The tax code 0T is very strict: you pay taxes on your income according to the full tax rate. If you know the difference, you can read your payslip and avoid surprises.

Comparison Table

Here’s a quick comparison:

If you want to learn about BR tax code read our blog What Is Tax Code BR and How Does It Impact Your Pay?

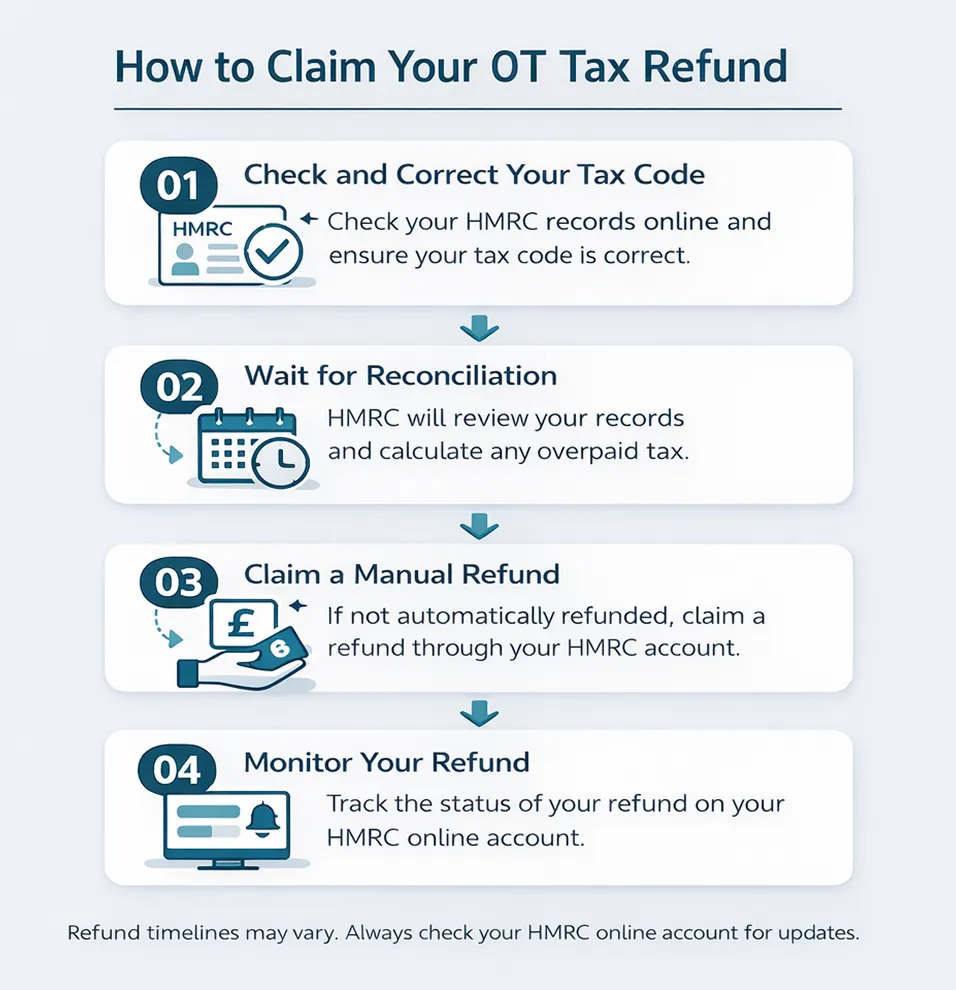

How to Claim Your 0T Tax Refund?

If you have a 0T tax code, you don’t get a tax-free Personal Allowance. From the first pound you make, you have to pay taxes on it. This can lead to overpayment. You can get your money back by following these steps:

1. Check and Correct Your Tax Code

First, check your tax code on your payslips or by going to the GOV.UK Personal Tax Account. The HMRC app displays tax payments and code. If unsure, call HMRC’s Income Tax helpline at 0300 200 3300. Prepare your P45 (or Starter Checklist), National Insurance number, and pay stubs. Update your information and HMRC will use the right code.

2. Wait for Reconciliation

After the tax year ends on April 5, HMRC (a tax code checker) usually checks for overpayments. If you paid too much in taxes, they might send you a P800 tax calculation letter that shows how much you can get back. If your information is on file, refunds may sometimes be sent automatically through direct bank transfer.

3. Claim a Manual Refund (If Needed)

You can ask for a manual refund if you need your money back sooner or haven’t gotten a P800 yet:

- P50 Form: If you stopped working during the year and didn’t claim taxable benefits, use P50 form. This makes it possible to make a claim during the year.

- Online Claim: Use your National Insurance number and P800 reference to quickly send money to your bank by following the P800 letter’s instructions.

- Cheque: HMRC may send a cheque, but after 31 May 2024, most refunds must be claimed online or requested.

- Written Claim: You can also write to HMRC and give them your personal information, work history, and the reason you overpaid.

4. Monitor Your Refund

Your next payslip should show the right tax code and any refund once your 0T tax code has been updated. If not, you can claim it through your Personal Tax Account or the HMRC app.

When Is the 0T Code Correct?

If you don’t get any tax-free Personal Allowance in the UK, the 0T tax code is right. There are a few situations where 0T is the right code.

1. Personal Allowance Is Used Up

One reason 0T is right is because your personal allowance has already been spent. This can happen if:

- You have another employment that uses up all of your allowance.

- You get a private pension where the allowance is applied first.

- Your overall income is substantial, more than £125,140 in the tax year 2024/25. In this instance, your Personal Allowance slowly goes down to zero.

0T makes sure you pay the proper amount of tax in these cases.

2. Have A New Or Second Job

0T is also correct when you get a new job or a second job. This frequently happens if:

- You didn’t provide your new employer your old P45.

- You didn’t finish the Starter Checklist.

HMRC can’t issue a full tax code without these forms. Using 0T for a while makes sure that taxes are collected correctly until HMRC updates the code.

3. HMRC Lacks Sufficient Information

Sometimes 0T is used because HMRC doesn’t have enough information about your income. This can happen if:

- You just got a new job.

- You get a termination payout even though you already have a P45.

- Your tax data are not completely up to date.

In these situations, 0T is a holding code until HMRC gets all the information.

What Should You Do If You’re on the 0T Tax Code?

If you see 0T on your pay cheque, act right away. This code says you won’t get a tax-free allowance. So you might be paying more taxes than you should. Look at your tax code and make sure your information is up to date. This helps make sure that you get the right amount of money. If you paid too much you might get your money back.

1. Gather Your Documents

Get the relevant papers together before you call HMRC or your employer:

- Your National Insurance (NI) number

- Recent pay stubs that demonstrate how much money you made

- P45 from your last job or a filled-out Starter Checklist (P46)

Getting them ready speeds up and smooths out the process.

2. Check Your Tax Code Online

You can log in to your HMRC Personal Tax Account or use the HMRC app. Look at the tax code that HMRC has on file for you. Check to see if it says 0T and if it fits your job position.

3. Update Your Details

If you just started a new job and didn’t give your P45 to your employer, act right away. Fill out a Starter Checklist if you don’t have P45. Make sure that HMRC has the correct information about all of your jobs and pensions if you have more than one. This makes sure that the right code is used for each source of income.

4. Contact HMRC by Phone

Call HMRC if changing your information doesn’t fix the problem. Call the Income Tax hotline at 0300 200 3300. Get your NI number, PAYE reference, and income information ready. Staff can help you fix your code and let your boss know.

5. Submit a Starter Checklist

The Starter Checklist (P46) has all the information that HMRC needs to give your employer the right tax code. If you don’t have your P45, always send it in.

6. Receive Your Refund

The revised code should be on your next payslip after HMRC updates it. Most of the time, you will instantly get back any extra taxes you paid. If it is after the tax year, HMRC may give you a P800 tax calculation that tells you how to get your refund.

Conclusion

In short, tax code 0T can seem scary. The code is usually temporary. It is used by HMRC for safety. It can happen when you get a new job. Having two jobs can set it off. It might also happen if you get paid more.

Quickly check your 0T tax code. Use your HMRC Personal Tax Account. The HMRC app can also help. If you need to, fill out the Starter Checklist. You can get back money if you paid too much tax. You might see refunds on your payslips. Or come after the checks at the end of the year.

When work changes, update your information. This helps you avoid making mistakes on your taxes. If it looks wrong, call HMRC. Quick action stops surprises on payday.