Posted by:

Admin

Date:

December 15, 2025

Category:

Understanding K Tax Codes: A Complete Guide

Understanding the UK tax system:

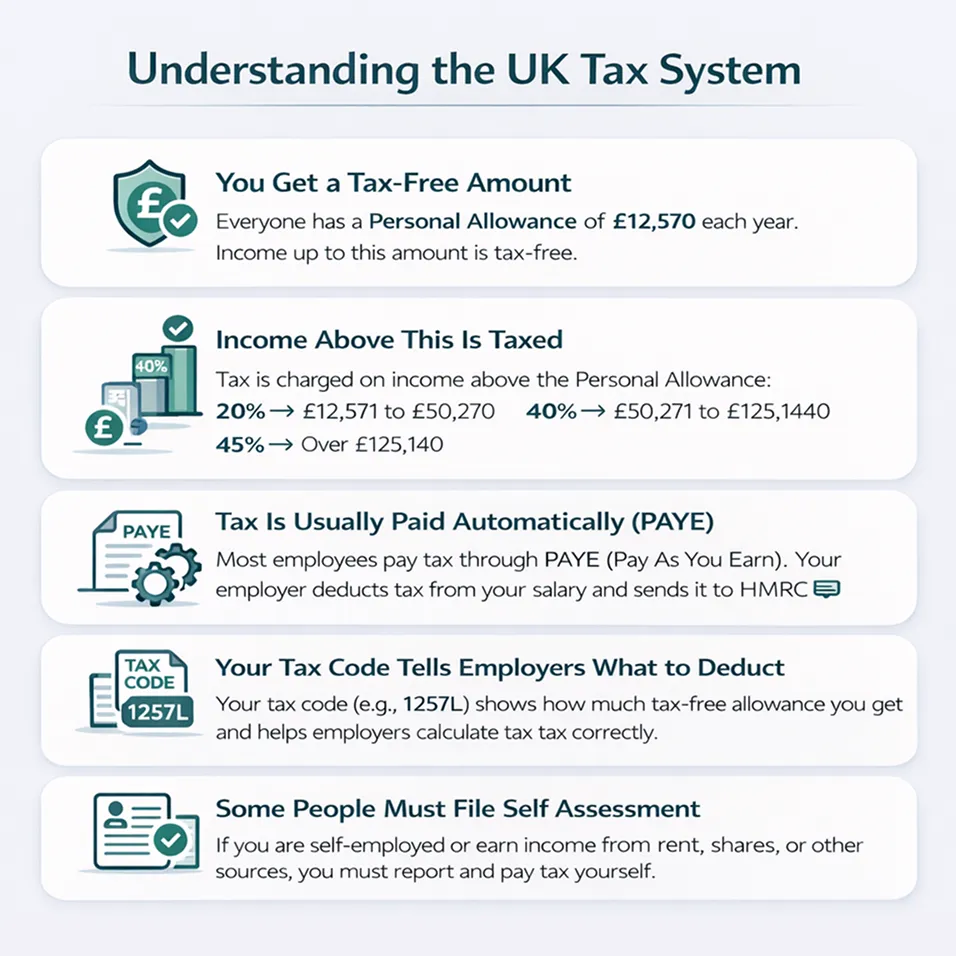

Before you ask, what is a k tax code. It is good to understand the UK tax system. The tax system in the UK works in the following way.1. You get a tax-free amount

Everyone gets a tax-free amount, i.e., £12,570 you earn each year. This is your personal allowance.2. Above that, you have to pay taxes

Over the amount of personal allowance, you pay tax based on how much you earn. Here is a guide:- 20% on income from £12,571 to £50,270

- 40% on income from £50,271 to £125,140

- 45% on income above £125,140

3. Usually, you pay taxes automatically

Your employer deducts the taxes from your pay through the PAYE system. PAYE stands for Pay As You Earn. It allows your employer to calculate the tax you owe, and send it straight to HMRC.4. Your tax code guides the employer

Your employer takes out your tax based on your tax code. The normal code is 1257L. This indicates that personal allowance is given to you and tax will be calculated without this amount.“Most income tax is deducted at source: by employers through the Pay-As-You-Earn (PAYE) system, or by banks etc. for any interest payments. The UK income tax system is cumulative in the sense that total tax payable for a particular financial year depends upon total income in that year.”

Stuart Adam and James Browne

5. Some people have to fill out a Self Assessment:

In case you are self-employed, or have any other income source (rent, shares, etc), you have to report and pay them by yourself. A k code tax calculator is how you calculate k code tax in case of self assessment.

How to decipher the tax code

So, what exactly do the numbers and letters imply? A tax code is not just some random string of numbers and letters. Each number and letter carries a different meaning. It is important for you to decipher it to understand how much tax you have to pay.

What do the numbers imply?

The numbers simply mean the amount of tax-free income you are getting. For instance, in the normal tax code 1257L, you multiply the figure 1257 by 10 and get 12570, the amount that is tax-free.

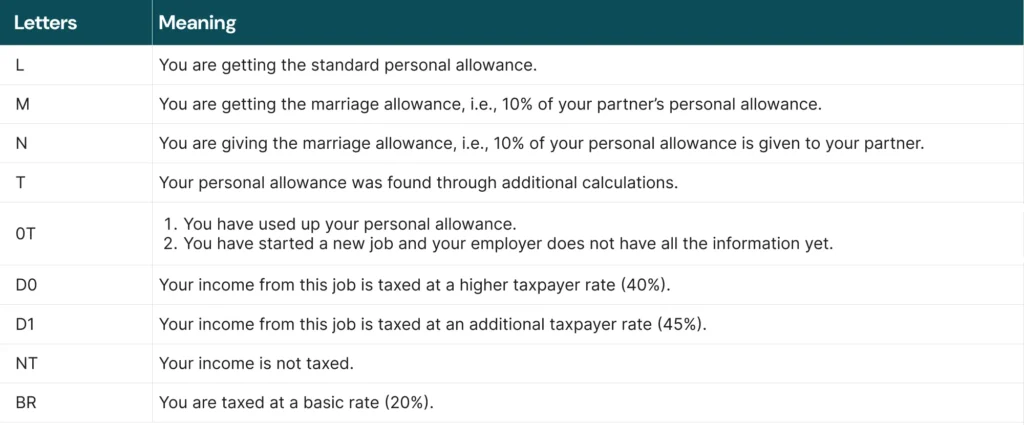

What do the letters imply?

Now, for the letters, each one depicts a different meaning. Here are the commonly used tax codes and what they mean.

What is a K tax code?

So what is a K tax code? Good question. If you see a K tax code on your pay slip, it means that you owe tax on extra income and it is greater than your personal allowance.What is a K tax code and why do I get it?

There are multiple reasons as to why you can get a K tax code. Such codes are not seen very often but here are the conditions it may be used in:You get a company car

You get a state pension

You owe tax from the previous year.

- A wrong tax code

- A change in income

- Missing information

How to Check if Your K Tax Code Is Correct

To check using the K code tax calculator. Also you can review all your correspondence with the HMRC. They send you a detailed breakdown exploring your code. You should make sure they have your updated information. Also, recheck if you have missed any important notifications. If you are still in doubt, contact HMRC using their official phone number or website. They will anwer your queries regarding your tax code.Changing K tax code:

With the massive amount of tax, you might ask is the K tax code bad? Should I get it changed? The answer to this is it depends on the situation. Even with a K code UK, employers cannot take more than 50% of your wages. Use K code tax calculator to check if your tax code is correct. Yet, if you think your tax code is wrong you have to contact HMRC immediately. You have to provide HMRC with all the information they need to sort your tax code. Once they confirm, they will change the tax code.If the K code is not wrongfully given to you, then HMRC will change it once you are done paying all your overdue taxes. Check with the K code tax calculator to confirm if you are due a rebate.Do I qualify for a tax refund if I have overpaid tax?

If you have the wrong tax code, you may end up paying more tax than you owe. It is good to confirm this with a k code tax calculator. Your tax code can be wrong because of the following reasons:1. You change jobs

Your new employer might not get full tax info right away. So they might guess your code, or use an emergency code leading to the wrong tax.2. Marriage Allowance not claimed

If your spouse gives you part of their allowance and it’s not updated in your code, you miss out and pay more tax than needed.3. Expenses or income change

If you suddenly start getting a company benefit or stop receiving one, or your income changes a lot, HMRC might adjust your tax code, but sometimes they get it wrong.How to get a refund on overpaid tax

If your K code is corrected the same year, you should be refunded the overpaid amount in your next payslip. If your K code was wrong in a previous year, you have to send HMRC a P800 tax calculation. It is a letter explaining if you paid too much or too little.Consult Sterling Cooper Consultants for Expert Opinion

It is important to understand your tax code and pay your tax accordingly. In the other case, you’ll end up paying more or less taxes than you owe. At Sterling Cooper Consultants, our accountants provide you with their expert opinion in not only understanding your taxes but managing them most effectively. Our taxation services will cover everything, from defining what is a k tax code, to making sure your k code tax calculator is on point. We make your tax calculation stress free.Taxes are not getting any easier.

FAQs

It is an HMRC program under which landlords can report rental income that they have previously failed to disclose. They can pay the tax due with fewer penalties.

Recent Posts

New HMRC Interest Rates Explained

Common Errors on VAT Returns and How to Avoid Them?