Posted by:

Admin

Date:

December 16, 2025

Category:

blogs

What is the difference between bookkeeping and accounting?

When you think of who manages the finances of the business, you may think either bookkeepers or accountants can do the job. However, they both perform different roles, even though they both need financial information to work with. Bookkeepers simply record all the transactions. It is more of an administrative role. Accounting, on the other hand, is more analytical. Accountants analyse the information that bookkeepers provide and maintain businesses’ financial health based on that. Here is everything you need to know about the differences between bookkeeping and accounting.

Bookkeeping and Accounting: Required Credentials

One of the key differences between bookkeeper and accountant is their education. The following are the credentials required to get each of these jobs.The Educational Record of a Bookkeeper

To be a bookkeeper, you don’t need a formal degree. Just a high school diploma is enough. Many bookkeepers learn on the job, take short courses, or get certified by training programs (but it’s not mandatory). To do the job well, the bookkeepers need to:- Be very accurate since even small mistakes cause a huge impact in finance.

- Know basic financial topics like tracking income and expenses and managing invoices

The Educational Credentials of an Accountant

To be an accountant, you need a bachelor’s degree in accounting. If you do not have that, then you must have one in finance. You can advance yourself with qualifications such as a Certified Public Accountant (CPA). It can increase your knowledge of the subject.It will also lead to better opportunities for you. Here is how you can get it.- Have a bachelor’s degree, preferably in accounting.

- Gain real-world work experience as an accountant.

- Pass the CPA Exam.

Certifications:

Bookkeeping and accounting, both skills, can be enhanced by certifications. If you want to be a bookkeeper, you can look into certificates by the Association of Accounting Technicians (AAT). Their certification has levels depending on whether you are a beginner or want a boost in your career.You can also get certification by the AAT if you are an accountant. This certificate also has levels based on how advanced you are in your career. Other certifications that you can get as an accountant are Chartered Accountant (CA) or Certified Management Accountant (CMA).Get in-depth financial reports for better decision-making.Bookkeeping and Accounting: Salaries and Benefits

Salary is another difference between bookkeeper and accountant. Both accounting and bookkeeping offer decent salaries, but accountants usually make more, especially over time. Here is how much they earn.Salary of a bookkeeper

Bookkeepers earn a salary of £18,000 to £35,000 annually while working 37 to 39 hours a week. Their benefits depend more on the employer and the job they’re in, and are often less comprehensive than what accountants receive at big firms.Salary of an accountant

An accountant’s salary ranges from £23,500 to £148,000 a year, depending on the city, role, and company. Those just starting out are usually on the lower end of that range.Bookkeeping and accounting Software

In the past, bookkeeping and accounting were done mostly by people. They used paper or spreadsheets to do this. Now, accounting software can do much of that work on its own. This has made things easier and faster. These tools offer the following benefits in bookkeeping and accounting.Bookkeeping tools

Record and organise daily transactions like sales, expenses, and payroll.Accounting tools

Create reports, analyse trends, and prepare for taxes or financial decisions.Examples:

QuickBooks and Bench are two such software programs that can be useful to accountants and bookkeepers.Quickbooks:

QuickBooks gives you a software platform and lets you choose how much help you want from live experts. It has both bookkeeping and accounting options.Bookkeeping Options

1. Live Assisted Bookkeeping- You do the bookkeeping yourself using their software.

- You get help from a live bookkeeper when you have questions or need guidance.

- QuickBooks pairs you with a dedicated bookkeeper who does the bookkeeping for you.

- They handle everything through the software, you just connect your business accounts.

Accounting Options

The software can pull reports (like income statements or cash flow reports). It helps you analyse your financial data. If you upgrade to QuickBooks Online Advanced, you get more features, like:- Deeper insights

- Custom reports

- Business performance tracking

Bench

Bench focuses on full-service bookkeeping, combining live human support with a user-friendly software platform.Bookkeeping Options

Experts bookkeepers do all of it for you. You get a login to their software where you can:- Check your financial data anytime

- See how much money is coming in or going out

- Ask questions

- Get clarity on your numbers

- Understand your business’s financial health

Role of Accounting Vs Bookkeeping

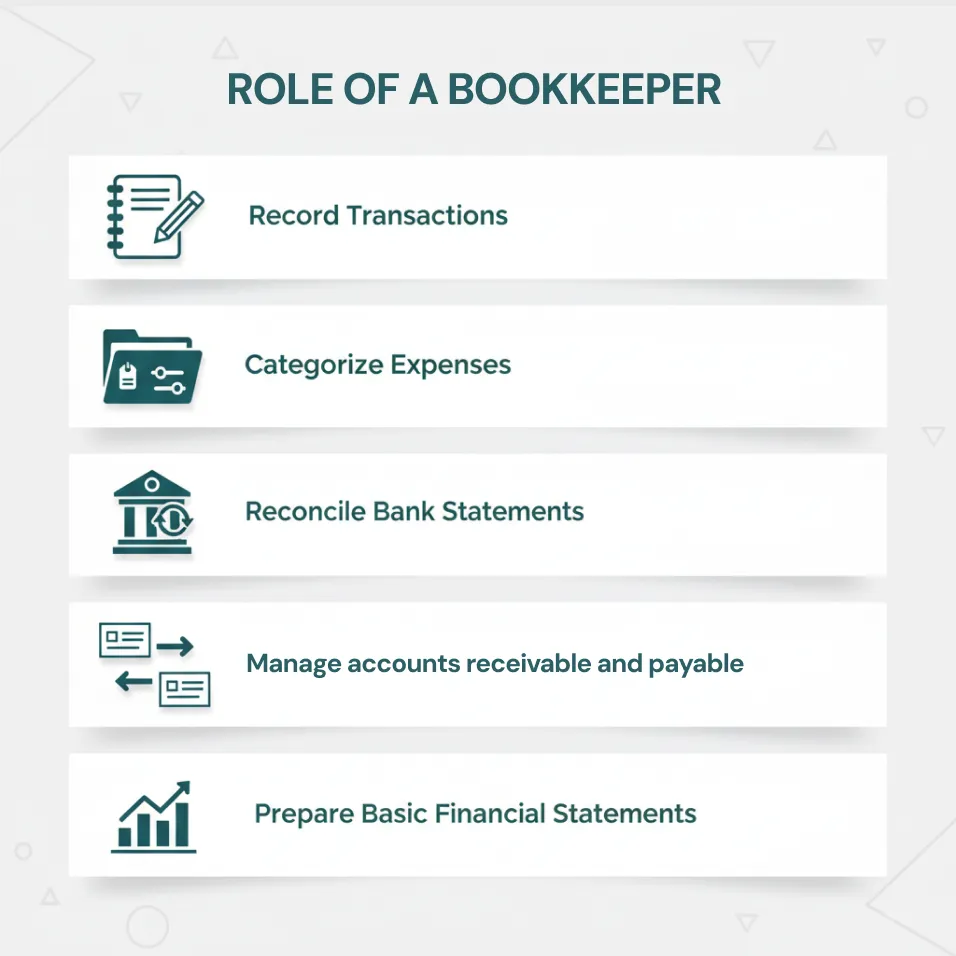

Bookkeeping and accounting both are valuable when judging the finances of your business, even though they play a different role each. You might wonder what does a bookkeeper do vs an accountant. Here are the roles they play and how it is different between bookkeeper and accountant.Role of a bookkeeper

A bookkeeper plays a key role in recording all the information that is required in running a successful business. They are the financial record keepers, and their job helps you get a picture of the running costs of your business. Their role is described in detail in the following points:1. Record transactions

They write down every financial move you make in your business. This includes sales, expenses, invoices, payments, payrolls, etc..2. Categorize expenses

They check the expenses on which the capital is being spent and then categorise them accordingly. For example, putting “rent” under “overhead” or “office supplies” under “administrative expenses.”3. Reconcile bank statements

They make sure that the business records and the bank records match each other. This is beneficial while paying taxes and corresponding with the HMRC.4. Manage accounts receivable and payable

They keep track of who owes money to your business and to whom you owe money.5. Prepare basic financial statements

They prepare initial versions of financial statements and balance sheets.

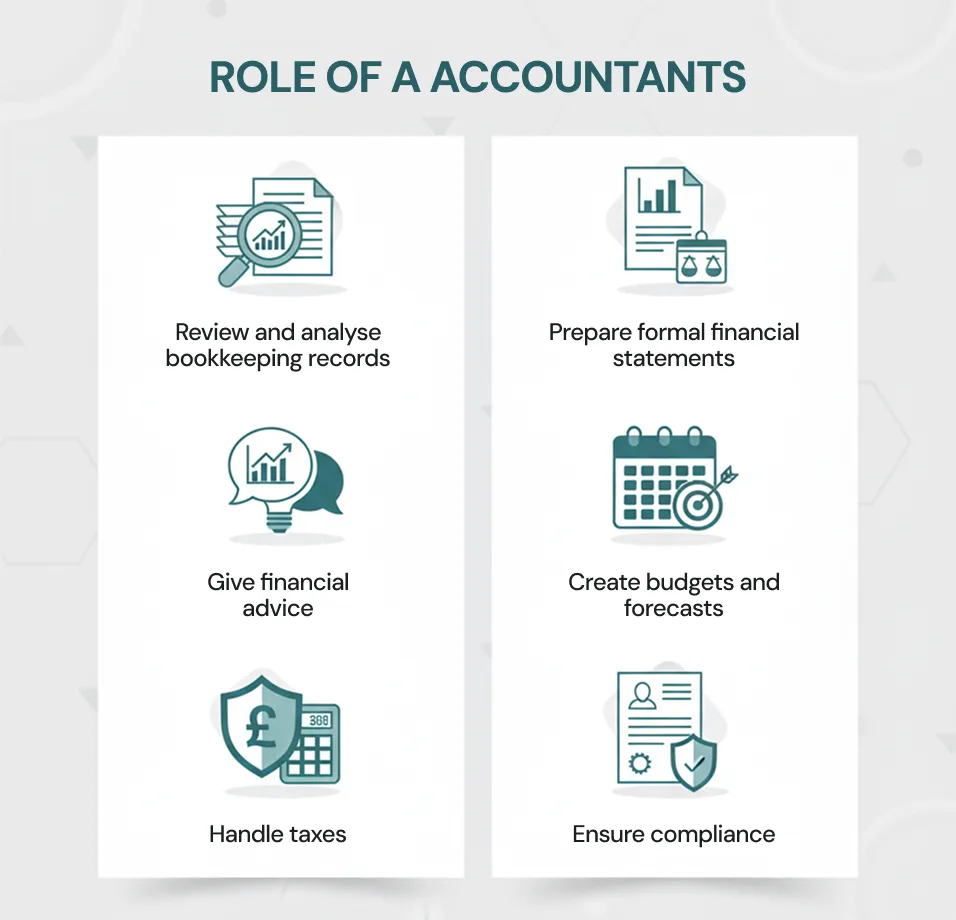

Role of Accountants

The accountants are the financial advisors of your business. They guide you to the financial growth of your business. Here is the roles they perform:1. Review and analyse bookkeeping records

They ensure that all the records are complete and accurate.2. Prepare formal financial statements

They use the recorded data and prepare profit & loss statements, balance sheets, and cash flow statements.3. Give financial advice

They help you understand how your business is doing and what to improve.4. Create budgets and forecasts

They predict future income and expenses based on trends.5. Handle taxes

They prepare your entire tax return. They also plan your tax strategy so that you can reduce your taxes legally.6. Ensure compliance

They make sure your business follows all the UK tax laws. This makes sure you never get in trouble with the HMRC.Maintain accurate financial records with our expert bookkeeping services.

Bookkeeping and Accounting: Scope

Bookkeeping and accounting each work within its boundaries. Here is how their scope is limited.Scope of Bookkeeping

It operates at the most basic level of financial data management. Its scope is:- Limited to raw data handling

- Internally focused

- Highly transactional

- Defined by structure, not judgment

Scope of Accounting

Accountancy has a broader, more strategic reach than bookkeeping. Its scope includes:- The full financial lifecycle

- External communication

- Legal integration

- Decision-support function

- Dynamic and evaluative

Accounting Vs Bookkeeping: The Golden Rule

The golden rules are basic guidelines that help you decide how to record money going in and out of a business. In the double-entry accounting system, the golden rules are used to record financial transactions. This system requires that you should record every transaction in at least two accounts, one is debited and the other credited. These rules determine which should be credited and which should be debited. Here is the difference between bookkeeping and accounting based on the golden rules.The Golden Rule of Bookkeeping

Since the bookkeeping focuses on the recording of regular transactions, it majorly works on the following rule:“Debit what comes in, Credit what goes out.”When dealing with cash flow and assets, this rule is very important. The account should be debited when something of value enters the business. This includes cash, equipment, or goods. The account should be credited when something of value (payment in cash) leaves the business.Suppose your business purchases office supplies for cash. The office supplies are coming into the business (an increase in assets), so you debit the Office Supplies account. The cash is going out (a decrease in assets), so you credit the Cash account.Your Journal Entry should be:- Debit Office Supplies

- Credit Cash

The golden rule of accounting:

Accounting furthers bookkeeping by introducing a more structured system of classifying transactions. There are three types of accounts on which all accounting falls: Personal, Real, and Nominal. Each of these has its own golden rule.1. Personal account:

A personal account means the accounts that belong to people, companies, or organisations. These could include customers, suppliers, banks, or even the business owner. The golden rule for these accounts would beWhen someone receives something from the business, their account is debited. When someone gives something to the business, their account is credited.For instance, if your business receives a loan from a bank. The business receives cash, which is recorded by debiting the Cash account. The bank is giving you the money, so you credit the Bank Loan account (a liability).The Journal Entry would be:“Debit the receiver, Credit the giver.”

- Debit Cash

- Credit Bank Loan Account

2. Real Account

Real accounts deal with tangible and intangible assets. This means the things you own and use in your business operations, such as buildings, land, machinery, cash, and even patents or goodwill. The golden rule for these accounts is:“Debit what comes in, Credit what goes out.”An example of this would be if your business purchases a vehicle for cash. The Vehicle account is debited because a vehicle (an asset) is coming into the business. Since the cash leaves the business, this means the cash account would be creditedThe journal entry would be:- Debit Vehicle Account

- Credit Cash Account

3. Nominal Account

Expenses, losses, revenues, and gains are all represented by nominal accounts. These short-term accounts are closed at the end of the accounting year. This is done once the profits or losses are determined. The golden rule for these accounts is:This means any expense or loss incurred by the business is debited. Any income or gain earned by the business is credited.Suppose your business pays monthly rent. The Rent Expense account is debited because rent is an expense. The Cash account is credited because cash is going out of the business.The journal entry would be:“Debit all expenses and losses, Credit all incomes and gains.”

- Debit Rent Expense Account

- Credit Cash Account

Bookkeeping and Accounting: Summary of Differences

The table below summarises all the differences between bookkeeping vs accounting.| Feature / Aspect | Bookkeeping | Accounting |

|---|---|---|

| Definition | Recording day-to-day financial transactions | Summarising, interpreting, and analysing financial data |

| Education Required | High school diploma; optional certification (AAT) | Bachelor’s degree in accounting or finance; CPA/CA optional |

| Primary Role | Maintain financial records and transactions | Provide insights, prepare reports, handle taxes |

| Scope | Narrow: focused on transactions | Broad: covers full financial lifecycle |

| Certifications | AAT, NACPB (optional) | CPA, CMA, CA, ACCA, AAT |

| Salary (UK) | £18,000–£35,000/year | £23,500–£148,000/year |

| Tools Used | QuickBooks, Excel, Bench | QuickBooks Advanced, Xero, Sage, FreshBooks |

| Golden Rule | Debit what comes in, Credit what goes out | Three rules (Personal, Real, Nominal accounts) |

| Decision-Making | Does not support strategic decisions | Provides decision-support and financial advice |

| Compliance & Tax Filing | Supports by keeping accurate records | Ensures compliance, handles returns, and tax planning |

| Focus | Internal operations and data entry | Internal and external reporting & regulatory adherence |

Conclusion:

Bookkeeping and accounting are both valuable roles for the finances of your business. They help you track your income and expenses. At Sterling Cooper Consultants, our expert accountants and bookkeepers help you in making informed decisions on planning budgets and managing cash flow. We also assist you in preparing financial reports, filing taxes correctly, and staying compliant with laws. We help you prevent business risks, financial errors, missed opportunities, and even legal trouble. To get help, contact us now.Ready to take control of your business finances and stay compliant all year round?

Speak to our expert accountants and bookkeepers at Sterling Cooper Consultants today, and make smarter financial decisions for a stronger, more secure future.

FAQs

You should become a bookkeeper if you are just starting your career in finance. It offers you job security and flexibility of work.

You should become an accountant if you want to focus on the bigger financial picture. You can work in any industry and you’ll be paid well.

Bookkeeping is the process of maintaining your company’s records. Accounting refers to the analysis of these records and making decisions based on them. Auditing is the process of verifying a company's financial statements and records.

If you are a bookkeeper and you want to become an accountant, you will have to pass the CPA exam. Some places require the accountant to complete a certain number of credit hours of a degree before they can be called as such.

If you are good at maths and computing and possess the necessary skills, such as detail orientation and being organised, then it won’t be hard to learn.

Accounting manager, accounts payable specialist, accounts receivable specialist, corporate controller, senior accountant, and staff accountant are some of the accounting jobs in demand.