Posted by:

Admin

Date:

February 4, 2026

Category:

New HMRC Interest Rates Explained

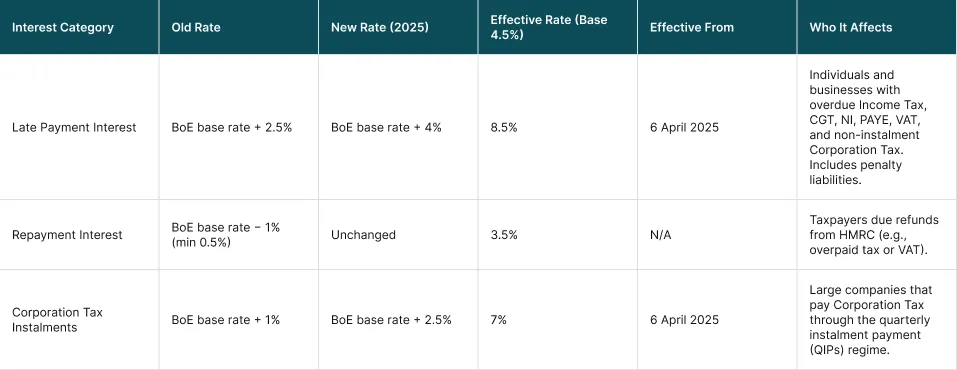

HMRC has announced changes to interest rates for tax payments this April, i.e., April 2025. These significant changes to the interest rate regime have tightened the financial consequences of late tax payments. Previously, the late payment interest rate was calculated by the Bank of England (BoE) at a base rate plus 2.5%. Now it has been increased to base rate plus 4%. Due to this, the effective interest rate to 8.5% when the BoE base is 4.5%. This is among the highest rates in more than ten years. It marks a more aggressive stance of the HMRC on compliance. HMRC interest rate changes are going to impact businesses as well as individuals significantly. This blog contains everything that you need to know about it.

What Are HMRC Interest Rates and Why Do They Change?

HMRC charges interest on unpaid and or overdue taxes. The purpose of these interest rates is to encourage you to pay taxes on time. They also make things fair for everyone who does. Here are the three main types of interest rates that you need to know about:

1. Late-Payment Interest

If you don’t pay your tax bill on time, this is the extra cost you have to pay. This interest is charged by the HMRC from the day after your payment was due. It continues until the day it’s paid in full. Late payment interest discourages late payments. It also covers the extra time HMRC had to wait for your payment.

2. Repayment Interest

This is what HMRC pays you when they owe you money. For instance, you paid much more tax than you were supposed to, or you were due a refund you didn’t get. This interest is usually less than late-payment interest. It is supposed to be fair, but it stops people from using HMRC as a savings account.

3. Corporation Tax Instalment Interest

Corporation Tax is often paid by large companies in advance in the form of instalments. If HMRC does not get these instalments on time, they charge interest. This is just like the main late-payment rate. The rate, however, is slightly lower than that, though it still adds up.

How Are These Rates Set?

The base rate of the Bank of England (BoE) is the basis for all HMRC interest rates. This is the primary interest rate in the UK, and it fluctuates according to the state of the overall economy. HMRC uses the following fixed formulae:

- Late-payment interest = BoE base rate + 4% (as of April 2025)

- Repayment interest = BoE base rate – 1% (with a minimum of 0.5%)

- Corporation Tax instalment interest = BoE base rate + 2.5%

As the BoE rates change, HMRC updates itself as well. It is done within a few weeks.

Why Do HMRC Interest Rates Change?

The change in interest rates serves a few purposes; it is not done randomly. They are meant to discourage late payments. Since they make it more expensive to delay, taxpayers are more likely to pay on time. Secondly, the interest helps preserve the value of the money. This is done by keeping the amount owed to HMRC from depreciating due to inflation. The system is also built to promote fairness and discipline. It makes sure that people who are paying on time do not get penalised, while those who delay their payments get penalties.

HMRC Interest Rate Changes Effective from 6 April 2025

HMRC made significant adjustments to its interest charging and payment procedures in April 2025. Here is everything you need to know about these changes.

1. Late Payment Interest Rate

The formula used to calculate the late payment interest rate has been adjusted. It is the Bank of England base rate plus 4%. So what does this mean? Well, in simple words, now small delays can be costly for you. The late payment rate, for instance, increased to 8.5% while the base rate was 4.5%. The interest rate on late payments was adjusted to 8.25% in May 2025, following a minor decline in the base rate to 4.25%. These changes are applied to the following taxes:

- Income Tax

- Capital Gains Tax

- National Insurance

- PAYE

- VAT

- Corporation Tax (non-instalment)

- Outstanding penalties

Interest on late payments is calculated daily. It keeps accumulating until the debt is paid off, putting further strain on finances every day.

2. Repayment Interest Rate

There has been no change in the rate that HMRC pays when it owes you money, such as for overpaid tax. It remains tied to the base rate but calculated as the BoE rate minus 1%, with a minimum of 0.5%. This means taxpayers are receiving 3.5% interest when the base rate is 4.5%. When it drops to 4.25%, you will get 3.25%. Depending on which party owes money, there is a growing disparity in how interest is handled. This is evidenced by the unchanged repayment rate and the higher rate applied to late payments.

3. Corporation Tax Instalment Interest

For larger companies paying Corporation Tax in quarterly instalments, the interest charged on late payments has risen from base rate plus 1% to base rate plus 2.5%. At a base rate of 4.5%, this means a 7% interest rate on missed instalments. This applies to businesses with taxable profits typically over £1.5 million. This is because these businesses are required to follow the quarterly instalment regime. Any delay in scheduled payments now carries a noticeably heavier cost.

How Much Could HMRC Interest Rate Changes Actually Cost You?

Currently, even a small payment delay might result in observable additional expenses. Let’s examine a simple example to give you a general notion. The interest payable at an annual rate of 8.5% on a £10,000 tax debt would be approximately £210 if the payment were made 90 days after the due date. This continues for three months, and it is only for one bill. As delays become longer or amounts become larger, the amount increases. The average interest rate for late payments was closer to 6.75% last year. Accordingly, interest on the same £10,000 that was 90 days past due would have been roughly £165. Here are rounded estimates using simple interest. Actual amounts may vary, subject to compounding, exact timing, and HMRC calculations.

| Amount Owed | Delay | Interest Rate (2024) | Interest Cost (2024) | Interest Rate (2025) | Interest Cost (2025) |

|---|---|---|---|---|---|

| £10,000 | 90 days | 6.75% (est.) | ~£165 | 8.5% | ~£210 |

| £25,000 | 90 days | 6.75% (est.) | ~£412 | 8.5% | ~£525 |

| £10,000 | 180 days | 6.75% (est.) | ~£330 | 8.5% | ~£420 |

| £50,000 | 30 days | 6.75% (est.) | ~£281 | 8.5% | ~£354 |

Why did HMRC Interest Rate Changes happen?

The Autumn Budget 2024 officially announced the 1.5 percentage point increase. It is a component of a larger strategy to boost public budgets and enhance tax compliance. Here are four major reasons behind this decision:

- To stop people from delaying payments: The HMRC interest rate changes deter people from taking up short-term borrowing from HMRC.

- To get cash in the door faster: HMRC interest rate changes push more taxpayers to pay on time, which helps HMRC improve its day-to-day cash flow.

- To tackle the tax gap: For the 2023–2024 period, HMRC is attempting to bridge a reported £32 billion discrepancy. This gap is between the tax it should be collecting and what is actually paid.

- To match rising government costs: In order to maintain financial equilibrium, the government expects to charge more when others owe it. This is because it pays more to borrow money.

Impact of HMRC Interest Rate Changes on Individuals

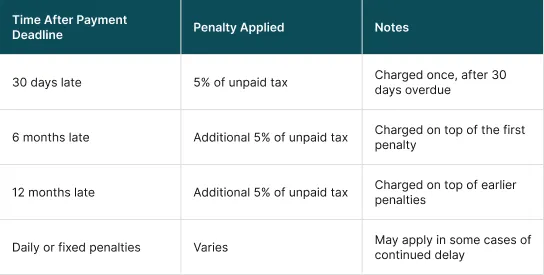

If you pay income tax or file Self Assessment, you will be affected by HMRC interest rate changes. You will pay 8.25% to 8.5% interest to the HMRC, depending on the Bank of England base rate, if you miss your tax payment deadline. This implies that it gets more costly the longer you put it off. Interests are not the only extra cost that HMRC takes. They have penalties for late payments as well, which are as follows:

You have to pay these penalties on top of the interest. All these amounts added up can cost a lot more than you expect.

Impact of HMRC Interest Rate Changes on Businesses

The recent rise in HMRC interest rates can seriously affect businesses. Paying Corporation Tax by instalments is specifically impacted by it. Interest is now assessed at a rate of 7% for late payments. It quickly mounts up and raises overall expenses. It can put extra pressure on cash flow for small and medium enterprises (SMEs). Since they are already dealing with higher borrowing costs and tighter margins, they may feel the impact more. Businesses can face extra penalties and charges apart from Corporation Tax when they fall behind. Here are the ones that they will have to pay additional costs for:

- PAYE (Pay As You Earn) for employee wages

- VAT (Value Added Tax)

- National Insurance contributions

Most business owners fail to account for these taxes. They do not have a clear picture of how fast interest and penalties pile up. This can cause the penalties and interest amounts to go far beyond their expectations.

HMRC’s Tougher Crackdown on Late Payers

Lately, HMRC has been more proactive in collecting unpaid taxes. The HMRC interest rate changes are a small part of this larger shift. 500 new staff members were added to their debt recovery team in April 2025. By April 2026, a further 600 staff members are expected to join the team. This additional staff will be dedicated to locating and collecting tax debts owed by both individuals and corporations. HMRC has also been using tools. One of their most powerful ones is called Direct Recovery of Debt (DRD). This tool allows them to take money directly from your account. They use it for covering your unpaid taxes, and they don’t even need a court order for this. With increased enforcement, DRD is becoming more popular and can be utilised for both personal and business tax debts. HMRC is also making better use of banking and credit data, giving it a clearer picture of a taxpayer’s finances. This helps them act more quickly when they suspect that someone is not paying what they owe.

Do HMRC Interest Rate Changes Still Apply if You can’t Pay?

Yes, you still have to pay interest with HMRC interest rate changes, even if you can’t pay your tax bill. Generally, when you can’t pay your bill, HMRC offers you a solution. It is called a Time to Pay (TTP) arrangement. Instead of paying the full amount at once, you can pay over several months in 6-12 months, through this plan. Interest will still be charged at the full rate from you. This will help you avoid penalties and legal action. Your total cost will still go up over time. To qualify for Time to Pay, you must do a few things:

- Prioritise filing all of your tax returns because HMRC won’t accept anything if any of your documentation is missing.

- Make early contact with HMRC, preferably before the payment deadline.

- Even if you are unable to pay everything at once, demonstrate that you can afford the monthly instalments.

This method may allow you some breathing room, but it will only be effective if you act promptly and maintain communication with HMRC. Usually, ignoring the issue results in increased expenses and more stringent enforcement.

Summary Table of New HMRC Interest Rates (2025)

Here is a quick summary of the HMRC interest rate changes:

Final Thoughts

HMRC is now tightening its grip on compliance with HMRC interest rate changes and stricter enforcement. You can no longer take compliance as an afterthought. Interest costs are now seen by both individuals and corporations as a significant and increasing financial burden. At Sterling Cooper Consultants, we help you stay ahead of all of this. We set up smart tax alerts and forecast cash flow impacts. We always ensure that you make timely tax submissions. We offer you support in navigating all kinds of taxes, from Self Assessment to planning Corporation Tax instalments. We help you avoid unnecessary costs and stay in full control. To get help, contact us now.

Ready to avoid costly HMRC surprises?

FAQs

Recent Posts

A Complete Guide to the 0T Tax Code

How Labour Could Reshape Capital Gains Tax in the UK?