Posted by:

Admin

Date:

February 10, 2026

Category:

How Capital Gains Tax Is Changing in April 2026?

On 30 October 2024, the Budget introduced major CGT updates. Autumn 2025 brought further rule changes and relief updates. Since then, future CGT direction has remained a key focus for taxpayers and advisers.

While April 2026 does not introduce an entirely new CGT regime, it locks in and normalises several major reforms introduced earlier. Most notably during the capital gains tax changes 2025 period. The main expected capital gains tax changes in the UK are a scheduled increase in the rate for Business Asset Disposal Relief (BADR) and the full alignment of carried interest taxation with income tax.

These changes alter how much tax individuals pay and who now falls within the CGT net.

In this guide, we will explore all that and more. Understanding these tax changes is crucial for anyone looking to manage their tax liabilities.

Key Takeaways:

- Reduced allowance: £3,000 exemption means more taxpayers are affected.

- Property impact: Buy-to-let and second home gains are particularly affected.

- Planning is key: Timing, reliefs and allowable losses can save thousands.

- Higher rates: 18% and 24% apply to many chargeable gains and these rates continue into April 2026.

- Even if gains seem small, good records can prevent surprise tax bills after April 2026.

What Changes From 6 April 2026

- BADR rate increases from 14% to 18% for qualifying disposals.

- Carried interest is taxed using income tax rules rather than CGT rules.

- Most other CGT rates and the £3,000 allowance stay the same.

What Is Capital Gains Tax?

Capital Gains Tax is charged on the gain made when an asset increases in value and is disposed of. Assets can include:

- Most personal possessions, excluding the main vehicle. Valued at a minimum of £6,000.

- Property excluding your main home. Your main home is liable if it’s used as a business or let out.

- Shares that are not in ISA or PEP.

- Cryptoassets like Ethereum and Bitcoin.

- Business assets.

A disposal can include:

- Sell an asset for cash.

- Exchange for another asset.

- Gift it to someone other than your spouse.

- Transfer it to a trust.

Private Residence Relief allows your private residence to be exempt from CGT. Exceptions include if the residence is being used as a business or being rented out.

Capital Gains Tax Changes Leading Up to April 2026

Capital gains tax changes in the UK have been on Labour’s agenda for some time now. The biggest reasons for these changes are:

- To promote economic parity between working class and wealthy individuals.

- Tax Equity.

- Increased Revenue.

- Limit tax planning opportunities.

This rationale has led to sharp changes in capital gains tax rates. These include:

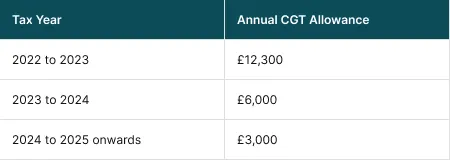

1. Reduced Annual Allowance

The annual CGT allowance has been reduced sharply.

This amount is to remain unchanged at £3,000. This brings more people into the CGT net.

2. Main Rate Changes

The main rates for some assets were raised from 10% to 18% for basic rate taxpayers and from 20% to 24% for higher rate taxpayers. These rates remain the same going into April 2026.

Higher rates: 18% and 24% apply to many chargeable gains and these rates continue into April 2026.

For many disposals, the main CGT rates moved to 18% for basic rate taxpayers and 24% for higher rate taxpayers and these rates continue into April 2026.

3. Other Changes

The rate for Business Asset Disposal Relief (BADR) and Investors’ Relief (IR) increased from 10% to 14% from 6 April 2025.

The CGT rate on carried interest rose to a flat rate of 32% from 6 April 2025.

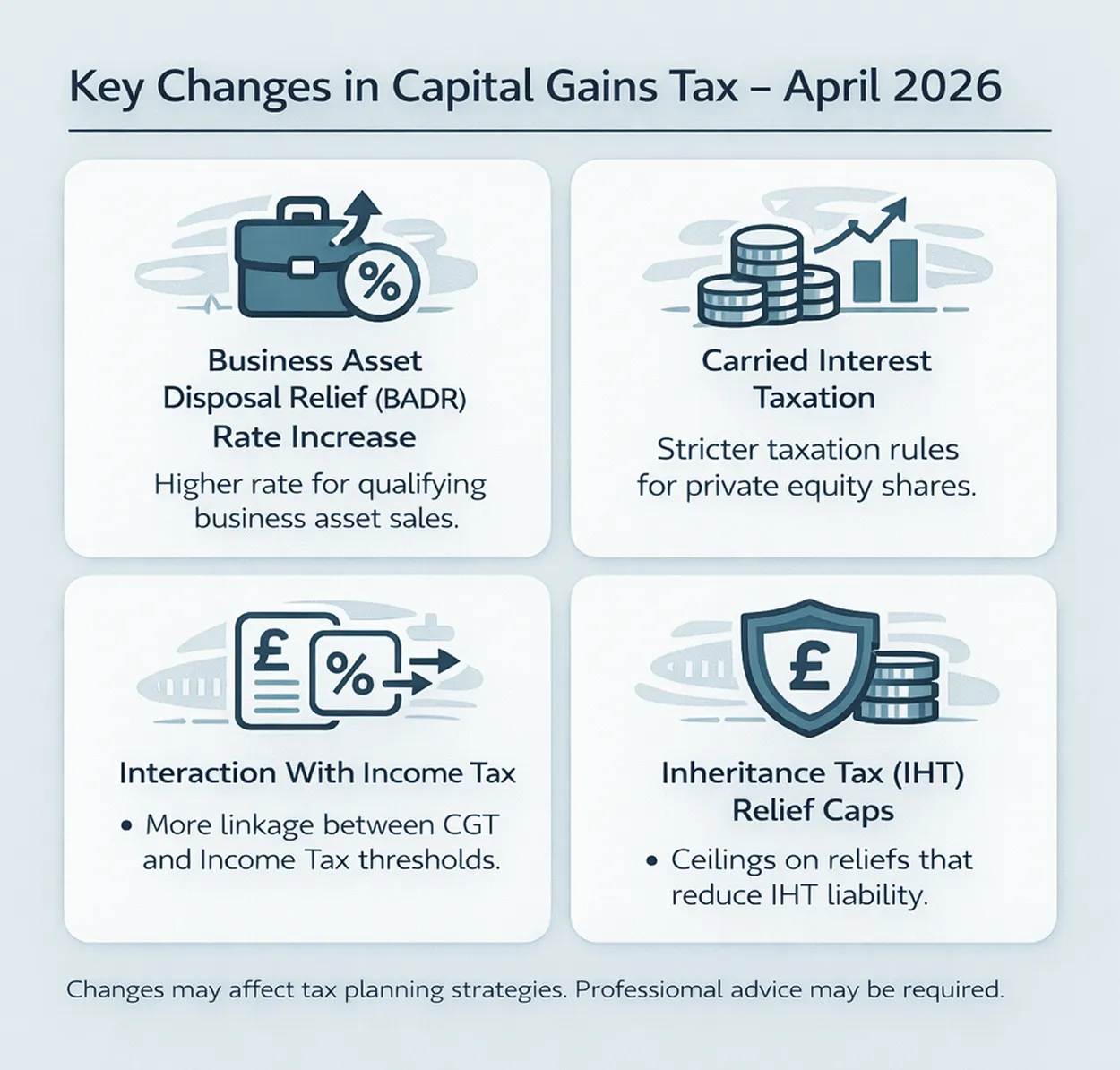

Key Changes in Capital Gains Tax in April 2026

There are several key changes expected as of April 2026. This is part of the CGT reforms aimed at generating revenue and creating tax equity. The 2024 changes raised the main CGT rates, while the 2025 changes aimed at lowering the CGT exempt allowances. The April 2026 changes will primarily affect Business Asset Disposal Relief (BADR) and carried interests.

To get more taxation forecasts, check out our guide on 2026 tax updates.

Here are some key capital gains tax changes in April 2026

1. Business Asset Disposal Relief (BADR) Rate Increase

Business asset disposal relief is a reduction relief offered under conditions to businesses that qualify. This relief results in lower tax than CGT on the disposal of assets. Previously, the lifetime limit for BADR was set at £1 million. This will remain the same. The CGT rate on disposals qualifying for BADR will increase from 14% to 18%.

BADR Rate Timeline

- On or before 5 April 2025: 10% on qualifying disposals.

- From 6 April 2025 to 5 April 2026: 14% on qualifying disposals.

- From 6 April 2026: BADR rate is 18% on qualifying disposals.

This means that selling a qualifying business or investment after 6 April 2026 will usually attract more CGT than before.

Review your exit timing carefully. Selling before April 2026 may result in a lower tax rate (14%) compared to later (18%).

2. Carried Interest Taxation

One of the biggest capital gains tax changes is that from April 2026 carried interest will no longer be considered as capital gains. From 6 April 2026, carried interest is taxed using income tax rules rather than CGT rules. The final tax outcome depends on the individual’s income position and how the return is treated under the carried interest rules.

This is a major shift for fund managers and partners who previously gained from CGT treatment.

3. Interaction With Income Tax

CGT is calculated alongside your taxable income. Your position in the income tax bands determines which portion of your gain is taxed at the basic or higher rate.

Example:

- Salary: £45,000

- Capital gain: £15,000

- Allowance: £3,000

- Taxable gain: £12,000

The gain is split between basic and higher rate bands, creating a blended CGT liability.

4. Inheritance Tax (IHT) Relief Caps

This is an IHT update that may matter for business and farm planning, but it is separate from CGT rates. Business Property Relief (BPR) and Agricultural Property Relief (APR) will be restructured. Here are the changes.

- The 100% relief cap is fixed at £2.5 million per individual.

- The value of qualifying assets above the £2.5 million allowance will still be eligible for a 50% relief, resulting in an effective IHT charge of 20% on the excess amount.

- Any unused portion of the allowance is passable to the surviving spouse. This means a couple can potentially pass on up to £5 million in qualifying assets free of IHT.

Capital Gains Tax Changes Impact on Property Owners

CGT changes have shaken up the property world. The impact on property owners is most observable.

1. Lower Allowances

Lower allowances mean that property owners now have to pay more taxes. With the limit being reduced to £3,000, landlords selling property often face CGT bills far higher than they would have paid just a few years ago.

2. 60 Day Reporting Rule

You must report and pay CGT on residential property sales within 60 days of completion. This rule remains unchanged in April 2026, but penalties for late reporting are strictly enforced.

3. No Relief Expansion

Despite calls for reform, no new reliefs for landlords are planned. This confirms the government’s direction under ongoing capital gains tax changes in UK policy.

Capital Gains Tax Changes for Shares and Crypto

Investors in shares and cryptocurrency are also impacted.

1. Smaller Gains Now Taxed

Previously, many small investors stayed under the CGT allowance. With the allowance reduced to £3,000, even modest profits may now be taxable.

2. Crypto Remains Fully Taxable

HMRC treats cryptocurrency as an asset, not currency. All disposals, including swaps and gifting (excluding spouses), may trigger CGT.

The capital gains tax changes 2025 significantly increased reporting requirements for crypto investors and these rules remain in force for April 2026.

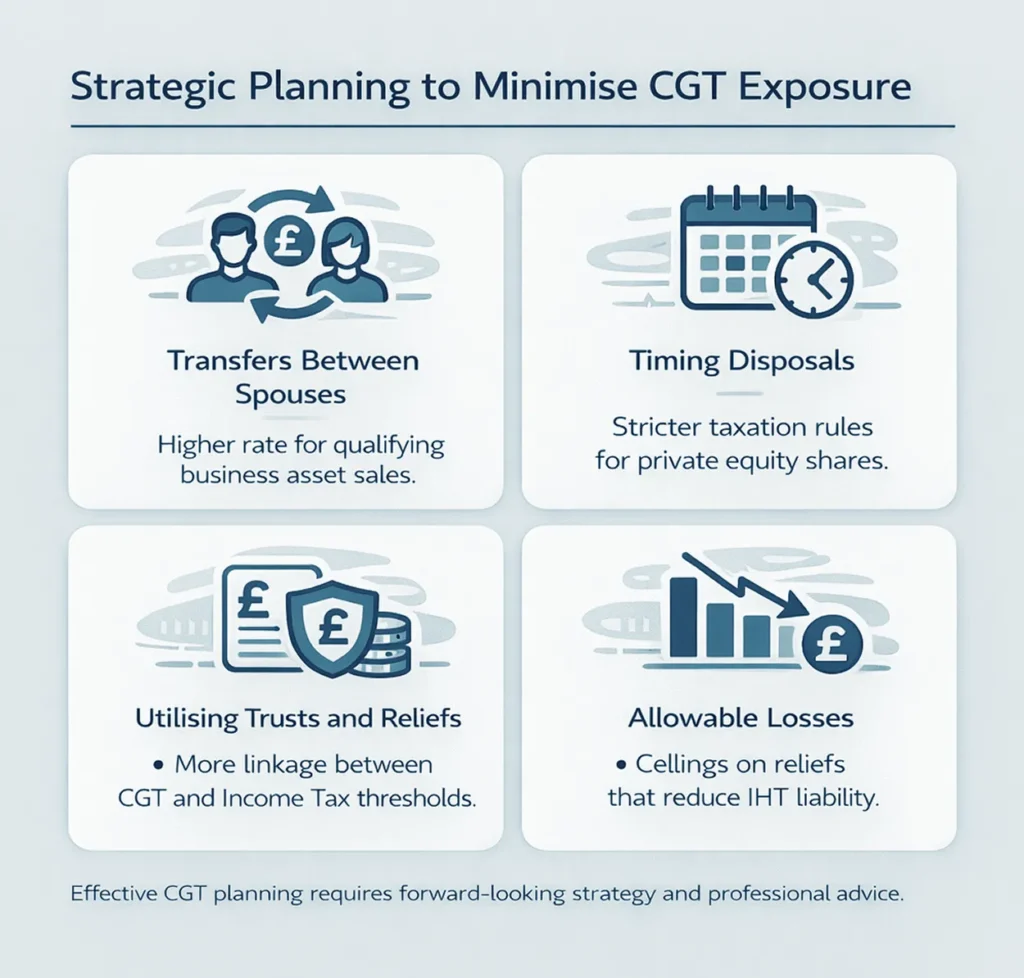

Strategic Planning to Minimise CGT Exposure

With the ongoing changes being part of long term reforms, it is crucial to plan ahead. Strategic planning can help mitigate CGT impact and allow financial adjustments.

1. Transfers Between Spouses

Spouses and civil partners can transfer assets tax free:

- Allows both CGT allowances to be used

- Gains may fall into lower-rate bands

2. Timing Disposals

Selling assets gradually over multiple tax years:

- Maximises allowances

- Reduces the portion taxed at higher rates

3. Utilising Trusts and Reliefs

Careful use of trusts or BADR can further reduce tax liabilities, although professional advice is essential due to complex rules and anti-forestalling provisions.

4. Allowable Losses

Losses are now an integral part of planning CGT mitigation. Due to reduced allowances and higher rates, capital losses can be used in a number of ways to minimise the impact of CGT. These include,

- Offset gains against losses in the same tax year.

- Carry losses forward.

- Utilise exclusions such as losses involving spouses, connected persons or non chargeable assets.

To get more tax saving strategies, check out our blog on tax saving tips.

Will CGT Increase Further After 2026?

Although rates and allowances are fixed as of April 2026, CGT is under ongoing review:

- The Office of Tax Simplification has recommended further alignment with income tax rates.

- Potential changes could affect reliefs, lifetime limits and reporting requirements.

Investors and property owners should stay informed, as future capital gains tax budget changes may further alter the landscape.

Conclusion

Capital gains tax changes in the UK have been significant in recent years. April 2026 marks the consolidation of the capital gains tax changes taking place in recent years. While there are no changes to the main CGT rates or allowances, the cumulative effect of recent changes has been solidified into a broader capital gains tax net with tighter anti-avoidance rules.

Smart planning is key in this changing landscape. At Sterling Cooper Consultants, we are all about smart planning and strategic thinking. Whether it is selling property, shares, crypto or business assets, staying informed and planning ahead is the only way forward. Contact us now to get strategic financial and taxation planning.

Unsure how the Capital Gains Tax changes affect you?

FAQs

For most assets:

- 18% for gains within the basic rate band.

- 24% for gains above the basic rate band.

For BADR and Investors’ Relief qualifying disposals:

- 18% flat rate, subject to lifetime limits and qualifying conditions.

Yes. The timing of a disposal can determine:

- Which CGT rate applies.

- Whether BADR or Investors’ Relief is available.

No. You generally do not pay CGT on:

- Your main home (subject to Private Residence Relief).

- Assets sold at a loss.

- Gains within the £3,000 annual allowance.

However, most other asset disposals may now trigger CGT due to the reduced allowance.

Recent Posts

How Do You Register a Business the Right Way?

New HMRC Interest Rates Explained