Posted by:

Admin

Date:

December 12, 2025

Category:

blogs

Paying Tax On Rental Income

Do you own any kind of property and give it to people to receive rent? If yes, do you pay tax on a rental income? Well, even if you don’t, you may be liable for this tax on rental income. Rental income is the money that you get for renting your property. Now it isn’t just the rent of the house. It includes any kind of payments you receive for the use of furniture. It also includes the earnings from any additional services such as heating, hot water, cleaning, repairs, etc. This blog covers details on paying tax on rental income.

Understanding property and taxes

The income tax on rental income depends greatly on the type of ownership. This refers to the fact that you own the property individually or share co-ownership with someone. If you do share, then the income tax on rental income depends on how much your share is. Here is how it works.Joint ownership with civil partner

If you are married or live together with your civil partner, then income tax on rental income works in the following way:Default rule

HMRC assumes that you and your partner are entitled to 50% of the rental income and the property. You may own more than your spouse. The income tax on rental income will be charged at 50%.Exception rule

If you own the property in unequal shares and receive rent unequally too, you may wish to be taxed accordingly. You can pay the income tax on rental income by doing the following:- Declare your beneficial rates. This means explaining who actually benefits from the income.

- Submit Form 17 to HMRC with evidence of your ownership.

Joint owner with anyone else

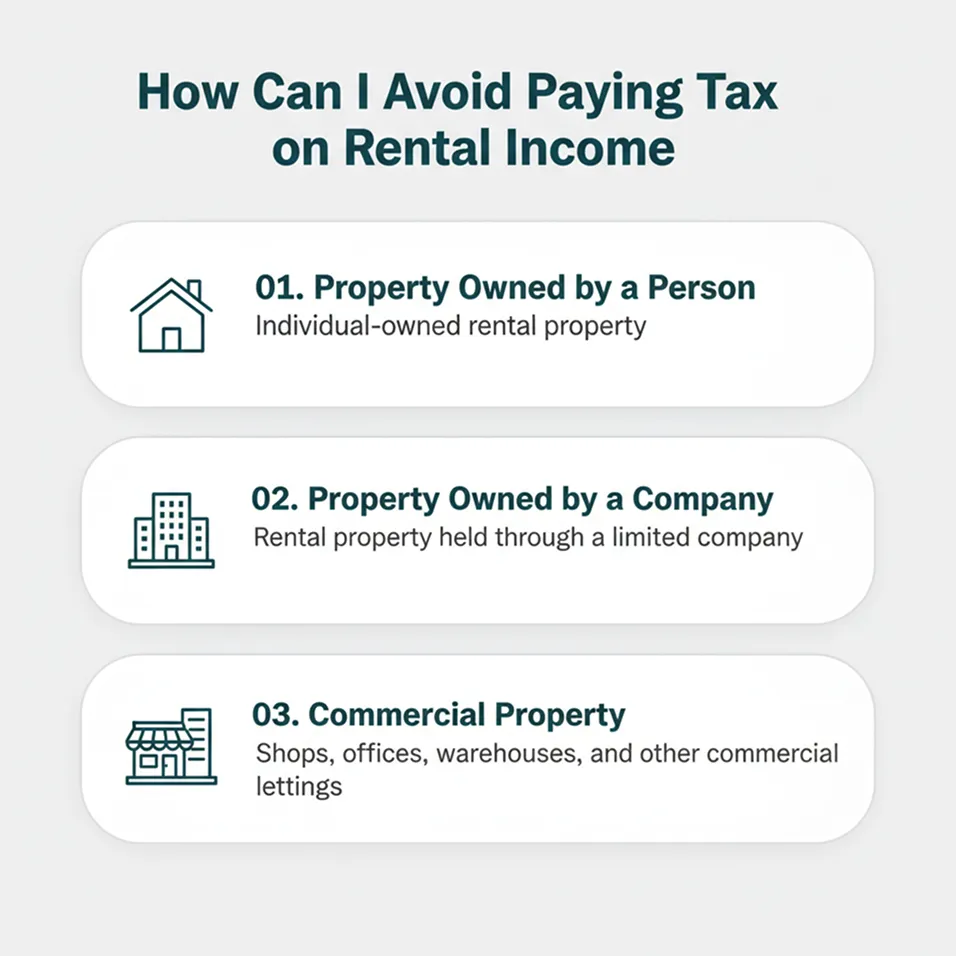

If you co-own property with anyone other than your spouse, then your income tax on rental income will depend on the share you own. If you own the property 50/50 but wish to allocate the income some other way say 60/40, you can do it. You must have documentation to support your arrangement.How Can I Avoid Paying Tax on Rental Income

You might ask, ‘How can I avoid paying tax on rental income?’. Well, you cannot avoid it altogether, but you can reduce it. Before calculating taxes on rental income, you can subtract tax allowances from them. There are multiple types of tax allowances that you get based on property ownership. Here is a complete breakdown of these tax allowances.1. Property owned by a person

If you own the property yourself, then you get the following allowances:Property allowance

You get a property allowance of £1,000 per year. If your rental income exceeds this, then you have to inform HMRC. This is applicable till rental income is £2,500 per year. You have to report it in the Self Assessment in the following cases:- If it is £10,000 before allowable expenses

- If your rental income exceeds £2,500 after allowable expenses

Wear and tear allowance

You can get a wear and tear allowance on your furnished residential property. It means that you can claim 10% of your rental income if your furniture or appliances undergo wear and tear. These can include TVs, beds, sofas, curtains, etc. It is applicable for the 2015-2016 tax year. It is replaced by replacements of domestic items relief.Replacements of domestic items relief

You can also get tax relief on replacing domestic items in this kind of property. The domestic items include:- Sofas

- Beds

- Carpets

- Curtains

- Fridges

- Crockery

- Cutlery

2. Property owned by a company

You have different kinds of tax allowances based on the type of your property; it can be residential, commercial or fall under furnished holiday lettings. Here’s how the allowances work.Residential properties

If you own residential properties through your company, your allowable expenses are the costs of day-to-day runnings. These include:- Council tax

- Services you pay for( gardening and cleaning)

- Fee of the accountants

- Utility bills (gas, water and electricity)

- Letting agents’ fee

- Buildings insurance

- Contents insurance

- Rent and ground rent

- Legal fees for the following: Lets of a year or less or renewing a lease for less than 50 years

3. Commercial property

If you rent out commercial property (shop, garages, etc.), you can claim the following allowances on some items::- Plant capital allowances

- Machinery capital allowances

Furnished Lettings

You can also claim a wear and tear allowance here if your furnished letting is residential. It is applied on or before 31 March 2016 for companies.For your furnished letting that is a holiday home, you can claim certain tax allowances. For these to be applicable, your property should be available as such an accommodation for 210 days per year. It should be used as a holiday residence for at least 105 days per year. Your longer lets should not be for more than 91 days a year.If you fulfil this criteria, you can claim the following allowances:- Capitals Gains Tax relief

- Business Asset rollover relief

- Entrepreneurs’ relief

- Relief for gift of business assets

- Relief for loans to traders

- Plant and machinery capital allowances on furniture and equipment

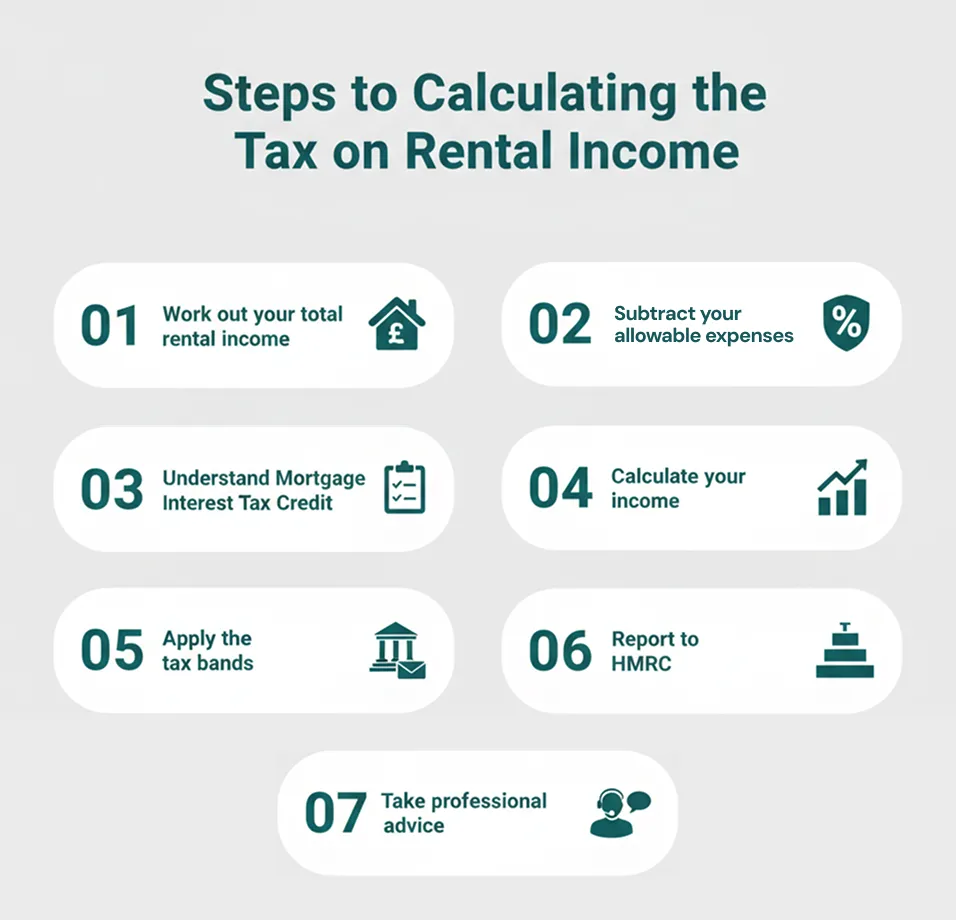

Steps to calculating the tax on rental income

Here are the steps that you should follow to find and pay taxes on rental income.1. Work out your total rental income

As described earlier, your total rental income is the rent and charges on other services you provide to your tenants. If your tenant pays you £1,000/month, your rental income is £ 12,000 per year.2. Subtract your allowable expenses

You can deduct these costs from your rental income. This would reduce your tax bill. If your income is £12,000 per year and your combined allowable expenses are £ 4,000 per year, then your rental income is £8000 that year.3. Understand Mortgage Interest Tax Credit

Mortgage interest is no longer an allowable expense. Now you get a 20% tax credit on your mortgage interest. This means that if your mortgage interest is £4000, you get an £800 credit which is 20% of £4000. It is applied after your tax is calculated.“Over the past two years there have been significant policy changes affecting the private rented sector, including the removal of mortgage interest relief for unincorporated landlords…”

Michael Jones et al.

4. Calculate your total income

Add your net rental income to your other income in case you have another job or pension. Say your salary is £3000 and your rental income is £6000. Your total income is £36,000 which is the sum of both.5. Apply the tax bands

Apply the relevant tax rate to your total income. Here are the tax rates based on your total income.| Type of tax-payer | Income | Tax |

|---|---|---|

| Basic-rate taxpayers. | £12,571 to £50,270 | 20% |

| Higher-rate taxpayers. | £50,271 to £125,140 | 40% |

| Additional-rate taxpayers. | over £125,140 | 45% |

If your total income is £36,000, then you get a personal allowance on the first £12,571. You are then taxed 20% on the rest of your income.

6. Report to HMRC

To declare your rental income to HMRC, use the Self Assessment tax return. This needs to be done every year.7. Take professional advice

To file your taxes more accurately, consider speaking to tax professionals such as accountants.Contact us for hassle-free Self-Assessment Preparation & Filing in HMRC

Penalties for not declaring rental income

Under the Income Tax Act 2007, rental income is taxable and it must be reported via a Self Assessment tax return. If you are a landlord, you have to register with the HMRC by 5th October, following the year your rental activity began. You should then submit their returns by 31st January. Meanwhile, you should keep a record of all of their important documents (rent, service charges, etc.). You can learn more about the latest changes through our blog on tax year updates 2025-2026.If you fail to declare your rental income, HMRC can penalise you based on the nature and duration of oversight. Here is how these penalties apply.Late filing

Initially, you’ll have to pay a £100 fine. If you don’t pay this, then you’ll be charged £10/day for up to 90 days.Unpaid tax

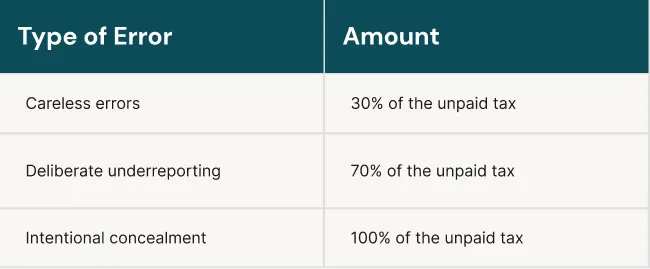

If you don’t pay tax timely, you’ll have to pay a fine. This fine is a certain percentage of the tax, and it is paid in addition to the total amount of tax. Here is how penalties work on unpaid tax based on errors in paying.

Voluntary disclosure

If you miss paying tax on rental income by mistake, you can use the ‘Let Property Campaign’ to disclose it voluntarily. Take the following steps for this:- Notify HMRC using the Digital Disclosure Service.

- Submit details of undeclared income and expenses.

- Pay the owed tax, interest, and reduced penalties.

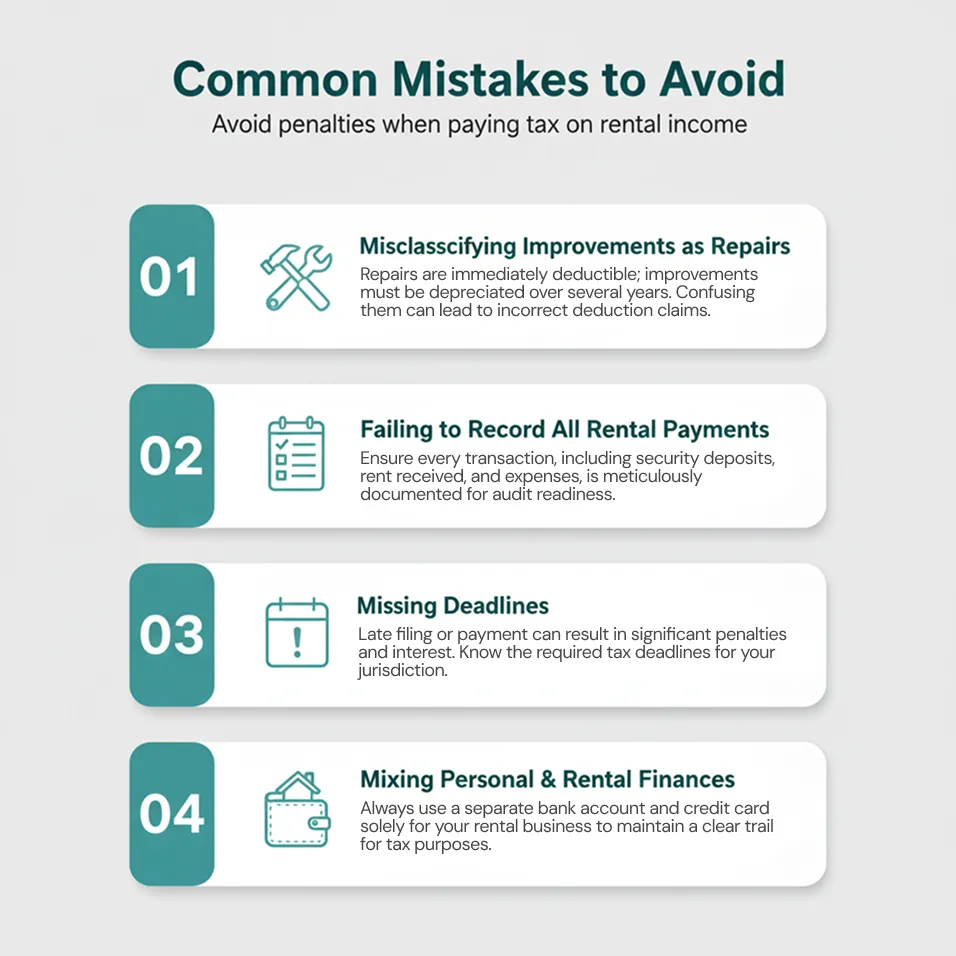

Common mistakes to avoid

To avoid paying penalties while paying tax on rental income, avoid the following mistakes:- Misclassifying improvements as deductible repairs.

- Failing to record all rental payments.

- Missing deadlines.

- Mixing personal and rental finances(in record keeping).

Conclusion

Calculating tax on rental income can be a daunting task. If you make mistakes or file taxes late, you are likely to pay penalties. Therefore, you should hire accountants to help you do your taxes. At Sterling Cooper Consultants, we help you file your tax on rental income error-free. Our expert taxation services will help you not only in calculating the taxes but also in filing them on time.Don't let your taxes overwhelm you.

Grab the bull by the horns, each moment you waste, taxes get scarier. Contact us, to get your taxes done stress free.

FAQs

Yes, reporting your rental income to HMRC is required. Penalties may result from failure to comply.

No, but you may offset them against Capital Gains Tax when you sell the property.

Yes, you can carry them forward to a later year or offset against profits from other properties.

Add the cost of the new item and any disposal costs, then take away what you got for the old item. If the new one is better, use the cost of a similar old one instead.

Yes, if HMRC suspects intentional tax avoidance, they can look into up to 20 years' worth of unreported income.

It is an HMRC program under which landlords can report rental income that they have previously failed to disclose. They can pay the tax due with fewer penalties.

Recent Posts

What is the difference between bookkeeping and accounting?

December 16, 2025

Understanding K Tax Codes: A Complete Guide

December 15, 2025