Posted by:

Admin

Date:

December 9, 2025

Category:

Dealing with HMRC Tax Investigations: Do’s and Don’ts

Types of HMRC tax investigations

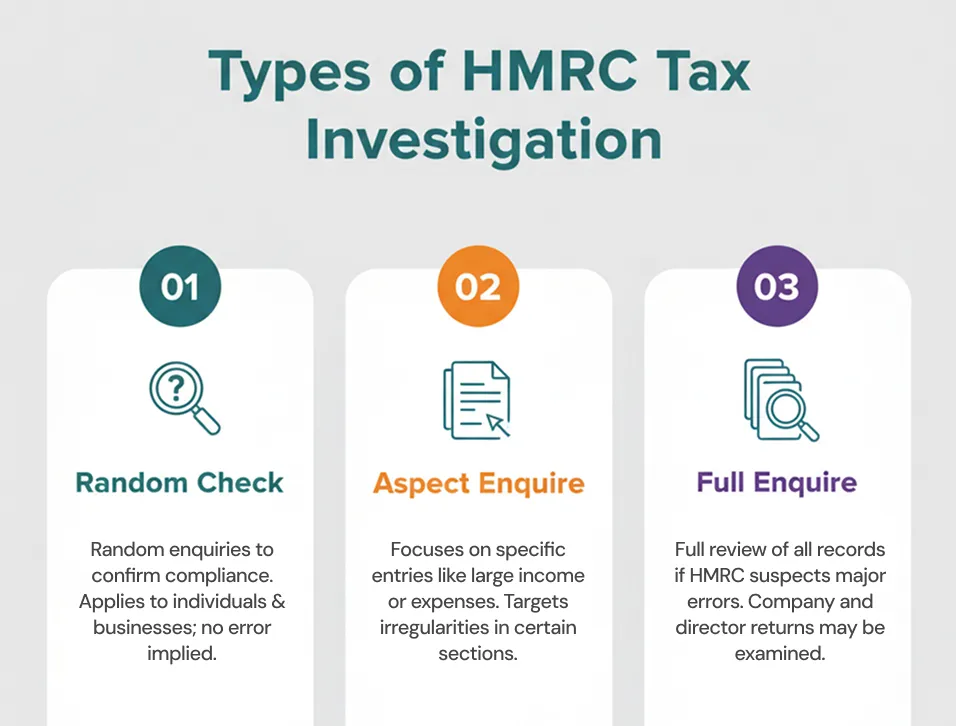

Now that we know the answer to do HMRC investigate tax returns is affirmative. Next step is to answer when do HMRC investigate tax returns. Different scenarios may warrant different types of investigation.HMRC tax investigations can be of following three types:1. Random check

As the name suggests, these HMRC tax investigations are random. There might be no implication of error on your tax returns. HMRC carries them out for confirmation. This type of enquiry can be carried out for both individuals and businesses. Random check ensures general compliance. Random checks are an answer to when do HMRC investigate tax returns.2. Aspect Enquiry

Aspect enquiries are related to a few entries on your return. They are focused on one or two elements rather than the whole return. These challenge the claim of some of your returns. If there is irregularity in any section, it can trigger an HMRC investigation. For instance, HMRC may ask you about a large income source or a large expense claim.3. Full Enquiry

HMRC tax investigations take place if HMRC believes there is a huge error in your records. They might view all of your records. Tax returns of your company, as well as its directors, might be called into question.

Why does a tax investigation begin?

You might wonder when do HMRC investigate tax returns. OR what triggers HMRC tax investigations. Here’s are some common reasons for which HMRC might trigger an investigation:1. Discrepancies in Tax Returns

HMRC tax investigations may occur if they find out mismatched figures, i.e., inconsistencies between income and expenses. They can also become alarmed if there are frequent errors on submitted returns.2. Sudden Changes in Income or Profit

If you have a sharp increase in your income, this may prompt HMRC tax investigations. Similarly, if you have a sudden and large profit, you might be under their radar as well.3. Industry Comparisons

Businesses are compared to industry norms by HMRC. Your company may draw notice if its reported performance differs noticeably from that of others in your industry. HMRC tax investigations may occur as a result of that.4. Frequent Late Filing or Payment

If you are frequently late in submitting your returns, you may signal poor compliance. HMRC tax investigations may happen due to this. Paying tax bills late can yield similar results.5. Unusual Tax Claims

If you put in an unusual or large claim for tax relief or deduction, HMRC may be compelled to look further. Large VAT refunds can also make you look suspicious. Any unusually large tax claim is sufficient cause for HMRC tax investigations.6. Tip-offs or Reports

Third parties may tip off HMRC against you. They can be random members of the public or your own disgruntled employees, or business partners. HMRC tax investigations are not prompted by all tip-offs. The tip-offs are first assessed. If found credible then HMRC tax investigations may proceed.7. Cash-Heavy Businesses

Cash-heavy businesses often prompt more HMRC tax investigations. This is because they are seen as higher risk. Some of these sectors include hospitality, construction and retail.8. Offshore Accounts or Assets

HMRC tax investigations are more likely to target you or your business if you have a foreign bank account. Another reason for their suspicion might be undeclared overseas income.9. Previous Investigations or Errors

You are more likely to face an enquiry if you have ever been reviewed before. A history of errors also means more risk of investigation.“Tax audits and tax investigations are the principle tools aimed at driving the taxpayer to pay the right amount of tax and to become compliant with the provisions of tax laws.”

Dr. Aitaa Sam Kilimvi

What is the HMRC tax investigation procedure?

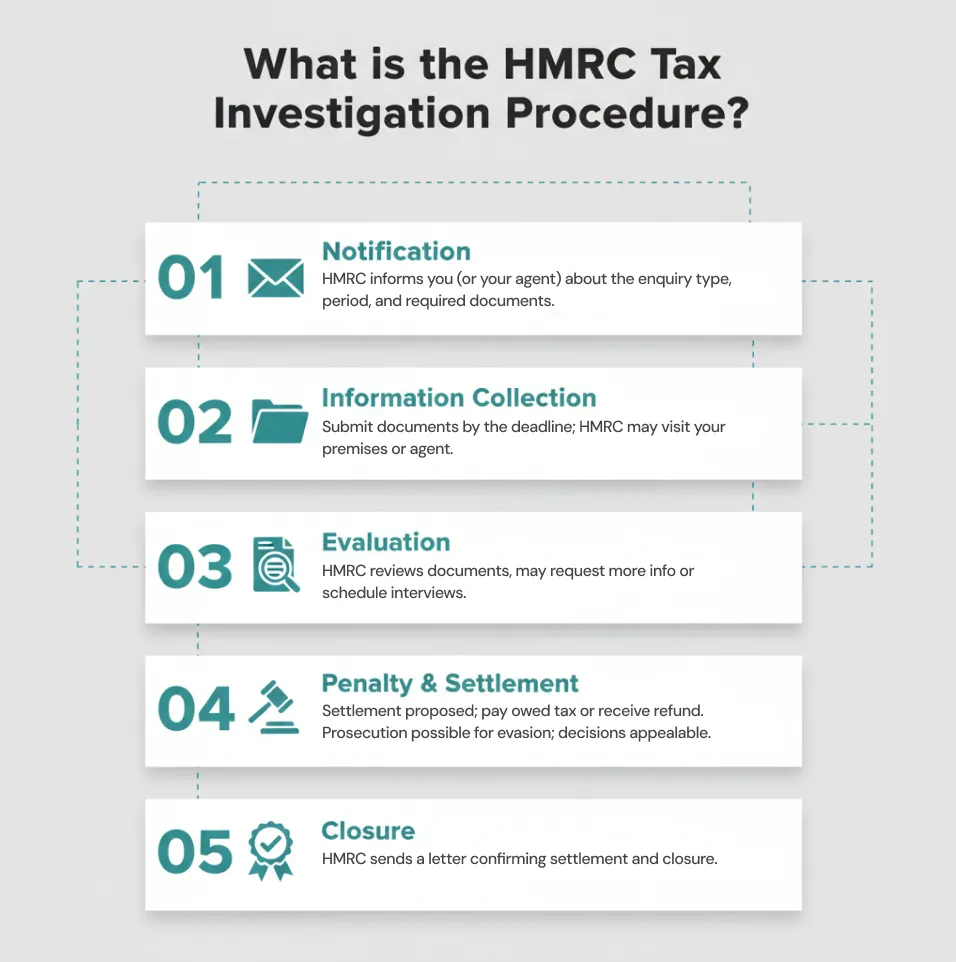

Now that we have covered when do HMRC investigate tax returns, we must not define their procedure. HMRC tax investigation procedure occurs in five stages. Here are the 5 stages of tax investigation:1. The investigation’s notification

The HMRC tax investigation procedure begins with HMRC informing. This is the first of the 5 stages of tax investigation. It happens via a letter or a phone call. They inform you about the following:- Type of enquiry

- The time period for it

- What do they need to conduct the enquiry

2. Collection of information:

The second of the 5 stages of tax investigation is data collection. You’ll be informed of a deadline by which you have to submit your documents. Their details are further in the blog. HMRC may visit the address you provide for your business or personal use. In case you have an agent, HMRC will pay them a visit.3. Communication and Evaluation

Next of the 5 stages of tax investigation is review and evaluation. Your documents will be viewed by the HMRC in this stage. They’ll provide you feedback on whatever they have gathered. You might be asked for more information or they might schedule an interview. HMRC tax investigation procedure continues with review.4. Penalty

On completion of the review, HMRC will propose a settlement based on your tax position. In case of underpaying, you’ll have to pay the amount you owe with a penalty. They will give you your money back if you overpaid. You will most likely face prosecution if you are found guilty of tax evasion. This is the most important of the 5 stages of tax investigation.Any of these decisions can be appealed within 30 days.5. Closure

Last of the 5 stages of tax investigation is the closure. When the investigation is completed, HMRC will send you a letter. This contains the details of the settlement and confirmation of closure.

The Dos: Handling the investigation properly

Once you know you’re under HMRC tax investigation, do the following:

1. Consult professionals for help

You need to consult professionals to take a look at your returns and investigation. They ensure the HMRC tax investigation procedure is smooth. Responding to HMRC on your own can cause trouble if you say something you are not supposed to.

To stay abreast of latest updates, check out our guide for changes and updates for tax year 2025-26.

2. Respond

You should respond to HMRC professionally and listen carefully to their claims. If you cannot get back to them on the deadline, communicate this to them.

3. Check Validity

Correct details:

The enquiry letter should contain the right details for validity. These include:

- Name

- Address

HMRC Tax investigation time limit:

Some may ask, how often do HMRC investigate tax returns. To answer, The HMRC have 1 year from filing deadline to investigate your tax returns. In reality however, HMRC has four years from the end of the relevant tax year to issue a discovery assessment after an inquiry into your tax affairs has been initiated. They can issue a “discovery assessment” for the missing tax if they can demonstrate that the taxpayer or their agent intentionally or negligently caused the loss of tax. If the taxpayer has been negligent, the standard four-year period is extended to six years. If he has been dishonest, it is extended to twenty years. The following is a more detailed overview.

| Tax Type | Routine checks (random enquiries) | Negligence(aspect enquiry, such as errors in filing) | Full Enquiry (tax fraud or evasion) |

|---|---|---|---|

| VAT | 4 | 4 | 20 |

| Income tax | 4 | 6 | 20 |

| PAYE | 4 | 6 | 20 |

| Capitals Gain Tax | 4 | 6 | 20 |

| Corporation Tax | 4 | 6 | 20 |

1. Verify the information schedule

An information schedule refers to a document that contains information required for an enquiry. This is needed to check if your return was correct. You should verify this document. Check if the requirements on the information schedule are important to check your return.2. Provide the documents

While you are responding to HMRC, provide them with the necessary records. They might ask you for:- Bank statements

- Credit card statements

- Invoices

- Receipts

- Records of payroll

- VAT records

- Job quotes

3. Give voluntary disclosures

While dealing with an enquiry, you might find skipped details or mistakes in your tax returns. This information should be disclosed to HMRC as soon as it is found. HMRC will investigate and check if this had any effect on the tax loss. Your penalty might be reduced because of disclosure.What are the Don’ts?

4. Don’t panic

You should take the enquiry seriously. However, you should not panic at all. It may cause you to make mistakes, overshare or present incorrect data.5. Don’t ignore the investigation

You need to respond to the HMRC enquiry. If you try ignoring it, it may cause more trouble. This is because you are likely to miss deadlines.6. Don’t destroy any document

If you destroy any documents, you’ll be considered guilty. Even if it goes against you, coming clean may reduce your penalty.If you don’t have records available, you should get their replacements. Make a request under the Data Protection Act 1998, and you’ll receive them.Conclusion:

It is important to respond to an HMRC investigation properly. For an effective defence, choose Sterling Cooper Consultants. Our self-assessment preparation and filing in HMRC services can help you understand the complexity of the situation and the possible repercussions.Don’t wait for HMRC to come knocking at your door.

FAQs

Recent Posts

What Are the Best Budgeting Strategies for Young Professionals?

What Are the Benefits of Automated Payroll Processing?